The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The beginning of the year was promising for the oil market. US-Iran tensions boosted both major crude benchmarks. Brent touched the highs of September 2019, WTI was at the levels of May 2019. However, the coronavirus caused a plunge of the recently recovered oil. We will consider the reasons behind that and make forecasts for the upcoming moves.

The spread of the coronavirus with an increased number of infected people and confirmed deaths caused risks of the slowdown in the Chinese economy. Two-thirds of China’s workforce can’t go to work. Huge factories, stores, and restaurants such as Apple and Starbucks are closed.

China is the world’s largest oil importer. That’s why the oil market is under pressure. Moreover, traditionally, the Lunar New Year holiday is the time of increased jet-fuel demand as Chinese citizens travel and go back home. This time, millions of people were locked and flights were canceled. The decline in the industrial activity led to an additional slide in oil consumption.

According to Bloomberg, coronavirus caused a decline of about 20% of total consumption.

Since last week, China stopped purchasing Latin American oil cargoes, while import of West African crude is lower than usual. The nation’s biggest refiners have been shortening runs at their plants.

Analysts call this dramatic fall the most sudden since the attacks of 2011 and the most shocking since the global financial crisis of 2008 to 2009. Currently, only cut of the oil production can save the situation.

China is one of the largest importers of OPEC oil. It purchases more than 70% of its crude from OPEC and its Russian-led allies. It makes the situation with the coronavirus critical for OPEC+.

The most important problem that may arise for the OPEC allies is the unwillingness to cut oil production more. We all remember that the organization together with Russia agreed to cut the production significantly to boost oil prices. It means there is a small room to cut more. Moreover, countries need money to support the domestic economy.

Parties discuss the possible shortage of the production. However, until now, allies couldn’t come to any decision. Previously, Saudi Arabia offered a short-term oil production cut of 500,000 barrels per day. Another option is a temporary cut of one million barrels a day.

Nevertheless, Russia disagrees with the deeper cut and supports an extension of the output cuts until the end of March 2020 (this was agreed in December 2019).

There are odds of the soon OPEC meeting that can be moved from March 5-6.

Any positive news on the deeper cuts will boost the price of the oil benchmarks especially Brent. Until then, prices may fall further down.

Let’s have a look at the technical setup.

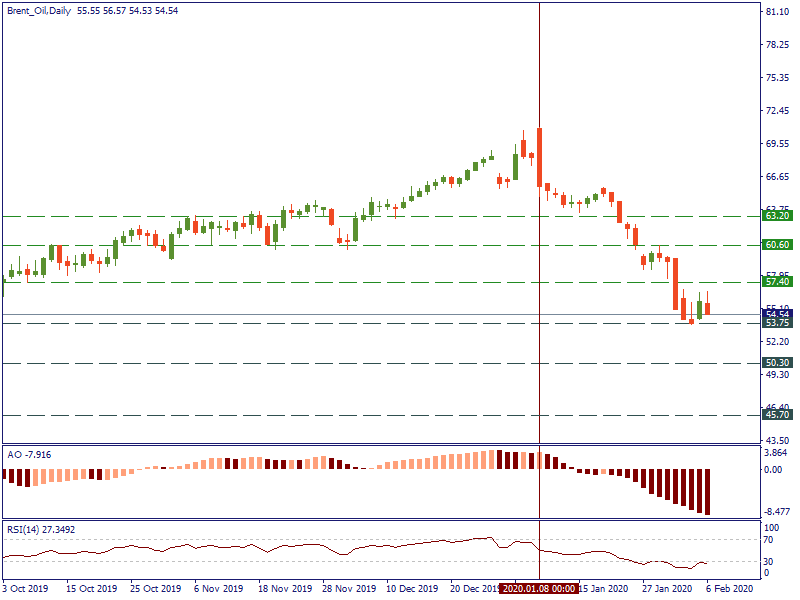

On the daily chart of Brent, the downtrend took place on January 8 after the US-Iran tensions calmed down. Currently, the price is at the lows of December 2018. Wednesday’s pullback was caused by the positive news declaring scientists developed an effective drug against the coronavirus. However, rumors were not confirmed by the World Health Organization.

If OPEC allies agree on the extension of the output cuts, Brent will get a chance to rise. Resistances are at 57.40, 60.60, 63.20. Negative comments on the coronavirus may pull the benchmark down. Supports are located at 53.75, 50.30, 45.70.

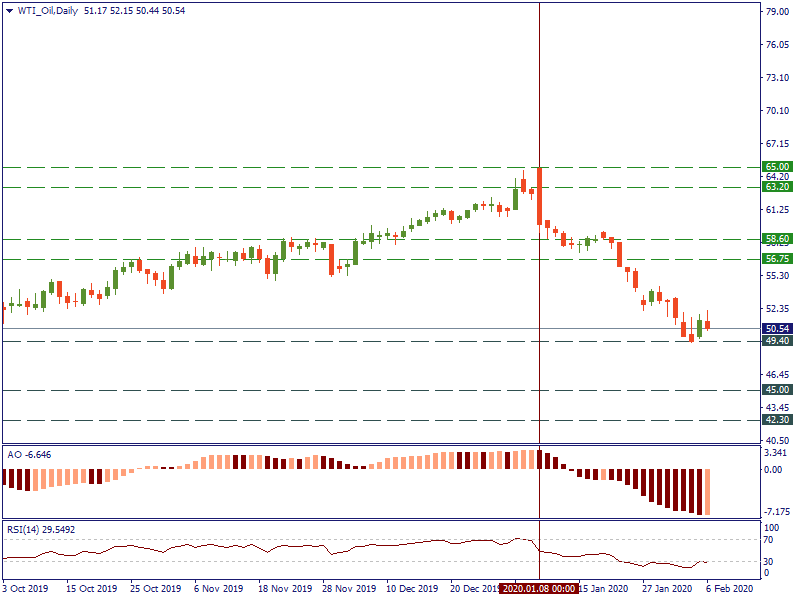

As for WTI. The picture is similar. Besides positive comments on the effective drug against the coronavirus, a sharp decline in the US Crude Oil Inventories was a driver of the market. WTI will be boosted in the case of the additional output cut or positive comments on the virus. Resistance levels are placed at 56.75-58.60, 63.20-65.00. In the case of the prolonged decline, supports are at 49.40, 45.00, 42.30.

To conclude, the dramatic fall of the oil market was caused by the spread of the coronavirus. An extension of the virus will increase the risks of the prolonged plunge. If OPEC allies can’t agree on the additional production cuts, the oil will suffer for a long time.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later