The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Besides US Retail Sales data, Australian Unemployment Rate and New Zealand GDP this week will bring us Quadruple Witching – one of the four most important days of a year for futures and options!

Quadruple witching refers to four days during the calendar year when the contracts on four different kinds of financial assets expire. The expiration date is the point at which a position automatically closes. In other words, traders will have to decide what they want to do with their open position before the expiry date. The days are the third Friday of March, June, September, and December. The assets are:

Options contracts also expire monthly. Futures contracts expire quarterly. Because traders and institutions run out of time at the close of trading, there is a lot of portfolio re-balancing, contract rollovers, and more. The last hour of the trading session (22:00 to 23:00 GMT+3) is when the volatility really increases, and assets swing dramatically.

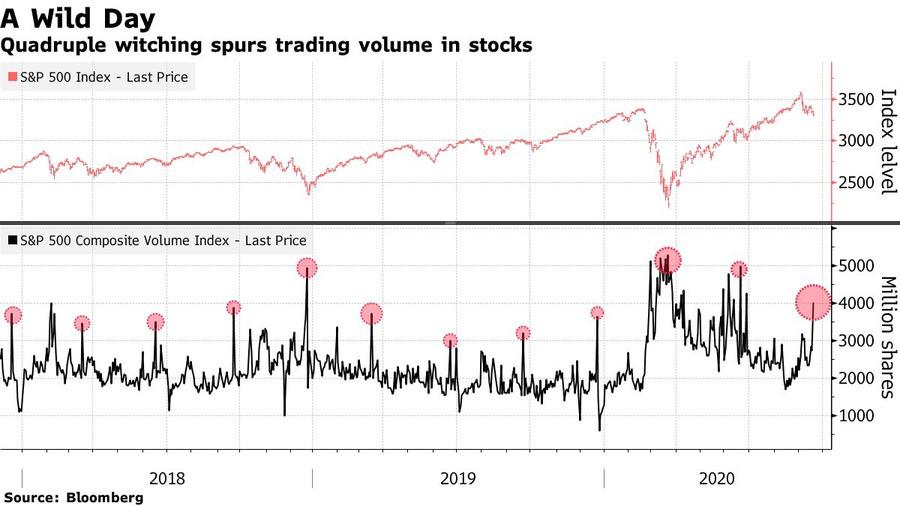

Because all four types of contracts expire on the same day, the quadruple witching day is usually accompanied by bigger trading volumes and volatility. On June 18, 2021, a quadruple witching day, a near-record volume of single-stock equity options was set to expire at the end of the day in the amount of $818 billion. As a result, a near-record of single stock open interest of about $3 trillion stood on June 18, 2021. Open interest refers to how many contracts are open during any given point during the day. It is an important metric for traders to watch since a large amount of open interest can move the value of the underlying stock.

But you need to know, that these Freaky Friday days (the second name for the day is even stranger than the first) in general are not bullish or bearish. You cannot just buy or short sell and make guaranteed money. What is guaranteed, however, is that there will be a big surge of volatility. There is on average 40% more volume on this day than the average.

Source: https://www.bloomberg.com/news/articles/2020-09-18/stock-traders-brace-for-quadruple-witching-amid-options-anxiety?sref=qgDWnyMx

Also, note that the last hour of the session is usually bearish because long positions are prevailing against short ones, and closing these trades might cause a plunge in prices.

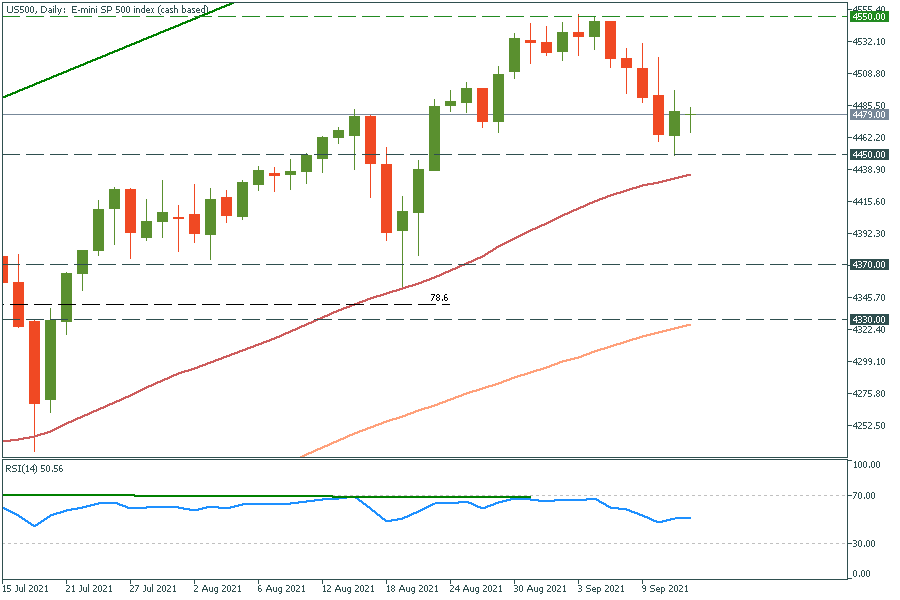

US 500 and US 100 will be more volatile this Friday. Because of trading volumes, US 500 index will be able to reach distant resistance at 4370 or plunge through the 4450 level (if the Index doesn’t do this earlier this week).

