The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Since its IPO in December 2019, Saudi Aramco’s stock price has been consistently declining. Before the New Year, it traded at $35. But in the second week of March, it was down to $27. After plunging to those levels, it gradually got back to the previously marked descending trajectory. That is how it got to $31 per share and seems well balanced at this level. What’s the status now?

While competitors such as Exxon freeze their dividends payout, some for the first time in decades, Saudi Aramco cannot afford to do the same. It stays committed to keeping the dividends coming as these have been the main attraction for investors to hold stock in this company – and investors, 98% of whom are Saudi nationals, are now going through one of the toughest financial periods in decades for the Kingdom. People need these dividends; the company needs these dividends. Therefore, Saudi Aramco will fight fiercely to ensure oil prices are high enough to generate them. That may explain the recent decision the company made announcing it would cut the output to 7.5mln of barrels in June – that’s after it was so adamant to keep pumping up to 13mln when the price war with Russia was on a month ago. Partly, that’s exactly what putting bottom to oil prices means in OPEC+ discussions: Saudi Arabia is bound to back it up because it depends on it.

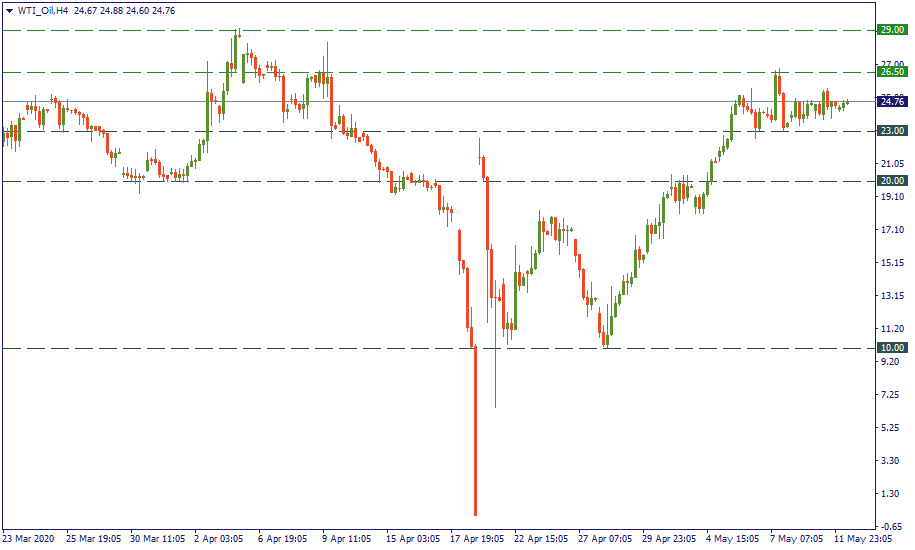

Excluding the single drop into the negative zone in the middle of April, the base for the WTI price movement in April was $10: that’s when the price was already over, but the oil glut has become more and more apparent. Since the beginning of May, when the first reports about the glut diminishing started appearing in the media, the price started climbing back. Eventually, it established itself a new base at $25 per barrel (for Brent it is at $30). At this level, it went into consolidation, which very likely will keep going during the month until the glut is finally dissolved. We know for a fact that Saudi Aramco wants to make sure there is no going below the current price level, and the support of $20 will be checking that commitment. When we see the price crossing $29, that would mean Saudi Aramco is getting back to financial capacity.

Saudi Aramco stock price depends on the dividends. If they keep coming, the price per share may stay at $30. If not, the downtrend is likely to continue.

The most interesting question is whether and when the stock price will start climbing. That will be largely defined by the global oil demand when the glut it over, by Saudi Aramco’s financial reports, which will definitely reflect the stronger hit in Q2 2020, and by the strategic perspective for Saudi Arabia.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later