We have outlooked several promising Forex pairs and the result can surprise you!

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

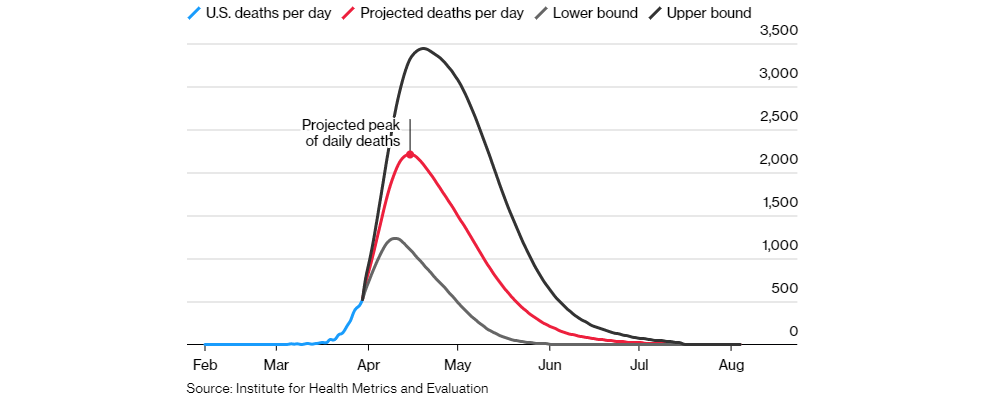

The virus spread is probably going through its toughest phase in Europe and the US, and its good news. Although the numbers of mortal cases being at their highest rates in Spain and Italy scream with human astonishment, both countries report that the expansion halted its dynamic. Statistically, that means the curve of the infected cases has reached its tip. A similar picture may be expected in the US within the two weeks’ time although these two weeks will be really difficult as Donald Trump outlined in his recent press conference.

Seeing that and adding European data, we can assume that the countries of the “first world” will have passed the red zone of the virus hit by May. As such, that already gives hope and certainty that the nightmare around will take “only” month to end. Why then the stock market is not happy? Is it not what they wanted – hope?

This is what you could have come across reading Bloomberg in the beginning of this week:

Source: Bloomberg

Indeed, at that time, the picture was offering a pretty optimistic outlook. Very moderate, but still positive.

The week was starting on a sunny note, after a Blitzkrieg-fast upward correction reaching levels of 2,650 for the S&P 500. The local downswing already took place retracing a part of those gains so by Monday the curve was already aiming back at 2,650.

Those who entered the market on Monday could have gained a good portion of their portfolio value. But they should have closed their trades on Tuesday, otherwise, by now, it all has been undone.

The same JPMorgan currently offers to hold on and not rush into buying stocks. The famous company refers to the fundamental susceptibility of the stock market to negative factors. And that’s still a pretty moderate opinion. There are those who say more:

Source: Bloomberg

Now that is pretty scary. Preparing for 2,175 in a matter of weeks? If we remove the emotional aspect from it, it looks pretty probable actually. With S&P in particular, we have several supports to check that: 50-MA which is being tested currently and 2,422 laying a bit lower. If these get crossed, well, it seems the stock market indeed doesn’t feel that optimistic in the mid-term.

It may seem a bit stretched but lets throw a general, maybe even intuitive look at the stock market movement. According to the suggested visual logic, S&P entered a channel which is opening wider the more it progresses through time. Too pessimistic? Maybe. But it’s better to factor in the worst and try gaining on that.

The impressions change rapidly, that’s why as we always say, it’s better to rely on numbers, facts, and fundamentals. Those who profess a lower bottom in April do not suggest that it will be like that forever – they merely say that the fundamental recovery of the market will not be an immediate U- o V-shaped upswing starting now. Rather, it will take longer and may start later, after the market possibly bottoms out at a lower level. Stick to the supports we have suggested before, and go with the trend. If it all goes down – you know what to do.

We have outlooked several promising Forex pairs and the result can surprise you!

4H Chart Daily Chart We sent out a signal yesterday to long EUR/USD between 1…

4H Chart Daily Chart EURUSD declined back yesterday after trying to test its 1…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later