China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

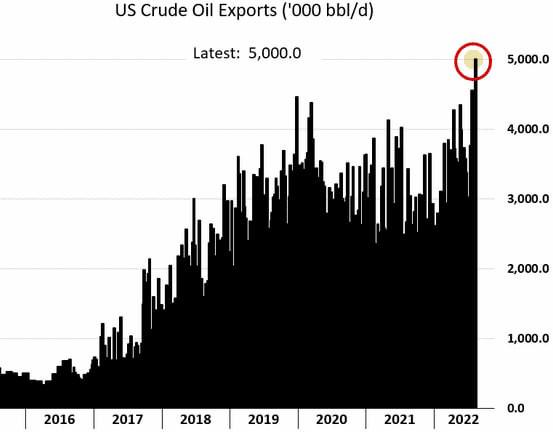

US oil exports reached a record last week at five million barrels a day, according to Energy Information Administration data. Moreover, EIA reported the US oil inventory shortage by 7 million barrels last week, combined with the decline in the US oil production of 12.1 million BPD versus 12.2 million BPD earlier.

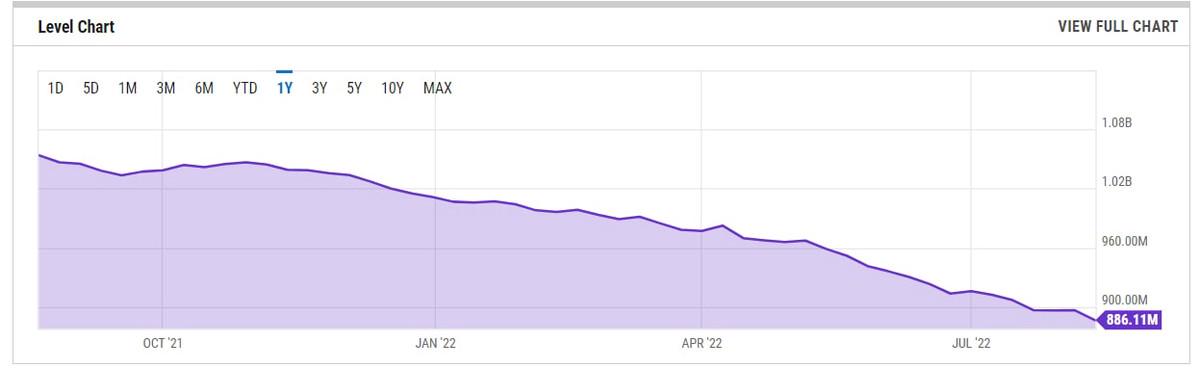

The fact that the United States spends more oil from its reserves while the production stays the same explains why the global oil inventories have decreased in the United States since 2019.

In the current conjunction, it’s too early to expect a cooling of oil prices soon. Moreover, more factors make the situation even worse:

1) Sanctions versus Russia due to the conflict in Eastern Europe.

Sanctions include:

Russia has always been one of the biggest oil exporters in the world and the largest one for the European continent. Nowadays, the USA has replaced Russia in the European market, but how long can the USA supply the European continent with its reserves? The question is rhetorical.

2) The United States and Asian countries replace Russian oil in Europe, but it’s too expensive.

Giant supertankers hauling crude oil across the globe have made the most money in more than two years, thanks to swelling shipments from the US and the Middle East. Benchmark earnings for huge crude carriers neared $40 000 a day on Wednesday to hit the highest level since June 2020. Assessments in the industry standard Worldscale system have jumped almost 40% over a week. Transporting oil by sea is not only expensive, but it takes much more time. Moreover, natural disasters such as droughts and storms can affect supply chains.

Earlier, we have already highlighted the fact that the oil industry is underinvested. New OPEC Secretary-General Haitham Al Ghais confirmed it. "There are other factors beyond OPEC that are really behind the spike we have seen in gas [and] in oil. And again, I think in a nutshell, for me, it is underinvestment — chronic underinvestment," he added.

For example, the main global oil supplier, Saudi Arabia, might raise its production capacity to 13 million barrels per day by 2027 from a capacity of 12 million now, and "after that, the Kingdom will not have any more capacity to increase production."

3) Chinese economy is going through hard times. But how long will it last?

According to the latest data, Chinese industrial production was up 3.8% year-on-year in July, but down from 3.9% in June and well below analysts' forecasts. To answer that, the People's Bank of China increased key interest rates in a surprise move. If the Chinese central bank keeps supporting the economy, the recession might be avoided.China is the first oil exporter in the world. Thus, potential economic stabilization will significantly increase the oil supply, pushing prices higher.

The exclusion of Russian oil for the European countries and the US, supply chain risks, sector underinvestment, the inability to increase production, the decrease in US inventories, and potential Chinese economic recovery - factors that lead to the energy market crisis and keep oil prices on the high level. In turn, high oil prices cause rising inflation in the US and European countries.

However, the US dollar wins in times of rising inflation, while other currencies stay under heavy pressure.

The price is consolidating in the bullish wedge ahead of some key news. After the breakout of the upper wedge’s border, XBRUSD will head towards 98.60. The text target will be 104.00.

Another important fact is that buyers still manage to hold prices above the 50-week moving average. If this weekly candle closes above this support, it will be a sign of an upcoming bull run during the upcoming week.

US dollar index is heading towards the 110.00 resistance, the potential point of the global reversal for the USD. Recent pump highlights the probability of rising inflation in the United States, which might be provoked by the upcoming oil prices jump.

If you want to find the highest point for the US dollar index, draw a “divergence” line on the weekly RSI chart. Technically, if the RSI touches this trendline and bounces off from it, the USD will finally reverse.

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later