The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Previously, we were basing our projections of the S&P on the assumption that the third wave up was just about to launch at 3000. Eventually, the fears of the second virus wave took over and pressed on the S&P and dented into it below 3000. Does it change the tactical outlook? No.

First of all, factoring in the possibility of the wide-scale virus re-appearance cannot carry on forever unless and until it actually takes place. So far, there are few cities with a surge in infections, but it is way too early to panic again.

Second, even if the second wave hits the globe, it is being technically factored in now, hence the impact will be smoothed and contained, if not absorbed.

Third, psychologically, if there are two consecutive and equally damaging disasters, the first one is always perceived as more hurtful and dramatic, while the following one comes as “well, that’s bad, but we’ve seen that already”.

That’s from a purely market reaction standpoint. From the phenomenological standpoint, a real hit to the economy caused by the second wave is also quite unlikely for various reasons such as the following.

First, imposing additional lockdowns is simply not affordable. Of course, different reasoning will be called to arms, but eventually governments will make their way to make sure that economies keep running even despite the raging virus. The logic is quite straightforward: there will be those who die because of the virus without a lockdown, but there will be many more who eventually die if economies get halted again. The latter will not only affect the current but also the future generations that will be struck down to poverty. No one wants that – neither the rich nor the poor.

Second, a lot of businesses already adjusted their activities as per the guidelines of remote functioning. Some of them will actually stay in many ways “virus-configured” because sometimes it is even more efficient. In other words, whatever happens next, people are more prepared and experienced.

Third, even without the vaccine (but hopefully with it), the medical treatment and organization is now much more advanced against the virus re-appearance compered to its unprepared state before.

So overall, whatever comes from the virus side, it will not be as scary as it has been until now.

For this reason, we still maintain that the S&P will be gradually growing even if it falls to yet another local lower. It will eventually pick. The question is – how?

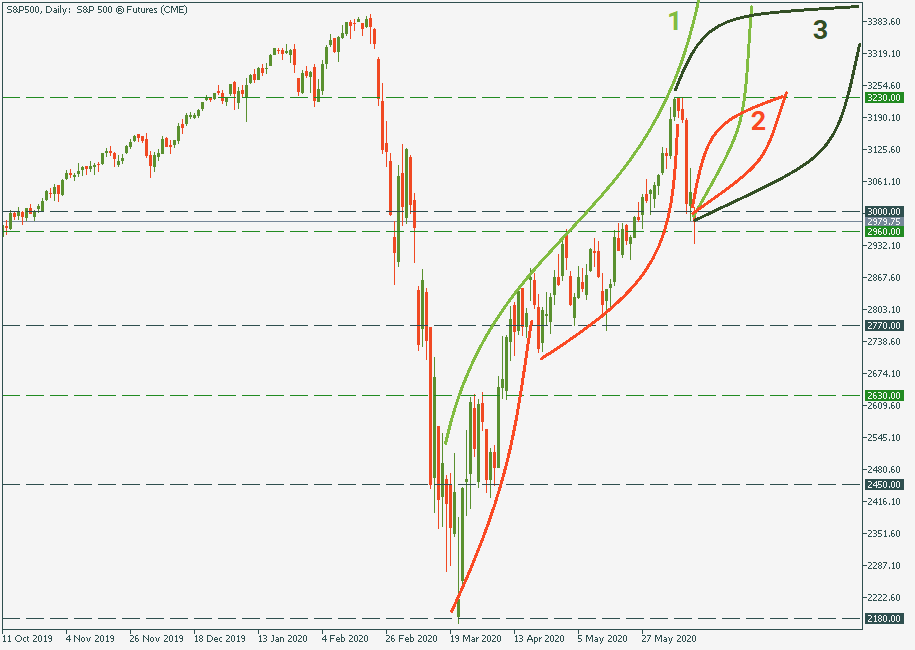

The first scenario marked as a light green zone as number “1” is a direct graphic continuation of the growth trajectory S&P was in until recently. The current drop, although notably larger than previous ones, falls well into a potential beginning of another wave up. That may be too optimistic a scenario though.

A more realistic and general suggestion is that the S&P will move somewhere within zone 3, which gives large room for possible chart maneuvers, the most probable of which is marked by zone 2.

That’s why 3,230 is still a likely bullish target for the end of this week-beginning of the next week.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later