The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

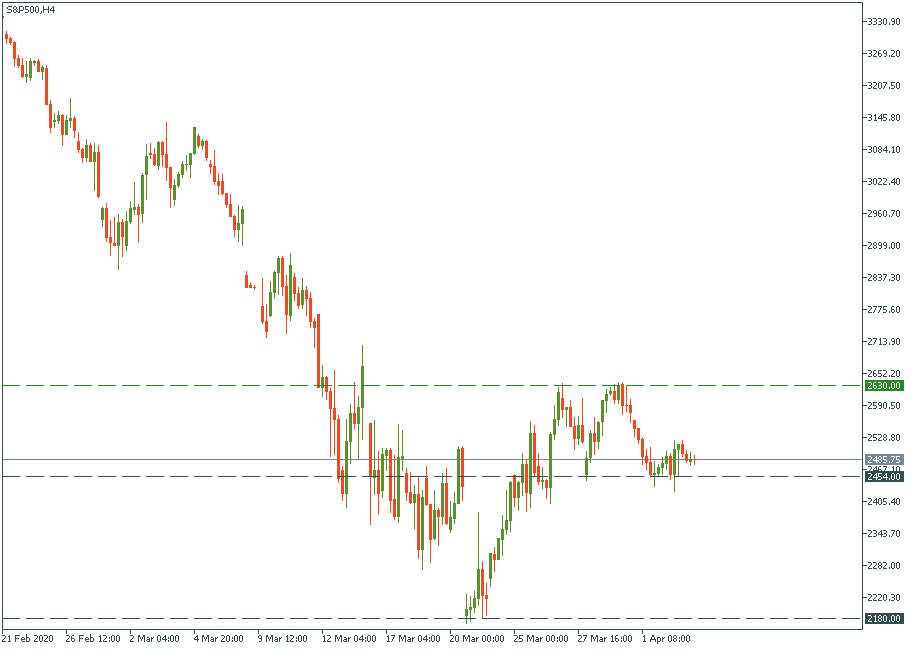

Probably, the main question most observers have now with respect to the stock market and S&P 500, in particular, is whether there will be another bottom or not. Fundamentals don’t give a simple answer.

On the one hand, the very fact that the market did not continue the plunge after March 20 but showed an almost instantaneous recovery from 2,180 to 2,630 is a good sign. It may be well interpreted that never before the US market has been as strong as now – fundamentally. Let’s remember the end of the year, January and Donald Trump’s speech in Davos: American economy was reporting multiyear expansion, record employment rates, worldwide loyalty to the USD, and the US as the economic, political and military centre of gravity. All of that couldn’t have been reached without the underlying healthy performance of the companies that comprise the S&P. In addition to that, the two-year discord over tariffs with China was over, and the path to the bright future was finally eyed. Therefore, in general, the US economy was delivering outstanding results in a world which (seemingly) found it’s general frame for prosperity.

An obvious strike at optimists camp is the unprecedented damage and the cross-continent scale of the virus infection which quickly grew from being an almost exclusively Chinese problem to the global pandemic. To the very last moment, the global community was reluctant to believe that borders will have to be closed, flights canceled, cities locked down, populations quarantined, and outdoor performance camps to be converted into hospitals. Once it did, the index went straight into the plunge.

The picture was significantly aggravated by an untimely dispute between Russia and Saudi Arabia over oil supply quantities, which the US refused to help to sort out on the spot. Now, with approximately 30% of global oil oversupply, petroleum tanks sitting full, and the price of oil pushing states to close the wells, observers comment that the moment to solve the matter may be lost. Aggravated by this, what previously looked like a possibility of a recession more often appears like a full-scale depression.

And lastly, the US never saw 6.5mln people applying for unemployment social benefits. Pretty ironically, the damage to the labor market in the US was as unseen as its strong indicators were right before the virus hit.

Last Thursday, Donald Trump urged Russia and Saudi Arabia to sit at the negotiations table. This week, a remote OPEC+ meeting is supposed to take place (hopefully). Although observers are pretty skeptical about the outcomes, the initiative itself and the confident manner with which Donald Trump was announcing that to the journalists are still somewhat reassuring.

Also, Spain and Italy seem to be seeing the levels of infections leveling out, with the US itself nearing the peak of the virus within the coming two weeks. China is already back to recovery.

Therefore, the general picture is no longer that universally dark as it was, say, a month ago. There are brighter spots in the outlook, and the S&P’s recovery seems not that far away. Very likely, the investors have already priced in the worst of the damage and are now looking for lighter scenarios.

Therefore, let’s keep the spirits uplifted, but the mind cold and observant: the trade decisions should not be affected neither by hope nor my desperation. Rather, by calculation. Next week will show us where the situation leads.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later