China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

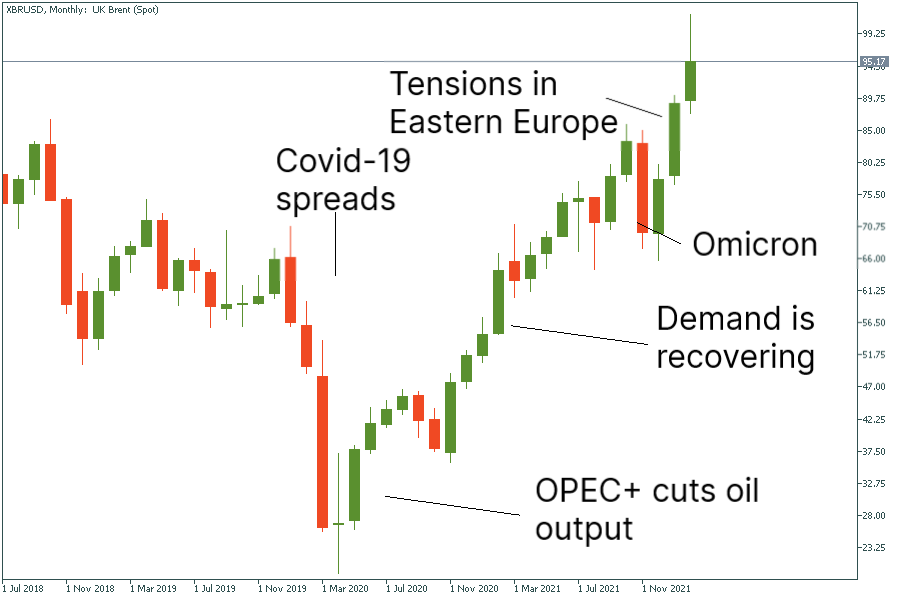

There is no calmness in the oil market; history taught us. Since the pandemic began in 2020, we have seen ups and downs in oil prices, from the negative $37.63 per barrel for May 2020 WTI crude to breaking out of the $100 level this February. Now traders wonder if they should expect a rally continuation or an inevitable correction. In the first case, the price may rise above the highs of 2012. In the second kind of scenario, we will see a heavy slump similar to one in 2015-2016. Which case is likely to come to life this time?

At first, let's review the primary factors driving the oil prices. Like any other commodity, oil is heavily dependent on the law of supply and demand. The supply levels from the key oil-producing countries, including the US, Saudi Arabia, Russia, Canada, and China, impact oil prices. A cut of the regular supply flows pushes the oil prices up. At the same time, the oil demand should remain high to support the price levels.

The second factor is linked to the Organization of Petroleum Exporting Countries (OPEC). Founded in 1960, this organization of 13 members regulates oil production levels and sets the direction for oil prices. In 2016, OPEC+, a larger group of oil producers, was formed. The renewed alliance conducts meetings several times a year to control the number of barrels in oil reserves.

The change in the performance of the USD is another factor driving the prices of oil. As commodity prices are usually quoted in US dollars, they tend to fall if the USD is strong.

Finally, the sanctions, wars, and agreements between the key oil-dependent economies also influence the complicated market of black gold.

Right now, all three factors have a heavy impact on the market. The restoring economic activity worldwide resulted in a global splash of demand for crude. Even though OPEC+ decided to increase output by 400 000 barrels each month starting in August 2021, the oil’s uptrend remained intact. There are two main reasons for that: the unprecedented demand and tensions between Russia and Ukraine. The former cause has already been analyzed by OPEC+ and is taken into account. At the same time, the latter one is surrounded by a lot of uncertainty. All in all, the military order to attack Ukraine by Russia's President Vladimir Putin made an oil test $100 on February 24.

The price of Brent may easily overcome the current highs if no intervention into the oil production is considered. According to JP Morgan, if the conflict in Eastern Europe lasts for a long time, the breakout of the 100 mark for both WTI will be more than possible. In that case, JP Morgan expects WTI around $107 and Brent at $110 a barrel next quarter.

The bearish pressure may come from the final revival of the Iranian nuclear deal that will free more oil into the market. Also, if the US or OPEC decides to pump more oil amid the escalation in Eastern Europe, this can result in the oil trend's reversal.

There are high chances that the oil prices will repeat the scenario of 2014 and correct. There are specific reasons to believe that: the pandemic is far from its end, the tensions in Eastern Europe can eventually cool down, and more oil may be added to the market.

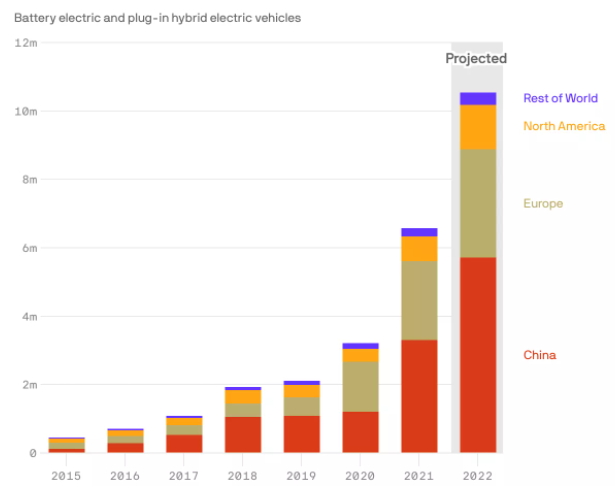

Moreover, researchers say that the demand for electric vehicles is set to break a record this year. While this is bearish news for the oil prices, this is a bullish factor for the prices for raw materials such as lithium and nickel since the industry is facing supply chain problems.

Sourced by: https://www.axios.com/

On the Brent chart (XBR/USD), you can see that the key resistance lies at $102. As the price reached the channel's upper border and entered the overbought zone on the RSI chart, we may expect a correction towards the lower border at $76. This is the level of 50-week MA. On the upside, if the breakout of $102 happens, the price will rise to the $109 level – the resistance unseen from 2014.

You can trade both WTI (XTI/USD) and Brent (XBR/USD) with the FBS broker. You can even have $100 in your account after completing seven steps that will guide you through trading basics.

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later