The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The last week of January was quite shaky for the markets, as the news on coronavirus pushed investors to buy safe-haven assets and Treasuries and selling the risky assets. The outbreak was followed by the quarantine in Chinese Wuhan and businesses quickly closing their divisions in China. A sharp sell-off triggered by the risk-off sentiment reminded us about the possibility of a recession, which has been in analysts’ forecasts for more than a year. And while some analysts see the outbreak as a short-term risk and look for a brighter future, others are deeply focused on the worrying signals. So, should we be afraid of it now?

The headline speaks for itself. The S&P 500 index has been up by over 356% since the bullish market began in March 2009.

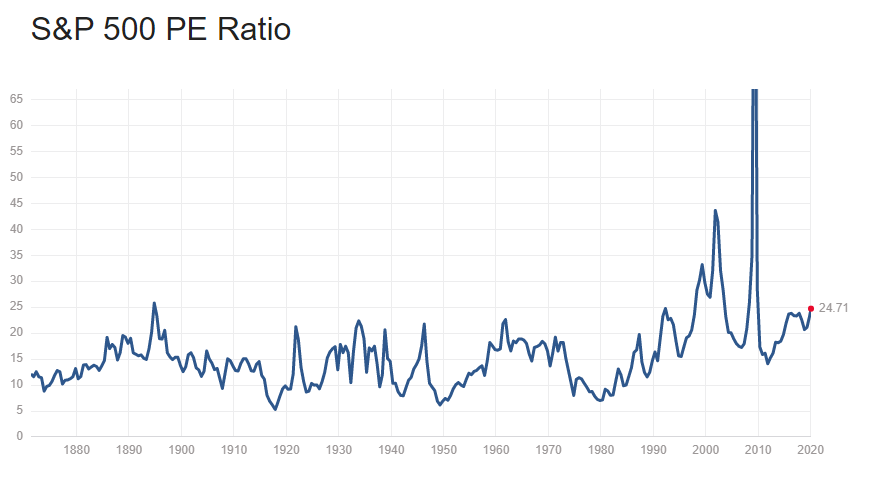

The index has been quite overvalued and there are metrics that confirm that. At first, let's have a look at the P/E (price/earnings) ratio - this measure shows the average valuation of the US biggest stocks. The average value of this indicator for the last decade equals 14.81. According to recent data, the ratio reached 24.71. This is a much bigger level compared to the historical one. That is why we may suggest that the index is trading at 24.71 times forward earnings. On the chart below we can notice that the ratio has not been going up since the 2008-2009 crisis. Thus, to keep everything in balance either earnings would need to increase significantly, or the stock prices would need to fall.

Sourced by: Multpl

The other measure to look at is the median price to earnings ratio. It excludes the performance of very profitable and very unprofitable companies. The indicator demonstrates that the S&P 500 is overvalued by 30% vs the typical valuation level.

With the data given, we may suggest that the market is about to enter the correction phase soon. The real outcome depends on the global picture and the decisions by the Fed. And the global outlook is not so sunny now.

The famous spread between the yield on 3-month and 10-year US Treasuries, which made many investors panicking during the last autumn, inverted this week once again amid the economic fears connected with the outbreak of coronavirus. Just a month after a cautious optimism surrounding the signing of the US-China phase one trade deal, the yield curve inversion raised the recession fears in the markets. However, analysts doubt about the long-term effects of these circumstances and suggest it to be an overreaction of the financial markets to the current situation.

Let’s not forget the Federal Reserve. The Fed Chair Jerome Powell has already announced a short-term yield control by adjusting the Fed balance sheet. His actions towards the control of inflation (which is currently moving below the target of 2%) and economic growth may support the economy amid global fears.

So, for now, we can't really tell that the reversal of the S&P 500 index will happen soon. As the Federal Reserve continues to monitor the risks, and international institutions take measures to prevent the spreading of the virus, the index will continue to gain strength. Pay attention to the news, as it is the main determinant of the market's behavior.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later