The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Facebook made a pretty significant upswing recently. From $258 per share, it leaped to almost $290 – more than a 10% rise. Nvidia followed the suit with other stocks as well showing that the tech sector of the S&P wants to make the best of the elections. How exactly? In general, Republicans in the US Parliament are more preferred by this sector than the Democrats. At least, the fact that things in the Senate are going to stay pretty much the same as they have been so far means that there will probably be no more restrictions on the tech giants. Logically, they are happy about it – precisely, 10%-happy, like in the case of Facebook. What about the S&P in general?

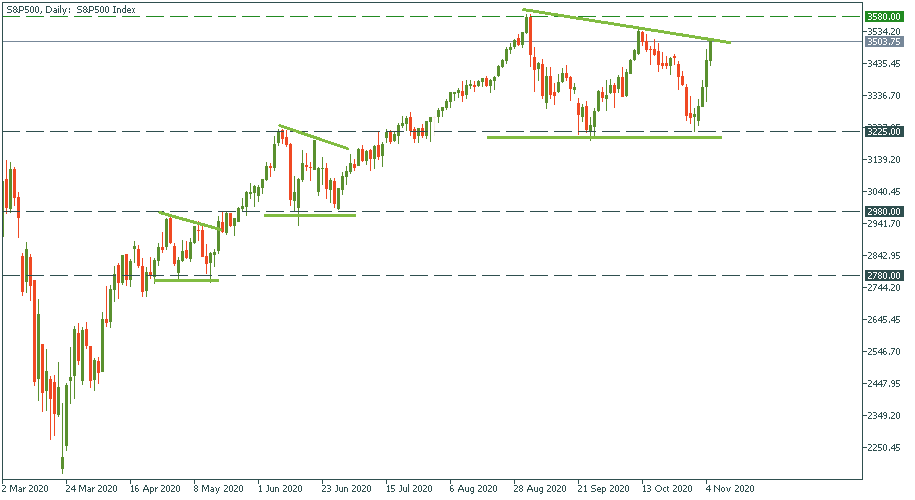

Look at the daily chart of the S&P below.

In March, the S&P oscillated between 2780 and 2980: an upswing, a correction downwards, another weaker upswing, a correction to the same support, then marching upwards.

In June, a similar oscillation happened between 2980 and 3225: reaching a high, going down, making a lower high, going down again to the same bottom, then breaking to the upside again.

In September-October, we same almost the same, just protracted pattern: up, down, up but lower, down again, then breaking upwards once again. The support is now 3225 and the resistance – to yet get broken – is 3580.

What does it suggest? We are likely to witness a strong bullish push beyond 3580 that may well last until the very end of the year. Once it exhausts itself, the support to be watched for the bearish revenge will be in the area of 3580. But now – enjoy the march with bulls.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later