The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

71.43% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

As we have announced previously, the earnings reports season has started. The next two weeks will be full of releases and webcasts on corporate performance in the first quarter of 2020. Some of the companies have already reported their results. Knowing in advance that those reports cannot be “good”, let’s see how those financials affected the price of their respective shares. Based on that, we will be able to anticipate the most probable reaction of other stocks to their reports.

JPMorgan reported its results on April 14. Its EPS for the first quarter of 2020 was $0.78, which is a 70% decline year-over-year against the previous mark. Compared to the EPS of 2019’Q4 which was $2.57, the drop was also 70%. The 12-month EPS was $8.85, a decline of 4.6% year-over-year.

Overall, the presented results were pretty far away from the market expectations. For example, the consensus for the quarterly EPS was $1.7 - almost $1 higher than the released figure. Anticipating a strong hit at the general 2020 performance because of this, the stock plunged. How bad was it?

By the time of the announcement, the stock was traded at approximately $101.50 and was suggesting a generally optimistic outlook. During and after the announcement, the share dropped by $10, losing 10% of its value. On the next day, it continued the decline and touched the current level of $87. The continuation of the downward trend was fueled by similarly dramatic results of other financial titans such as Bank of America and Citigroup, who also reported on Wednesday.

Therefore, until now, a total of 15% reduction is the reaction of JPMorgan to its financial results. Is it bad? Looks like it is, but let’s see other banks as well.

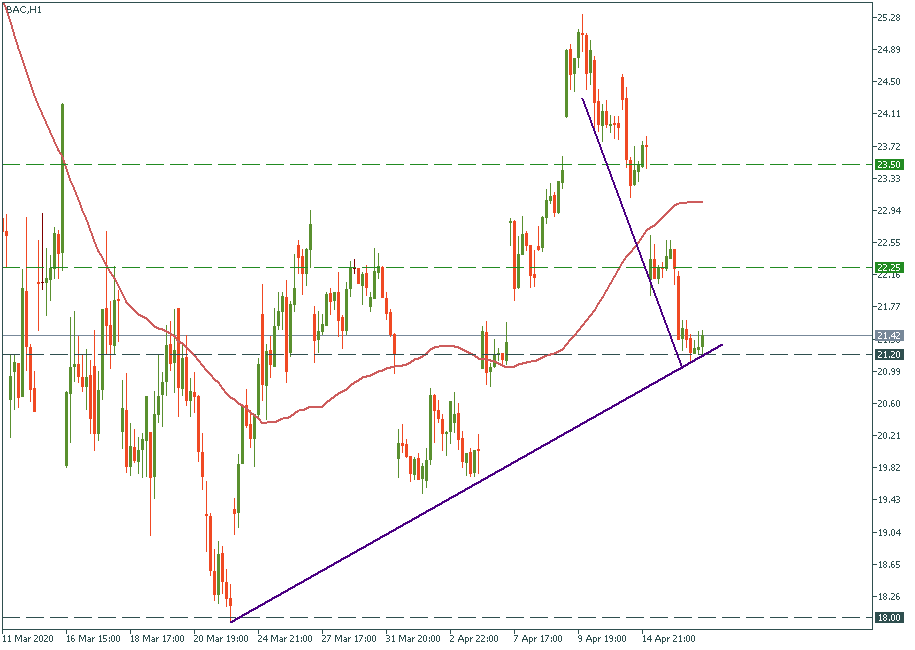

Bank of America brought a $0.4 EPS, which was slightly lower than the $0.42 forecast and 46% less than the EPS of the previous quarter. So it gave a bit lighter picture, but still, showed substantial damage ot the corporate performance.

The stock reacted in a similar way. It dropped from $23.50 to $22.25 on the day of the report and continued its way down to $21.20 the next day, making a total of 10% reduction in the share price from where it was before the announcement. It’s clearly better than a 15% reduction of JPMorgan but still a notable decline.

Citi’s share showed a similar 10% reduction in value dropping from $45 to the current $40. The bank’s EPS reported on April 15 was $1.06, which is 44% lower than the EPS of the previous quarter and almost 20% higher than what the market thought it would be. In other words, bad, but not that bad.

As you have noticed with all the three banks, their reports made the prices drop by 10-15%, but none of them broke the tactical upward trend, which is there since the middle of March and is believed to be the path of the stock market’s recovery. Even JPMorgan, which was the first to come with its lower-than-expected devastating results, like a harbinger of destruction, did not break the key barrier. It is testing that support, like the rest of the banks, but still, it hasn’t shown a strong desire to go below it.

Most probably, investors are weighing the risks for the rest of the industry to be pressed by the burden of big debts and unpayable loans, a result of the virus hit. The fact that the marked support is actually acting as support means that things are not that bad. Otherwise, the share prices would not even make that stop where they are now. “We’ll see if that goes on”, one may say. That’s fair enough, but as of now, we can state that the financial sector absorbed the punch and looks like staying straight. In the meantime, lear how to trade CFDs to make sure extract the maximum from trading stocks.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later