Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

As it turned out, it will take some time before the miners of Ethereum, and cryptocurrencies based on the same blockchain stop buying video cards. However, it seems that a start has been made. The shift will happen after the Merge event occurs on the Ethereum network, that is, the transition to the Proof-of-Stake (PoS) model. Now its tentative dates have been set.

In practice, this means that the Ethereum Mainnet system will merge with the new Beacon Chain. Only a few cryptocurrencies use the Proof-of-Stake model. These are Cardano, Tezos, and Algorand. According to official data, this event will take place before mid-2022.

The transition of the Ethereum network from the Proof-of-Work model to the less resource-intensive Proof-of-Stake has been expected for quite some time. However, this did not happen, and gaming video cards are still in high demand among miners.

Proof-of-Work (PoW) is used when miner's technical equipment solves complex mathematical problems. When equipment adds a verified block to the blockchain, a miner receives a reward in the form of a cryptocurrency. Adding blocks is a complex process that requires significant computing power. Once a computer finds a solution, it sends a message to other computers in the community for review. The solution is easy to test because other computers already have the answer.

The key feature of this math problem is asymmetry. The task should be difficult for a miner but simple enough for the network because of cryptography. Every miner in the network tries to find a solution first. At the same time, it is possible to find it only by direct enumeration; therefore, a successful solution requires many attempts.

Unlike Proof-of-Work, in Proof-of-Stake the creator of a new block is selected by the system in advance based on its share in the total amount of cryptocurrency.

The idea of POS is to solve the problem of POW associated with high-energy consumption. The PoS participant has a limited percentage of possible verifications of transactions. The limit corresponds to the amount of cryptocurrency in the participant's account.

The chart above shows that global supply declines while the price gains momentum. Two factors contribute to this situation:

It will not be a surprise if this trend continues until the announcement. Until then, whales and almost every miner and retail investors will hold this coin.

The problem is that to get PoS reward, which is 3.2% per annum, an investor needs to hold at least 32 ETH or join the pool, which might be risky. Furthermore, many retail investors will not be interested in this asset anymore.

There are questions in the ETH community whether such a transition is necessary. Almost until the end of 2019, the world's PoS coins lagged PoW in popularity. Many PoS blockchains have shown a tendency towards tight centralization when control over the project is in the hands of several dozen of the wealthiest holders. The American Commodity Futures Trading Commission (CFTC) directly threatened ETH that it might recognize it as a security and remove it from the crypto market if the transition happens.

"Buy the rumor, sell the news" – saying which most of the time works on the global market. This situation might not be an exception. Ethereum might lose at least half of this community, as miners will not work on its protocol.

However, let's not get ahead of ourselves and look at the current situation, which is positive for the second-largest crypto coin by capitalization.

There are several factors that point to the massive upcoming Ethereum boost:

The price has broken through the symmetrical triangle and reached a global 0.5 Fibonacci resistance level. After a tiny pullback and retest of the triangle, we expect a massive rally in this cryptocurrency pair. If the price reaches the previous high and Bitcoin will trade above $60.000, Ethereum might cost as much as $15.000.

Profits from the world's largest GPU makers exploded after the 2020 dump, and cryptocurrency mining has an extreme and long-term impact on the graphics card industry. The fact is that over the past two years, cryptocurrencies have risen noticeably, and the demand for chips suitable for mining has grown. At the same time, a few years ago, after the 2018 crypto dump, it seemed to manufacturers that miners were not a very attractive audience, but now they welcome this new category of consumers.

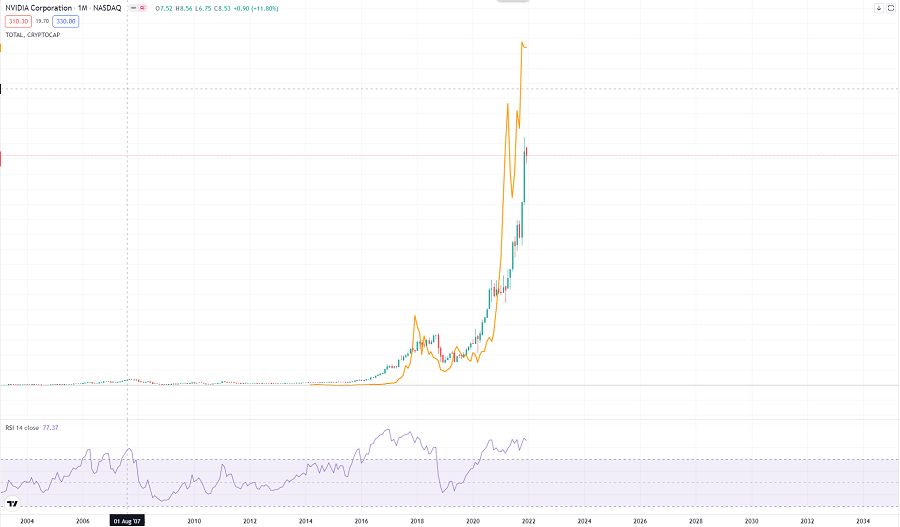

On the screen above, NVIDIA and total crypto market charts are compared. Notice that the correlation is enormous. It confirms that about 90% of CPU producers’ revenue comes from miners. Ethereum is the most profitable coin to mine on CPU nowadays (Bitcoin miners prefer to use so-called ASICs). If Ethereum switches to a POS network, AMD and NVIDIA will lose more than 30% of their capitalization.

Of course, CPU producers cannot lose the miners' market; therefore, some new crypto coins on the PoW network might be created.

As for today, such stocks as AMD and NVIDIA still have space to fly further if the US government will not dump stock and crypto markets by monetary policy tightening.

Until “The Merge’ Ethereum will perform well due to the deflation model and rising interest from investors and miners. Afterward, Ethereum might lose its attractiveness for a significant part of its community, and as a result, the price will decrease.

Don't know how to trade crypto? Here are some simple steps.

Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Hold on to your seats, folks! Bitcoin (BTC) is back with a vengeance, soaring past the $30 000 mark on April 11th, reaching its highest point since June 2022. And it's not just BTC - Ethereum (ETH) is also making gains, trading at $1917 and bagging 3.1% gains...

Hey, have you heard about the latest news on de-dollarization? It's the process of shifting away from the US Dollar (USD) as the world's reserve currency for trading...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later