eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

“I want you to know how sad I am to be giving up the best job in the world,” – Boris Johnson said in front of the paparazzi and his colleagues before leaving the UK Prime Minister chair. He held the post for three years after Theresa May left in 2019 due to Brexit contradictions. Changes of such scale aren’t often seen in Europe, so it’s wise to break the situation down.

It all started with a no-confidence vote at the beginning of June. The UK Conservative party (Tory) criticized Johnson’s job for “perceived incompetency as a leader,” beginning the most significant turmoil in the newest history of Britain. Also, Johnson had a party during Covid-19 pandemic, which was totally unacceptable for a Prime Minister.

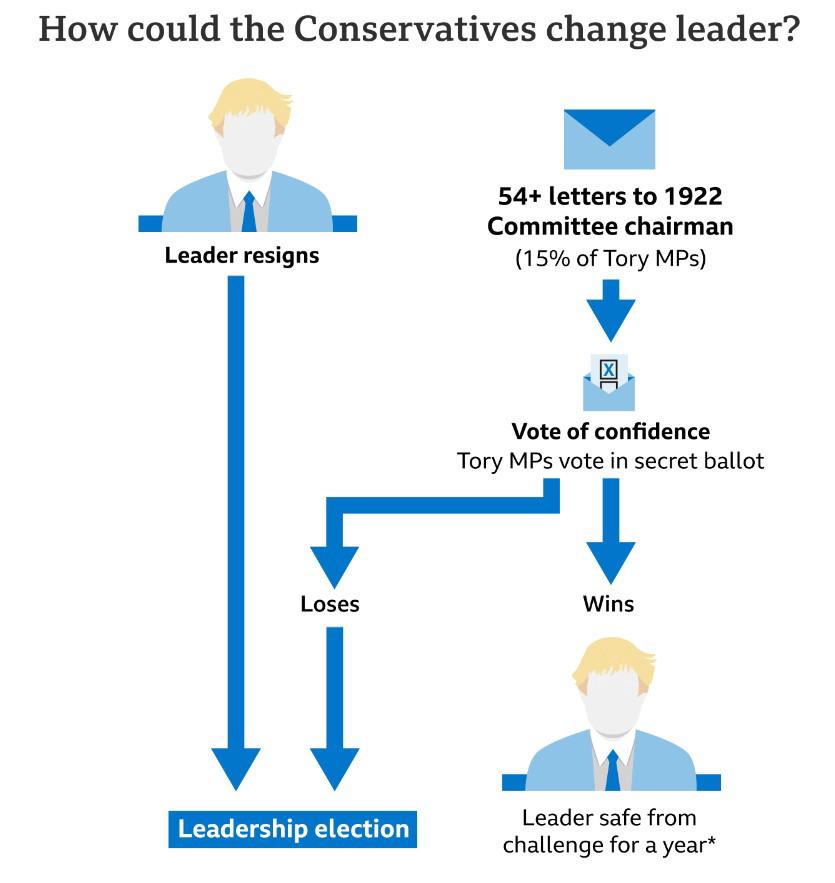

If Tory had been successful, Boris would have left much earlier. Here’s how the process works:

Source: BBC

However, Mr. Johnson received the support of 211 out of 359 members of the House of Commons (lower chamber of the UK parliament). The result means 59% of his members (MPs) supported Mr. Johnson.

The story doesn’t end here, though. Another round of problems for Boris started as he hired Chris Pincher as a deputy coordinator of the parliamentary faction. Earlier, Pinches was accused of sexual harassment, and Johnson knew it.

After the Chris designation, a 24-hour period of political turbulence began. Over 40 government resignations happened before Johnson decided to give up and leave the chair of Premier Minister. The general public supported the decision: Twitter is filled with cheers and glees ahead of the next PM election in autumn.

Boris Johnson was the UK Prime Minister and head of the conservative party for three years. The Tories, in turn, are the leading party in the UK, with the Liberal Democrats as the main rival. Usually, elections in the UK need to happen no more than five years apart. Unless an earlier one is called, the next election isn’t due until January 2025.

Boris Johnson could call an early election if he wanted (the law permits this), but now Mr. Johnson has resigned. After the conservative party chooses a new leader, he (or she) can call an early election if he (or she) wishes.

Pound Sterling is rallying at the time of writing, although it is hard to ascertain just how much of the move is linked to the domestic political news or the broadly supportive global market.

The pair made a double divergence on the RSI. Also, we are close to the support trendline. Our outlook on the British pound is bullish. The currency may rise to the 1.2324 resistance. Also, it may soar higher if the next PM chair candidate is met with glee from the market participants.

GBPUSD daily chart

Resistance: 1.2324, 1.2700, 1.3000

Support: 1.1900, 1.1740

Do you want to get GBP updates Live? Subscribe to the @FBSAnalytics Telegram Channel where I post more daily trade ideas!

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later