The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

So we have now an all-out oil price war between Saudi Arabia and Russia.

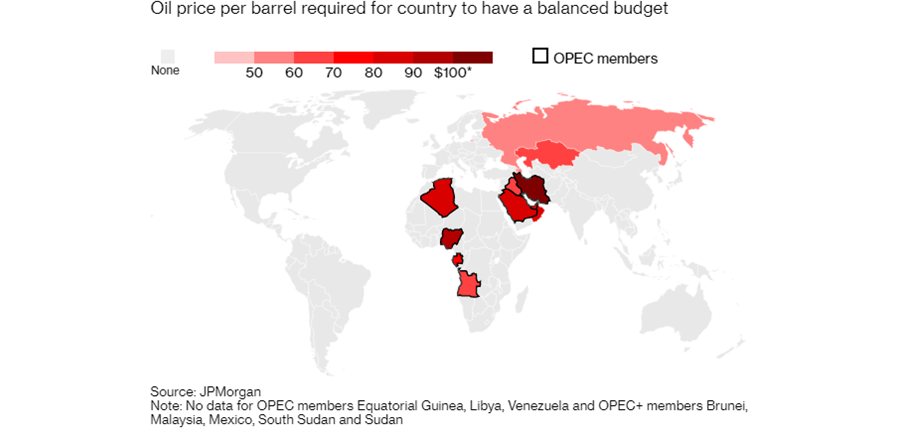

Russia is planning to increase its oil supplies undoing the December output cut once its term ends in March. It is assuring that its fund reserves are ready to absorb the damage from lower oil prices for as long as up to 10 years (with oil prices at $25-30 per barrel).

Saudi Arabia, in response, prepares to increase its own supplies for up to 12mln barrels per day. It also offers its crude under huge discounts, especially in Europe, to push away Russia from its core market.

The opposition doesn’t end here, however: the situation is actually a triangle of relationship rather than a Russia-Saudi Arabia standoff. The US is involved heavily, but indirectly, although it may be not that obvious: recently they just commented that they were hoping to see the oil market in an “orderly” condition.

Let’s observe the starting points of each protagonist here.

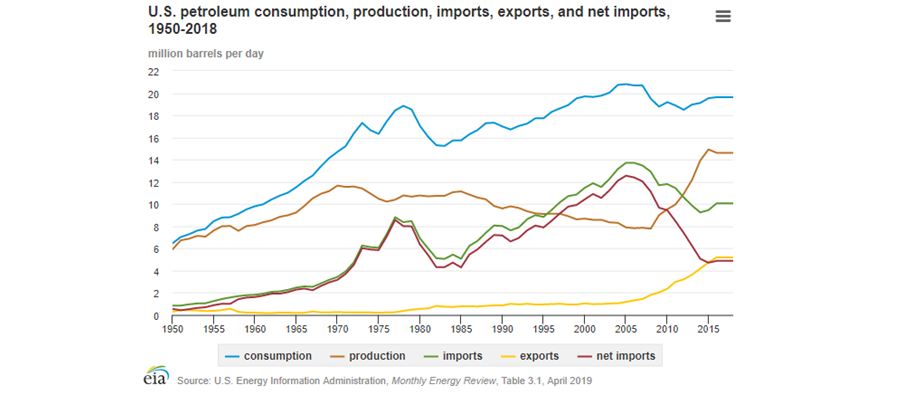

Source: US Energy Information Administration

Source: JPMorgan

Now, as we cross-weighed the strategic pros and cons for each country's positioning, let's see their mutual relasionships.

Now, the March 5 meeting was the OPEC+ meeting, which means mainly Saudi Arabia and Russia. As long as the two disagreed on the oil cut, the opposition is said to be between those two countries. But in reality, there is a triangle: Saudi Arabia, the US, and Russia. And going deeper, there is a Russia-US opposition conditioning these happenings.

Formally, here is the sequence of events. The virus comes, hits China, hits the global economy, reduces expected global oil demand, presses the oil price down – all suffer. Specifically, OPEC (headed by the oil-dependent Saudi Arabia) and Russia suffer because of lower oil-export profits. So the KSA comes up with an urgent proposition to lower the output across all OPEC members and Russia to balance out the lowered demand and prevent the oil price from slumping on the mismatch between the demand and supply.

Russia, in general, has no problem with a cut as such. And it has a little problem with Saudi Arabia itself, all “small” issues aside. But it does have a problem with the US and its shale production, which already gained momentum and its share in the global oil market.

