The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Oil prices have been climbing up for a long time. What have stopped them?

First of all, prices fell on Wednesday after the API reported a surprisingly large crude build. It was reported an 8.7-million-barrel build, while analysts expected a 1.9-million-barrel draw. On Thursday US commercial crude oil inventories rose by 7.9 million barrels from the previous week. However, fuel demand remained weak. That disappointed many bullish investors as they hoped the oil demand would increase in the USA due to the Memorial Day weekend and easing lockdowns all over the world, but it didn’t improve as much as they thought. There are many doubts when the oil demand will return to its pre-crisis levels. Things are not so bad. For instance, Morgan Stanley reported that the demand will significantly rebound by the fourth quarter this year.

Oil prices are really sensitive to the whole market mood. Today investors are a bit confused as US-China relationship got worse ahead of Donald Trump’s press conference on Chinese actions. China imposed a security law in Hong Kong and, by that, threatened its autonomy, freedom and placed it at risk to lose its title of a financial hub. As a result, oil prices have started to ease off today.

According to OPEC+ agreement, all its members will cut the oil supply during the whole June. Saudi Arabia and some other OPEC members insist on extending output cuts of 9.7-million barrels per day beyond June. That's all well and good, but... Russia may reject this proposal as Russia’s largest oil producer, Rosneft, is struggling to supply its long-term buyers with crude oil. Also, Russian firms argued that these oil supply cuts just support the US shale production with higher oil prices, what gives the US oil producers a larger piece of the global oil cake at the expense of Russia and its OPEC allies. But, maybe OPEC will manage to get a Russian support.

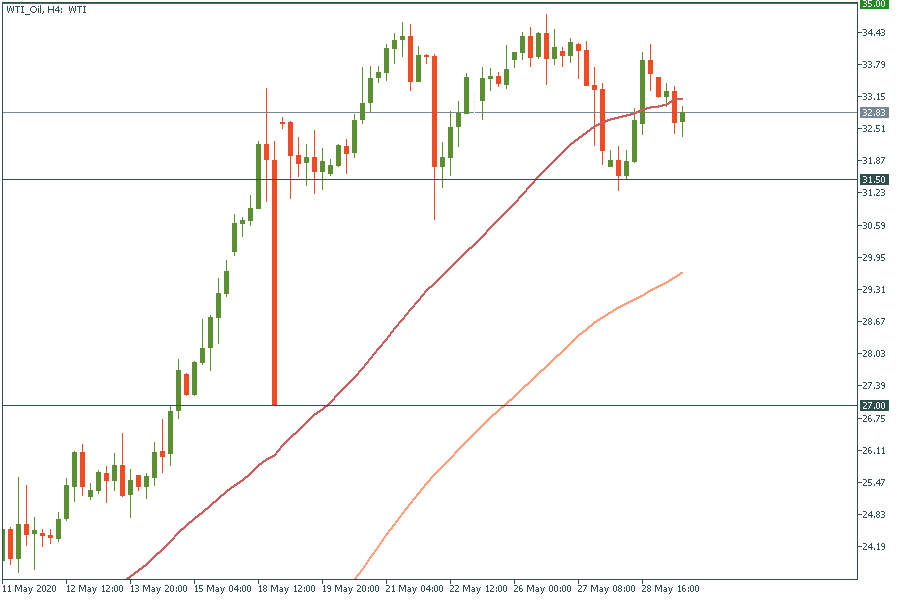

Let’s look at the WTI oil chart. The price has been increasing since April 28. Then the price entered the horizontal corridor on May 18. From that moment, it has been trading in a range from 31.5 to 35. If the price crosses the support line at 31.5, it may dip down to 27. Resistance levels are 35 and 37.5.

To trade WTI with FBS you need to choose WTI-20N.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later