The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

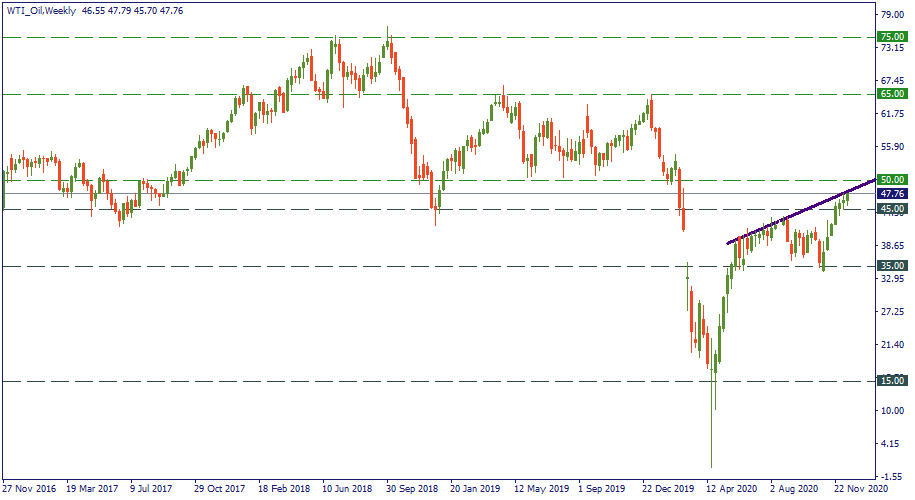

As 2019 opened, WTI oil was at $50 per barrel. Through that entire year, it was oscillating between this support and the resistance of $65. That’s exactly where it was when the virus stroke and the global oil demand plunged. WTI oil price did the same: it dropped from $65 to zero. $35 is the level which marked a definite start of recovery as it eventually proved to be tactical resistance. Closer to the year-end of 2020, the price moved into the channel $45-50 – that same channel that used to support the WTI oil price since March 2017. What’s the projection for 2021 then, will it repeat 2017-2019 and manage to get to $65?

As the new Joe Biden takes over from Donald Trump as the newly elected US President, some changes in American international affairs are expected. Joe Biden is believed to try to get back Iran to the nuclear deal. If that’s the case, Iran will likely see the sanctions over it lifted. If that happens, Iranian oil will get back to the market – and Iran already announced that it’s planning to double its oil production in 2021. If the chain of events completes the sequence to let Iran have back its access to the global market, that will press on the oil price downwards and cause some trouble to OPEC.

The oil cartel is experiencing increasing internal incoherence. The recent meetings it held were as controversial as ever and exposed existing disagreements between the member countries. That means the strategic goal of OPEC to put ground to the oil price may be an increasingly hard target to reach. That’s going to be a key point of struggle as $45 is notable below the minimum acceptable price range for most cartel member countries - the breakeven level for many of them is above $50. Therefore, whatever their disagreements are, they will likely ensure the supply cuts to keep the price above those levels. But how much above – that’s the big question.

Officially, Saudi Arabia expects the oil price to be between $45 and $50 through 2021 on average. That’s the range it factored into Aramco’s – and, hence, state’s – revenues (although that’s no longer going to be shared with the public – KSA doesn’t like sharing Aramco’s dividend plans). EIA and IEA say roughly the same and give moderate projections on the global oil demand while the oil glut is expected to clear by the end of 2021.

So here you go with practical advice based on the above observations.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later