The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Reserve bank of New Zealand holds a meeting on Wednesday at 3:00 MT time. As usual, we await an update on the monetary policy and interest rate. Currently, the regulator keeps the rate at 0.25%. Analysts don’t expect any change to it, given current performance of New Zealand’s economy. Still, a dovish surprise is seen as a possible outcome.

New Zealand has been showing pretty impressive post-Covid results. The country successfully handled the pandemic and released better-than-expected inflation figures for the fourth quarter of 2020 (0.5% vs. the forecast of 0.2%). These facts diminished the need in negative interest rates and took the NZ economy on track to a quick recovery. Still, the country has only just started the vaccination process, and the travel industry remains under pressure. Additionally to that, the RBNZ does not like rising bond yields and surging kiwi. The New Zealand dollar is trading at the highs of 2018 against the US dollar. Combined with the booming housing market, skyrocketing NZD worries policymakers.

Thus, the RBNZ may try to hold rising kiwi by highlighting existing risks from closed borders and late vaccination.

According to JP Morgan analyst, "We’ll hear from the RBNZ tonight and the risk for me is a dovish surprise, I will be looking to be short NZD into the meeting”

Another problem that might be in the focus of the RBNZ board is the QE limit. The bank might have bought as many government bonds as permissible. That’s why it might need to take unusual actions during the upcoming meeting.

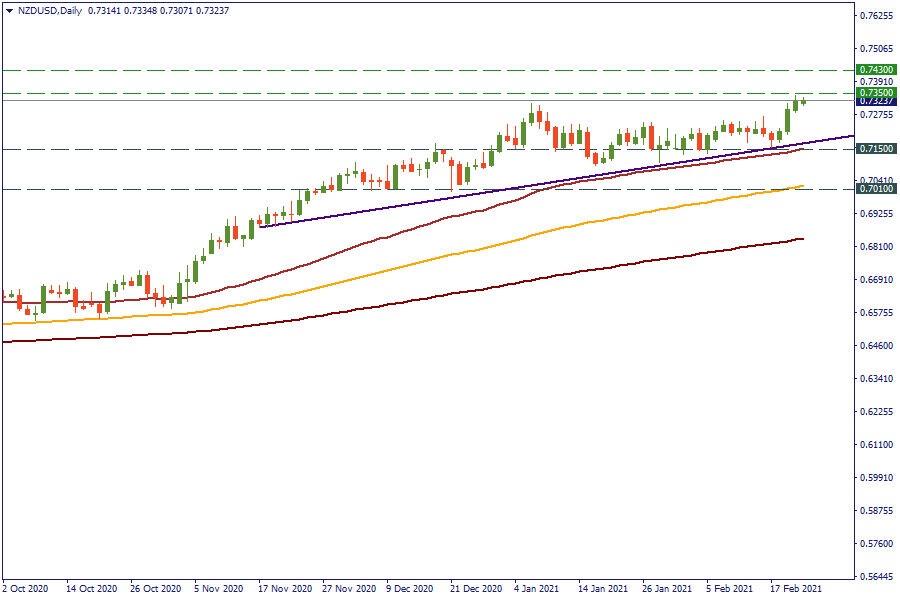

The kiwi has been implementing a bullish pattern. Right now, it is trading near the resistance at 0.7350. If the RBNZ provides a dovish surprise, the pair will slide to 0.7150 with a high potential of a breakout. The next support will lie at 0.7010. If the resistance at 0.7350 is broken, the next key level will lie at 0.7430.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later