The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

December closes quite controversially for oil. US shale production is at the highest levels but not as booming as before. The country’s oil inventories give signs of shrinking here and there. OPEC+ is trying to support the oil price by deepening the output cut, but many predict that’s not enough, not to mention the non-compliance problems within OPEC members. Oil demand for the coming year is another shaky ground. So what will happen to oil prices in 2020? To answer that, we need to examine the factors which dictate that.

The 20th century was an era of oil as a primary energy resource. That’s the reason why throughout the century its price has been mostly within the corridor of $10-20 per barrel. The demand for it never ceased to expand in line with production. Even the Second World War did not change the flat curve of the price (in fact, it may have solidified it) within the mentioned price range.

Then 70-s came marking the start of the turmoil engulfing the entire Middle East, the biggest area of oil reserves in the world. The global source of fuel was shaken. This forced prices to rise to the levels unseen since the inception of the industry in the XIX century. 70-s, 80-s, and 90-s were the shock years, and although they saw immense oil price volatility, these three decades did not change the foundation of the industry. That is confirmed by the fact that by 2000, the price got back to the area of $20 per barrel.

However, the last 20 years show a different picture. On the monthly chart below, the oil price has been mostly in the area of above $70 per barrel – that is roughly where it is now. The reasons for that were the same that spiked the price in 90% of the cases before – unrest in the Middle East.

Therefore, amid all the manipulations, output cuts and negotiations, the central factor that heavily affects the oil price is a geopolitical situation in the Middle East. As long as there is an underlying potential for state-wide social unrest or military conflict in an oil-producing country of this region, the price will stay supported, even with the decreasing global demand. And the latter, although predicted by many in 2020, will not be as significant as to make the price break below the marked support and alter the marked long-term uptrend.

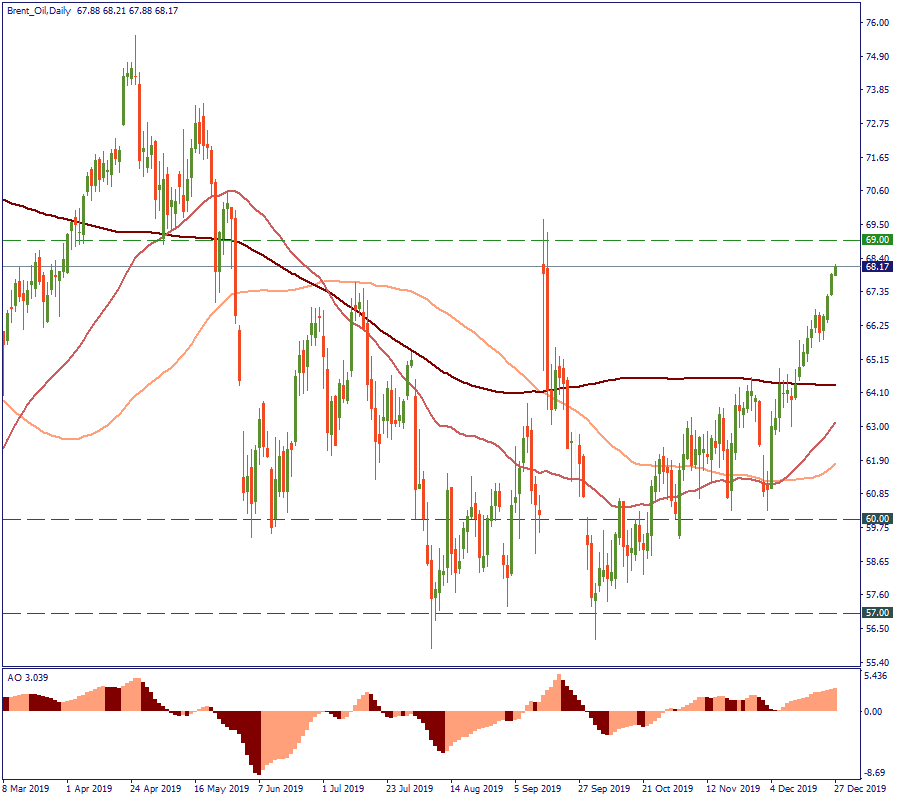

In the last week of December, Brent has traded at $68 per barrel. On the daily chart, the price is testing the $69-70 resistance, which is a 2019 high. Most of the observers predict that it will perform in 2020 slightly better than it did in 2019 and is not expected to drop below the area of $60.

Whether it will be to that level or not, we cannot know. But we can be sure that a certain drop will take place from the current level. OPEC plans for it, although keeping its optimism for the second part of 2020. EIA and the other observers also expect a decline. Nothing more than $70 or less than $60 has been voiced out so far.

Technically speaking, a downtrend is inevitable at some point. The last 3 months already showed a consistent rise, while December brings consolidation and steeper rise due to the improved US-China trade disposition and global economy. That cannot go on unchecked, and to be fueled, the price needs a more solid ground than just an improved environment. Will it have it? Quite unlikely.

The narrative of OPEC is to prevent the oil price from falling. That means, the price drop is the most expected trend from the cartel's point of view. An upsurge is seen as a very unlikely scenario by most who shared their opinions in the media. Given the numbers mentioned, the current price level of $68 per barrel is right at the top of the expected price corridor for the next year. Based on that, the safest plan would be not to buy, an active one – to sell.

You can trade Brent crude oil among other commodities and indexes offered by FBS. In MT4, it is labeled as BRN-20G.

Stay updated and trade wisely!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later