The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today, we are expecting decisions made about the global oil supply cut by the OPEC, the US, and Russia. Hence, it makes sense to throw a quick look at the OPEC in the context of the global oil market.

OPEC is a cartel consisting of oil-exporting countries: it defends the interests of those countries as they are mostly living on crude export profits. Currently, there are 13 countries. Geographically, most of them are located in the Middle East. Production-wise, the biggest outputs are also represented by that region, headed by Saudi Arabia.

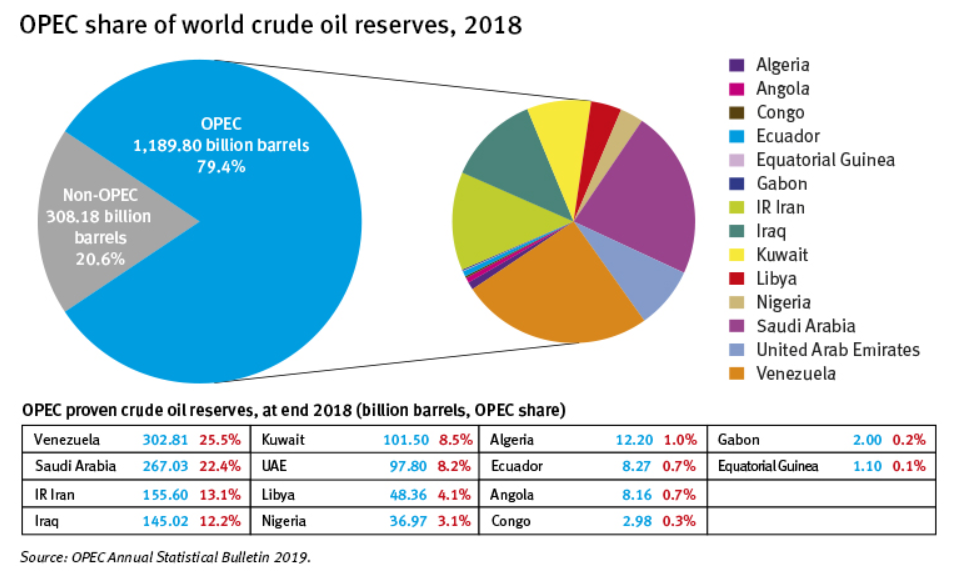

OPEC takes 80% of proven oil reserves globally. Although Venezuela takes the first place, its external political and internal social-economic status will keep its reserves underground in the nearest future. For this reason, Saudi Arabia is a factual #1 in terms of reserves, capacities, and it’s a true leader of the OPEC at the moment.

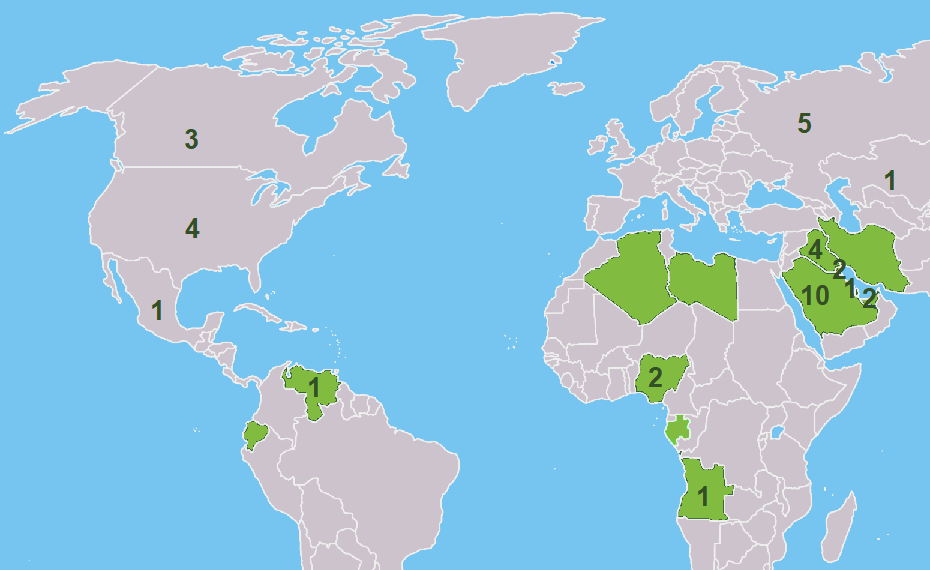

In terms of the exports, the below map shows the relative strength of the cartel. Countries marked in green are those which are in the OPEC, and numbers correspond to the reported 2018 total oil exports of each state if it was more than 1mln bpd.

Source: OPEC

As you can see, the concentration of numbers in the Middle East and their relative weight in the total sum of the biggest oil producers leaves little doubt: the OPEC has a firm grip on the oil market. While the only few countries which may counter what Saudi Arabia says are the US and Russia (Canadian exports are all consumed by the US, Iraq is normally following suit with the KSA).

That’s why what will be agreed today at 15:00 MT time will define the oil market in the nearest future. Traditionally, OPEC’s meetings have been held in the Austrian capital city, but as the situation demands, it has to be done remotely. WTI already surged to $27 in hopes of positive outcomes of the meeting.

If the market doesn’t get disappointed and witnesses 10% of global oil supply sealed, oil prices will shoot up. Otherwise, they are likely to plunge in expectation for big troubles ahead.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later