The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On December 5, the OPEC held its last meeting.

Before that, the market was expecting to have a rather positive outlook from it. That was in part fueled by some confident commentaries from the cartel’s Secretary-General Mohammed Barkindo. He had shared some optimistic expectations seeing “brighter spots” in the oil industry for 2020 and in the OPEC’s future in particular.

In turn, the latter was supported by the better picture in the US-China trade relations. These have stepped into a new stage of their trade talks in October, showing solid advancements towards an initial trade agreement. That supported the oil prices, which have been on the rise since then. In theory, these circumstances altogether should have given stronger grounds for the OPEC to finalize its meeting on a confident note.

Nevertheless, December 5 showed no such thing. More to that, the usual press conference that follows the OPEC meetings was canceled, leaving the audience with little facts to consider.

The only clarity that finally reached the media was that a deal was reached during the meeting. Also, a 500,000 barrels per day cut was reported later to take place in 2020. Examination of the related analytics shows that the only solid conclusion from the meeting is that the OPEC inclines towards supporting the oil price in 2020 or at least setting a stop to its downward movement potential.

The US has approximately 16% of the world crude oil production, while the OPEC countries have 30%. Apart from Russia, there are no other states which would be able to affect oil prices unilaterally manipulating the country crude oil supply. That means that the OPEC, US, and Russia are those who define the present and the future of global oil production and prices.

That is why there has been so much debate about US shale oil production for the coming future – because the US shale as the main driver of American crude production boom is the prime competitor of OPEC and a cause of a grim outlook for it. That is also why every step the OPEC takes is cross-checked with Russia to ensure the latter’s support – because Russia is a strategic competitor of the US in the oil production sphere (same as for the OPEC, though).

In turn, oil is the prime fuel source and the basic industrial chemical component for the entire world. As such, its demand and supply affect the economies of every state. Also, as a commodity, it is widely traded at the exchanges. And finally, the oil price affects the USD and other currencies, as it is traded mostly in USD.

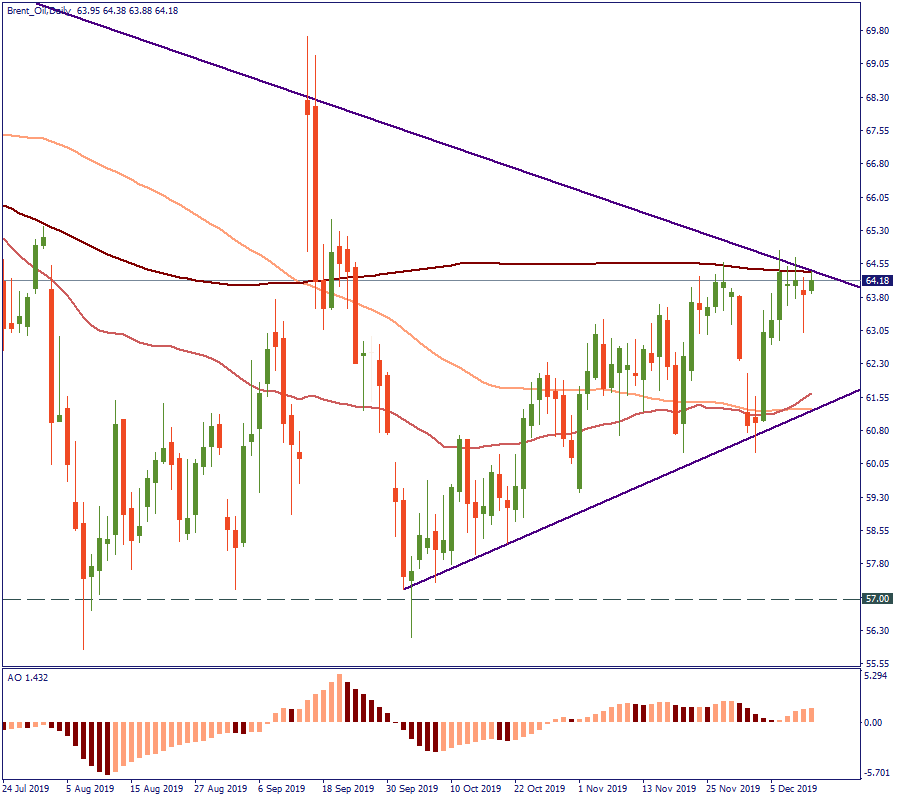

Since April this year, the price for Brent crude oil has been generally dropping and came to the $57 per barrel low in October. That is when things started to look better, including the reconciliatory signals from the US-China trade war. Therefore, the price started rising. On the daily chart, it trades at around $64 per barrel currently, which is where it decides if it intends to cross the August-to-October downtrend trajectory. In the same area, the price is testing the 200-day Moving Average, which is the main resistance for it at the moment. From the technical perspective, a decisive crossing of the 200-day MA would be a strong confirmation that the market is planning to keep rising.

Hence, look out of the news and trade Brent with FBS - to do that, you need to choose BRN-20G in MT4.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later