Recently, for the first time in two decades, the euro reached parity with the US dollar…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Nvidia will present its earnings report for the fourth quarter on February 16 after the stock market closes (23:00 GMT+2). In addition, Nvidia's management will hold a live question and answer webcast at 00.30 MT, February 17, to discuss its financial and business results.

Nvidia is a leading manufacturer of high-end graphics processing units (GPUs). GPUs are used in embedded systems, mobile phones, personal computers, workstations, and game consoles. Modern GPUs are very efficient at manipulating computer graphics and image processing. There are several reasons for Nvidia's earnings report to beat the market's expectations:

Mining popularity growth

Nowadays, miners form the most significant part of the demand for GPUs. As we can see on the screen below, the global Ethereum hash rate is gaining momentum, which means more and more GPUs are getting used. Therefore, we can assume Nvidia to show great revenue in Q4.

Global Ethereum hash rate. Ethereum is the №1 coin to mine on GPUs.

Metaverses

GPUs are also used to run metaverses, becoming a new driver for the technology sector. So far, there are already more than ten global projects, and even more, will appear in 2022. It is clear Nvidia benefits from this trend as the largest equipment supplier for this sector.

AMD outperformed expectations

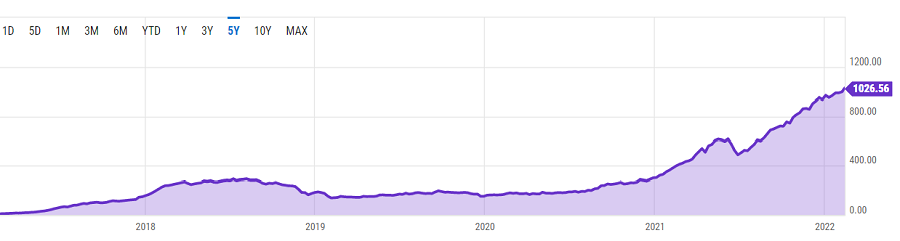

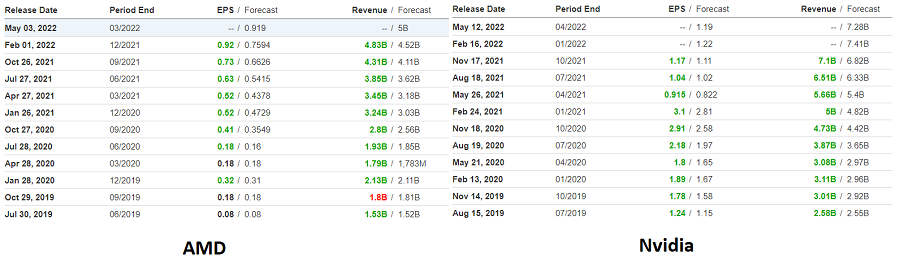

The main Nvidia's competitor, AMD, already published a revenue report for Q4 2021 on February 2, with the 6.8% advantage above expectations. On February 3, the stock opened 10% higher. If we compare Nvidia's and AMD's reports, we can notice these companies show similar results since 2019.

On January 25, Nvidia refused to buy the British company Arm from SoftBank amid unsuccessful attempts to obtain approval for a deal worth $40 billion from regulators. Therefore, there is no significant spending affecting the report.

According to these facts, we assume Nvidia's report will surprise investors and positively impact the stock price.

Nvidia, daily chart

The price has been moving in the descending channel since November 2021. The upcoming earnings report is an excellent opportunity to break through the upper border of this channel and continue the rally. Better than expected earnings report will send the stock to $270, an intersection of 50- and 100-day moving averages. If the price breaks through this resistance, we will see a pump with targets at $285, $310, and $333.

On the other hand, if the earnings report disappoints investors, the stock might fall to $210 support.

Don't know how to trade stocks? Here are some simple steps.

Recently, for the first time in two decades, the euro reached parity with the US dollar…

The second earnings season of 2022 has almost begun. From banks and tech stocks to cars and the retail sector: in this outlook, we covered the most promising releases of this summer and made several projections on the companies’ prospects.

The stock market has reversed, and now it’s going lower and lower…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later