Russia’s starting point is that the OPEC+ with its collective initiative to reduce the total oil output across all countries including Russia only resulted in an increased share of the US shale. Hence, the argument of the Russian side is: yes, the oil price is now more stable, but it came at the cost of giving more room for the US oil producers. And the latter undermines the strategic strength of Russia as an oil exporter. So now Russia doesn’t want to continue giving in to this output cutting spree, because it doesn’t want the US to grow stronger in shale oil production. In fact, Russia wants to push the US shale out of the game in this specific sphere.

In the meantime, Saudi Arabia is tired of facilitating most of the output cuts on its own and bearing the responsibility of OPEC’s destinies almost alone, while other OPEC members and non-OPEC partners (such as Russia) act as they please. In view of the huge untapped capacity to increase the oil output, Saudi Arabia is more than happy to do that. And by doing that, it will not only compensate for the lower oil price to keep the same profit level incoming but (supposedly) force Russia to get back to the negotiating table, because Russia, being unable to increase the exports at a similar pace, will suffer from lower oil price and hence lower profits.

Now, the US stays somewhat behind the scene here, but it is, in fact, a primary protagonist. The impact of the price war, which makes the oil price low and unstable at the same time, primarily hits small and medium-sized shale oil producers in the US. These will surely go out of business in the short-term as long as the situation follows the same direction for a couple of months. However, the question is how harmful that may be to the core of the American shale oil industry, presented by the giants like Exxon or Chevron – those most probably have prepared to situations like that and hedged the risks. Very likely, their preparations will be tested in the long run if the conflict goes according to the pessimistic scenarios.

That’s why Saudi Arabia, although a primary actor in this theater of war, is, in fact, a hostage of the situation presented by the opposition between the US and Russia. The US wants to grow its global oil supply market share reducing the dependency of global powers on Russian oil and increasing their dependency on the US. Russia wants to keep its market share and keep other global powers being dependent on its supplies not letting the US take this part of the pie. And Saudi Arabia is just trying to survive being caught between two fires and trying to exploit its only two aces: the biggest oil reserves and strategic interest of the US to have the KSA on its side.

We are witnessing amazing changes in the ways we live. The XXI century is an incredible era. But electric autos, nanotechnologies, cryptocurrencies, augmented reality or any other never-believed-before marks of the “era of the future” cannot change what lies at the foundation of the human civilization – humans. And until the human brain evolves into something naturally different from what it was 5000 years ago, no technological advancements will change human’s ways. That means, you can kill by a stone, a stick, a sword, a bullet or a laser gun – the action is the same; only the method changes. Applied to our question, oil as a global energy resource stepped into the scene only roughly a century ago; before, it was coal, water, forests, croplands, etc. But it doesn’t change the underlying process – the old good rivalry of global powers over spheres of influence and resources, and survival of smaller powers in between. In other words, essentially, what we are witnessing between the US and Russia with Saudi Arabia in the middle, is little different from what was happening between Russia and British Empire, Britain and Spanish Empire, Ottomans and Byzantine Empire, the Umayyad Caliphate and Frankish Empire, Carthage and Roman Empire, Greece and Persian Empire, and numerous other powers, which emerged and left the stage. Neither this will ever end.

For the oil market, although that’s not the first time it goes into turbulence, where the current situation will lead – nobody knows. As Warren Buffet said, if knowing the past guaranteed expected outcomes, Forbes 500 would consist of librarians.

For trading, however, nothing changes: sell at the highest highs, buy at the lowest lows. And currently, oil price seems to be very close to the rock bottom – however, don’t fall for this “seems”. Observers already voiced out fears that $3 per barrel (yes, the number is correct: its “three”) may be a possible outcome. And that makes sense: Saudi Arabia and Russia just stared their competition, and there is no indication that it is going to end soon – hence, there is little reason to expect the oil price to make any significant upswing other than in the course of correction. That’s why, until there is a peaceful resolution to the oil price war, there will be constant pressure down on the price, given the fact that the strongest weapon both countries have is to flood the markets with more oil.

Therefore, the current situation presents a choice for you as a trader. Either you play short-term/correction, or you play long-term/downswing, and the latter will be prevailing in the market as long as the war goes on.

The safest step, for now, is to hold and wait until the oil price indeed reaches its lowest levels, and then buy. When it is going to be – we are yet to see. But given the “normal” levels at $55-60 where the price has been balanced during recent years, it is worth waiting.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later