The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

A lot has changed during the summer of 2019. Before, even though traders talked a lot about the dangers for the global economy, they believed that the issues are temporary and will be resolved soon enough. Now the fall began and the pessimism took over. Will the central banks come to save the day?

News bulletin: key topics

In August, trade tensions between the United States and China have escalated dramatically. September has kicked in with both nations imposing additional tariffs on each other’s exports. In particular, America started collecting 15% tariffs on more than $125 billion in Chinese imports, goods affected range from footwear to smartwatches and flat-panel televisions. China, in return, began imposing additional tariffs on some of the goods on a $75 billion target list, including a 5% tariff on US crude oil. Face-to-face talks are awaited later this month but hopes run low.

As the current Oct. 31 deadline for Brexit is getting nearer, things have heated up in the UK. Prime Minister Boris Johnson clashed in a legal battle with the opposition lawmakers: Johnson pushed through a decision to suspend Parliament from the middle of September to the middle of October, while the opposition decided to try and delay Brexit for 3 months (the vote will take place on Wednesday, Sep. 4). In return, Johnson promised to call a snap election on Oct. 15 in the hope of winning a popular mandate to leave the EU on Oct. 31 no matter what. At this point, the future looks even more uncertain than it did before.

Weeks ahead: central banks taking the stage

With all this political and economic turmoil going on, central banks of the leading economies will have to become more active. Here are the upcoming meetings traders should look forward to:

Sep. 4 - Bank of Canada’s Meeting

Canadian central bank hasn’t made any comments since July. Traders will want to see whether its economic outlook has worsened and whether it plans any rate cuts this year. The tone of the BOC statement will determine whether the CAD continues to have some support or loses it.

Sep. 6 - Fed Chair Powell Speaks

Everyone will wonder what the chief of the world’s key central bank has to say about the current situation, so be ready for the volatility in the USD.

Sep. 12 - European Central Bank’s Meeting

The poor state of the euro area’s economy makes traders believe that the ECB will ease policy. The latest futures data indicated that net hedge fund positions in the EUR are broadly at neutral levels, so the currency might be capable of new big moves.

Sep. 18 - Federal Reserve’s Meeting

The market has priced in a rate cut at this meeting, so the fate of the USD will depend on whether the Fed will deliver the cut or not as well as on how the central bank will comment on its plans for the upcoming months.

Sep. 19 - Three Meetings!

Bank of Japan’s Meeting

A BOJ board member has said that the central bank must preemptively ease monetary policy to fend off risks to the economy. Still, Japanese monetary policy is already quite loose, so in reality, there’s not much the regulator can actually do to weaken the JPY.

Swiss National Bank’s Meeting

The CHF has significantly strengthened versus the EUR during the recent months and market players will watch whether the SNB aims to do something about it.

Bank of England’s Meeting

British central bank has to deal with even more challenges than other regulators because of Brexit. The key question is whether the BOE throws out some new monetary easing or says that it will wait and just monitor the economy for the time being. All in all, the GBP is already pretty oversold and this limits its further decline.

Sep 25 - Reserve Bank of New Zealand’s meeting

Traders will want to see what the RBNZ does next after cutting the benchmark rate by 50 basis points in August. Governor Adrian Orr said the bank would do “whatever it takes” to reach its targets. At the meeting, the RBNZ may clarify whether further easing is still necessary. If it's not, the NZD can take a breath and try to recover.

