The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

December 5-6 will see another meeting of the Organization of Petroleum Exporting Countries.

Although there were earlier talks of a possibility of oil production cuts, the most recent reports say that the cartel is most likely to keep the current level of oil output at least until the middle of 2020. One of the contributing factors to the steady production plan from the side of OPEC is the competition with the other oil-producing countries, primarily the US. Let us have a look at how the situation changed in recent months with respect to the US-OPEC oil rivalry.

The world’s oil output is nearly 80 million barrels per day, out of which 30% is the OPEC part. The US provides around 13 million barrels, which is 16%. That makes it the primary competitor for the OPEC, especially in the context of the political antagonism between the majority of OPEC country members and the US.

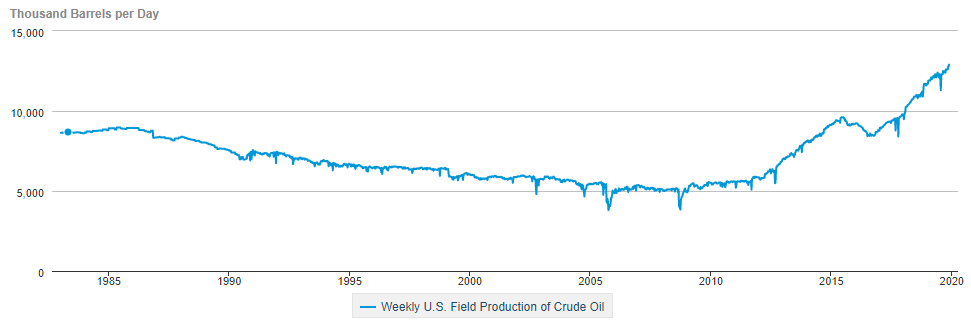

Until recently, American oil production has been increasing at an aggressive pace. The historical chart below shows how oil production in the US rose from 5 million barrels per day in 2005 to the current roughly 13 million. That is, after decades of a gradual decrease in the total output. The main driver for that was the production boom of shale oil, which takes around 60% of the total American oil output. Therefore, it has been creating a lot of pressure on the OPEC.

Source: www.eia.gov

However, recently the shale oil production expansion finally reached its peak and will unlikely rise substantially in the short-term.

Goldman Sachs revised the forecast for the US shale output growth in the next year. Now, instead of 1 million barrels per day increase, it is expected to grow by 0.7 million barrels per day in 2020. In turn, this figure is less than the 2019 level of 1.1 million barrels per day output.

That marks an important point for the OPEC as its future now becomes more secure with a weaker threat from the US shale side. Without this development at the end of 2019, it would probably be quite difficult for the organization’s Secretary-General Mohammad Barkindo to stay positive looking at 2020. He outlined recently that even if the market shows weakness at the beginning of the coming year, it will be not for long, and that in general, he sees “brighter spots for the 2020 outlook”.

That provides enough basis for us to expect a fairly positive summary of the OPEC meeting on December 5 and a relatively positive outlook for the oil prices.

EIA predicts the 2020 average price for Brent crude oil to be 60 USD for a barrel, while the 2019 average has been 64 USD. OPEC will share its own view on the price forecasts. However, the crude oil prices indeed decline, it will likely boost the US dollar as normally the US and oil have a negative correlation to each other.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later