The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

China was the first country that entered the coronavirus crisis, that’s why it should be the first out. However, the recent resurgence of new infections in Beijing made some investors worry about the second round of downturn. Today new virus cases decreased sharply. Let’s see how economists changed their predictions for the China’s rebound.

Most analysts upgraded their projections for the Chinese economic growth. They increased their forecast for GDP from 1.2% to 1.5% in the second quarter from a year earlier, according to the Bloomberg’s survey. Aidan Yao, senior economist at AXA SA in Hong Kong, said:

“With industrial production and services output both resuming growth, we now expect a positive GDP growth print for the second quarter”.

It seemed that the second largest economy may avoid the full-year recession after the historic contraction by 6.8% in the first quarter.

However, not every analyst has so optimistic prospects. The main reason of concerns is the reduced consumption. Many people lost their jobs and others had pay cuts. It will take a lot of time for most people to find new jobs. The central bank assured that it would expand its support measures to boost the domestic demand. It would offer interest-payment holidays and more credits to businesses. Moreover, economists anticipate that the People’s Bank of China will extend benefits for banks: decrease reserve ratios to 11.5% from 12.5%. However, it may be not sufficient enough. According to CBB International, most significant indicators of economic health such as manufacturing outputs, capital expenditures and retail sales are still well below pre-crisis levels. At the same time, Bloomberg strategists are confident that the industrial output and fixed-asset investments will grow in the next quarter.

Since the Chinese economy is the second-largest world economy, investors will look closely at the speed of Chinese recovery to understand how much time it will take for the global economy to return to pre-crisis levels. Moreover, the US dollar has shown the recent downward trend. The combination of growing Chinese economy and the weak US dollar will push the Chinese yuan upward.

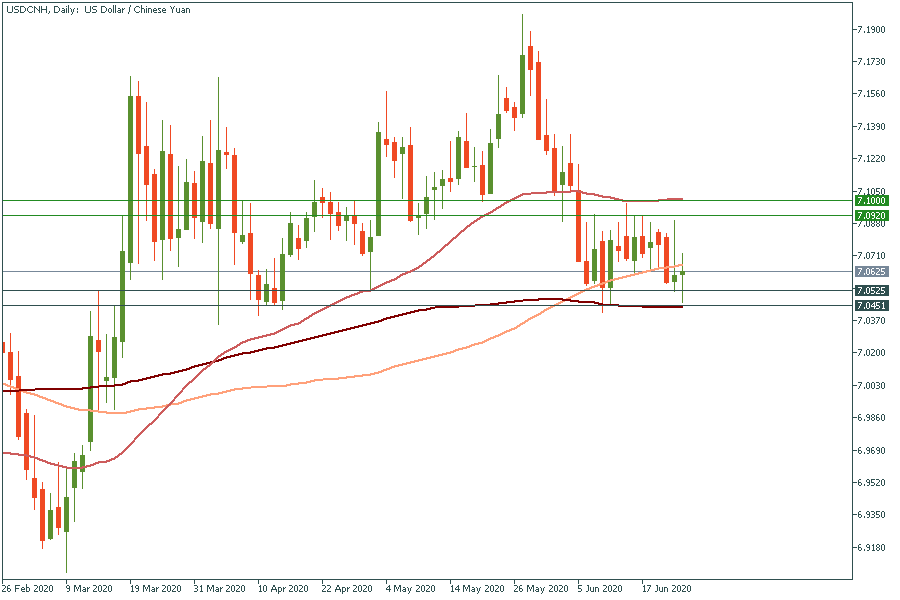

The USD/CNH has been declining sharply since the end of May and set a strong bearish trend. Then, it entered the horizontal corridor in a range between 7.0525 and 7.0920 at the beginning of June. Most analysts have bearish prospects for this pair. The move below the support at 7.0525 will push the price even lower to 7.045 where the 200-day moving average lies. Otherwise, if the price crosses the resistance at 7.0920, it may jump to 7.100 at the 50-day moving average. Follow news further and join the market momentum!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later