Time of the charts

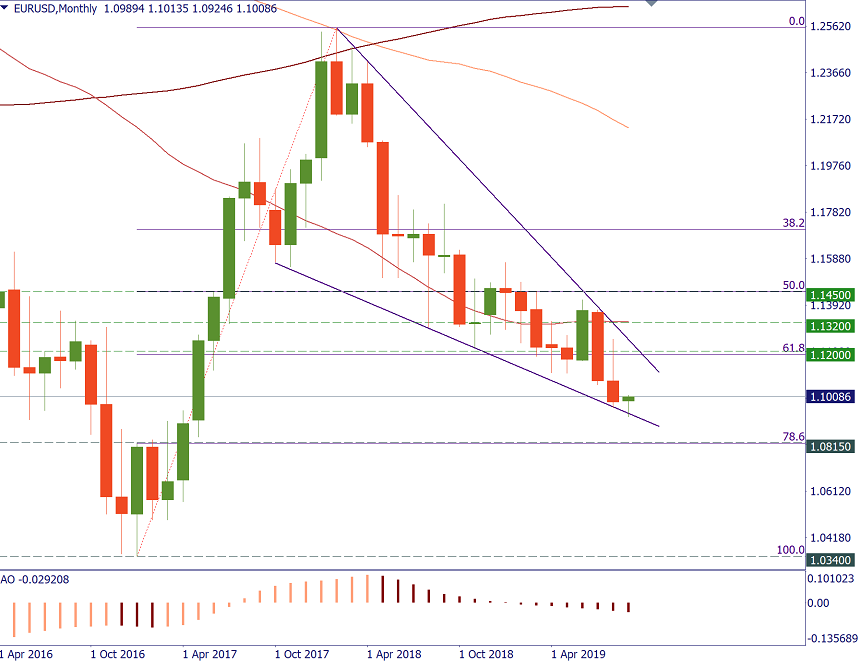

EUR/USD. The failure to fix above 1.12 in August shifts the focus to the lower levels, in particular, to the 78.6% Fibo retracement level of the 2017-2018 advance at 1.0815. At the same time, the technical picture will have to adjust to the fundamental one: the direction of the next big move will depend on which central bank acts more dovish - the ECB or the Fed. A likely scenario is for the pair to weaken after the ECB meeting and strengthen after the Fed's one.

GBP/USD. The level of 1.2000 is the key one to watch: daily and weekly closes below it will correspond to a political bloodbath in the UK and the increased risk of the no-deal Brexit. In this case, the pound may survive a freefall. Still, we need to acknowledge the fact that the pair has reached a support line and a long-term bottom. The rise above 1.2400 will give it a chance to test the downtrend resistance near 1.2700.

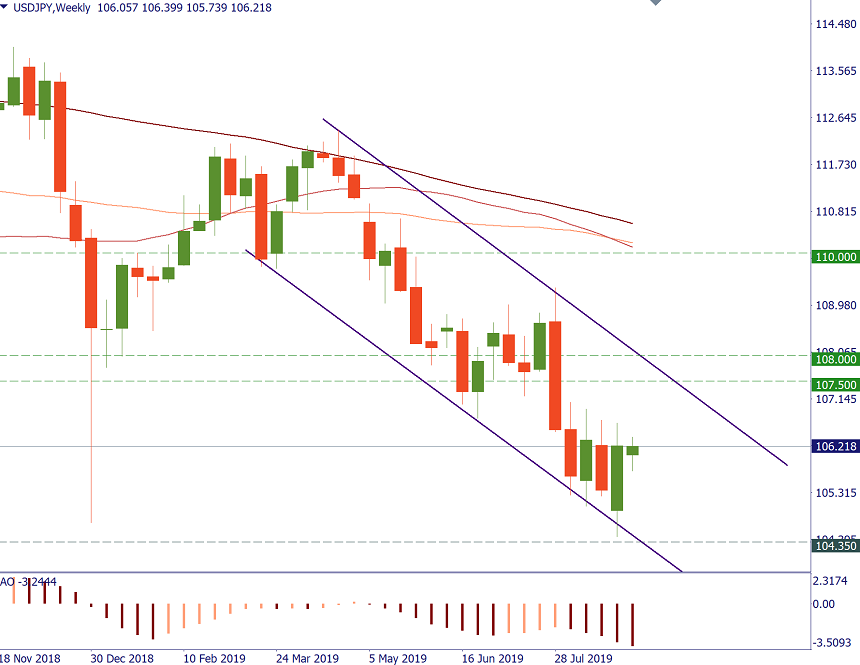

USD/JPY. The currency pair seems limited on the upside by the downtrend channel resistance line in the 107.70/108.00 area. On the downside, support lies at the 200-month MA at 104.35.

AUD/USD. The Reserve Bank of Australia wasn’t extremely dovish in September and now the AUD has some room for correction. A rise above 0.6850 will give it a chance to retest resistance at 0.6950. At the same time, a fix below 0.6700 will open a big door down to 0.6600 and lower.

Good luck with your trading! Follow us on Facebook and Telegram for more updates!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later