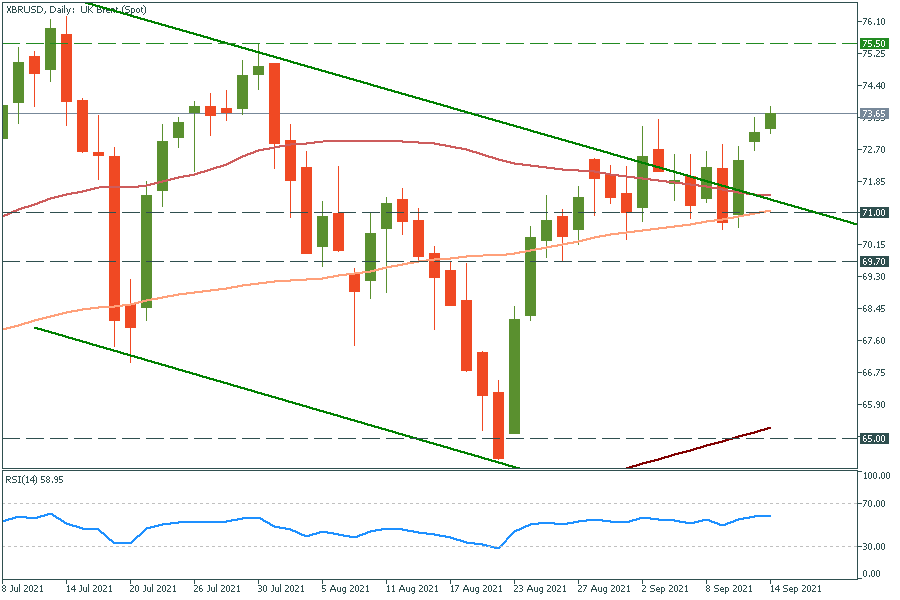

The same goes for oil, gas, and gold, so keep an eye on XAU/USD, XNG/USD, and XBR/USD. Brent oil is surging for several days already, so we may see strong pullbacks to the $71 level.

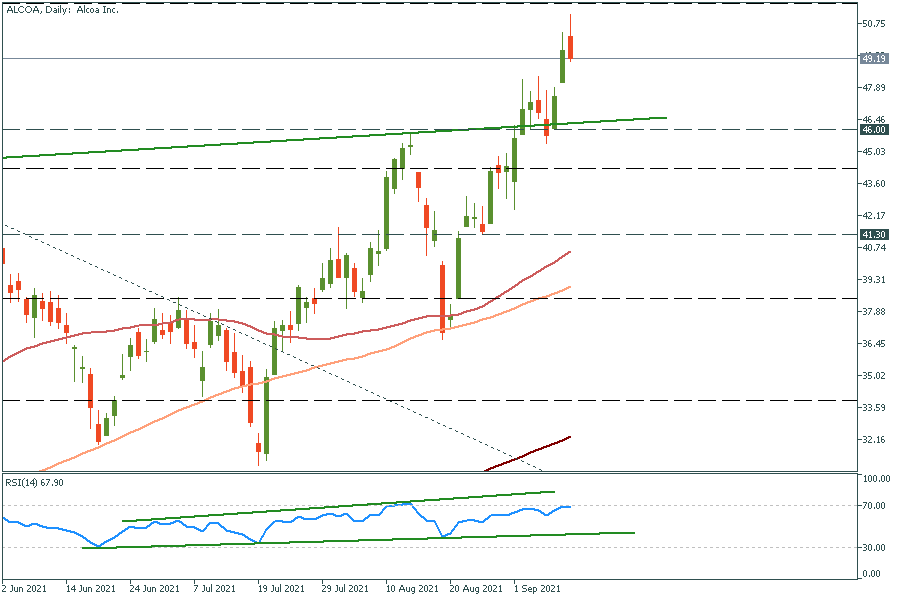

In stock market, consider trading such companies as Tesla or Alcoa because they either have huge options volume or are commodity-based. Moreover, Alcoa is on the rise because the aluminum price is skyrocketing. Both rise to $52 and plunge to $46 levels are possible.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later