I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

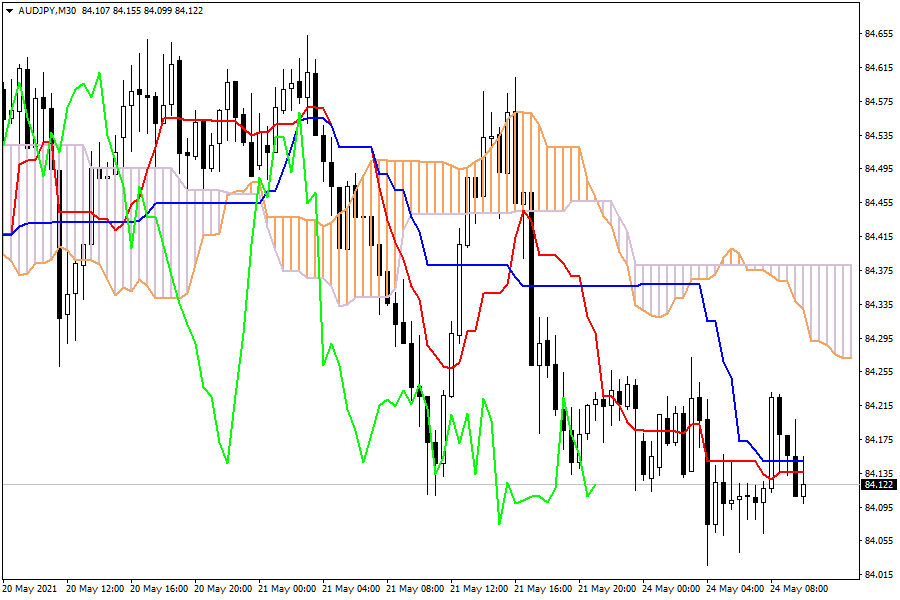

Ichimoku Kinko Hyo

AUD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

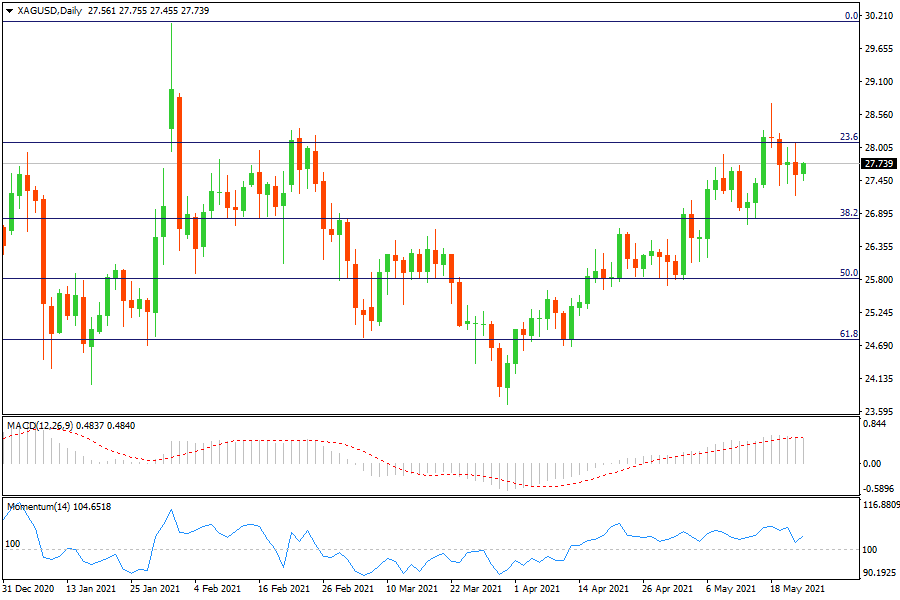

Fibonacci Levels

XAG/USD: continuous to stand below 23.6% retracement area. Bullish pressure is growing during the last hours.

EU Market View

Asian shares were mixed on Monday as investors awaited key U.S. inflation readings for guidance on monetary policy, while bitcoin tried to steady after being hammered on news of China's clampdown on mining and trading of cryptocurrencies. After surveys of the global service sectors out on Friday showed spectacular growth, all eyes will be on U.S. personal consumption and inflation figures this week. A high reading for the core inflation figures would ring alarms and could revive talk of an early tapering by the U.S. Federal Reserve. The diary has a crowd of Fed speakers this week, including the influential Fed Board Governor Lael Brainard, and markets will be keen to hear if they stick to the script on being patient with policy.

The dollar edged down in early European trade Monday, trading near three-month lows as confidence that the Federal Reserve was set to start tapering its bond-buying program in the near future ebbs away.

Group of Seven countries are close to reaching agreement on the corporate taxation of multinationals, clearing the way for a global deal later in the year, the Financial Times reported.After the United States agreed to accept a minimum rate of at least 15%, France, Germany and Italy said the new proposal was a good basis for sealing an international deal by July.

British employers called on Prime Minister Boris Johnson on Monday to overhaul regulation and tax rules to help them meet the challenges of Brexit, the post-pandemic recovery and preparing for a net-zero carbon economy.

The Confederation of British Industry (CBI) said 2021 should be a turning point for economic policy to break the pattern of weak productivity that has weighed on growth for more than a decade.

EU Key Point

I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Futures for Canada's main stock index rose on Monday, following positive global markets and gains in crude oil prices. First Citizens BancShares Inc's announcement of purchasing the loans and deposits of failed Silicon Valley Bank also boosted investor confidence in the global financial system...

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later