eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

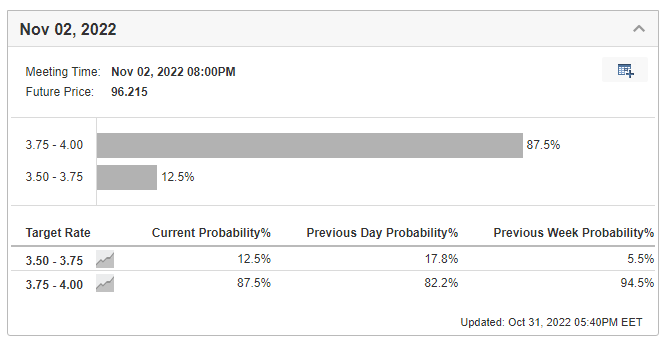

On November 2, the Federal Reserve will make an update on the interest rate and publish the Rate Statement with commentary on economic conditions that influenced their decision. According to the analysts, the Fed will come up with a 75-basis-points rate hike raising the rate to 4%.

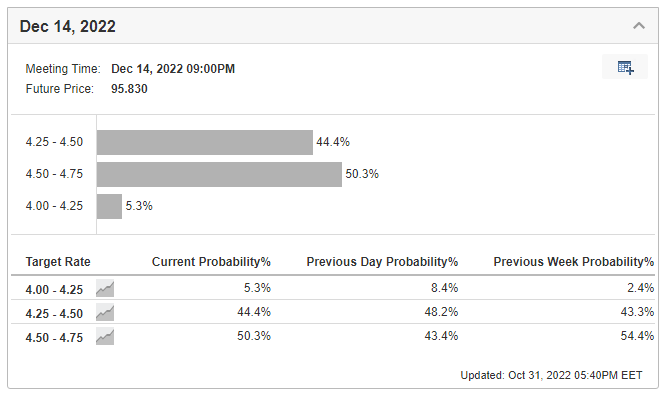

Markets are already pricing in this decision. Thus, all attention will be drawn to Powell's rhetoric regarding the next decision at the December 14 meeting. Currently, the chances of another 75-bps hike in December are estimated by the markets at 50.3%. Another 44.4% relates to a 50-point rate hike. Therefore, the Powell Speech can significantly turn the markets one way or another regarding the future actions of the Fed.

However, despite Powell's remarks, the main driver of dollar volatility will be the NFP and the CPI report on November 4 and November 10, respectively. This time, according to analysts' forecast, 200K new jobs are expected in October, against 260K a month earlier. These are rather low expectations. Therefore, as in previous times, the actual result may exceed expectations and boost the US dollar index in the short term. Nevertheless, we have to mention that the previous three times, the USD has fallen two days after the NFP release.

We expect the US dollar to stay under pressure until the CPI release on November 10. Jerome Powell might give a fresh breath to the stock and crypto markets ahead of the 2022 United States elections on November 8, where all 435 seats in the House of Representatives and 35 of the 100 seats in the Senate will be contested. Moreover, as recent history shows, NFP results might boost the greenback, but it usually falls after.

Thus, until the CPI release, we await a bullish rally in XAUUSD, EURUSD, GBPUSD, US100, US500, and crypto coins.

Buyers are trying to push the US500 index above the 3900 resistance. After the breakout, the way to 4075 will be open.

EURUSD broke above the descending trend line and the 50-day moving average. Moreover, at this moment, the price is testing this breakout, and it seems like the retest will be successful. We expect the pair to reverse toward the 100-day MA, which is currently moving between 1.0050 and 1.0090. Moreover, if the price breaks above this MA, it will move higher to 1.0200.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later