The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

A new trading week brings new opportunities. Have you read “The Black Swan: The Impact of the Highly Improbable”? The main idea of the book is simple: we should be ready for unpredictable events. As soon as you are ready to meet with something that no one expected, you will win. Let’s consider all possible variations for market moves in the upcoming days.

USD

On Monday, the US dollar index had been moving down after the attack of Mr. Trump on the Fed. American president claimed that it was a fault of the Fed that the stock market hasn’t been up 5,000 to 10,000 additional points as it was supposed to be. As a result, the USD has depreciated against most of the currencies.

Events to watch:

The direction of the USD will determine the moves of major currency pairs.

CAD

Last week didn’t determine either strength or weakness to the Canadian dollar. The CAD index didn’t surprise with significant moves. The beginning of the week isn’t shiny for the loonie, too. Although the USD was a loser against most of the currencies, the Canadian dollar wasn’t among them.

Events to watch:

Levels to watch: on Monday, during Asian and European sessions, the trading was limited with the lack of both bulls and bears strength. The further direction of the pair will depend on Monday closure price. If bulls manage to hold USD/CAD above 1.3334, odds of the further rise will prevent on the market. The first strong resistance lies at 1.3384 – the upper boundary of the consolidation zone. As soon as 1.3384 is broken, the USD traders will be able to push the pair towards 1.3346. However, technical indicators signal risks of the decline. MACD and Awesome Oscillator are near to cross the 0 level upside down. Bears need to pull the pair below 1.3305 (50-day MA and the bottom line of the previous consolidation). Next supports are at 1.3272 and 1.3221.

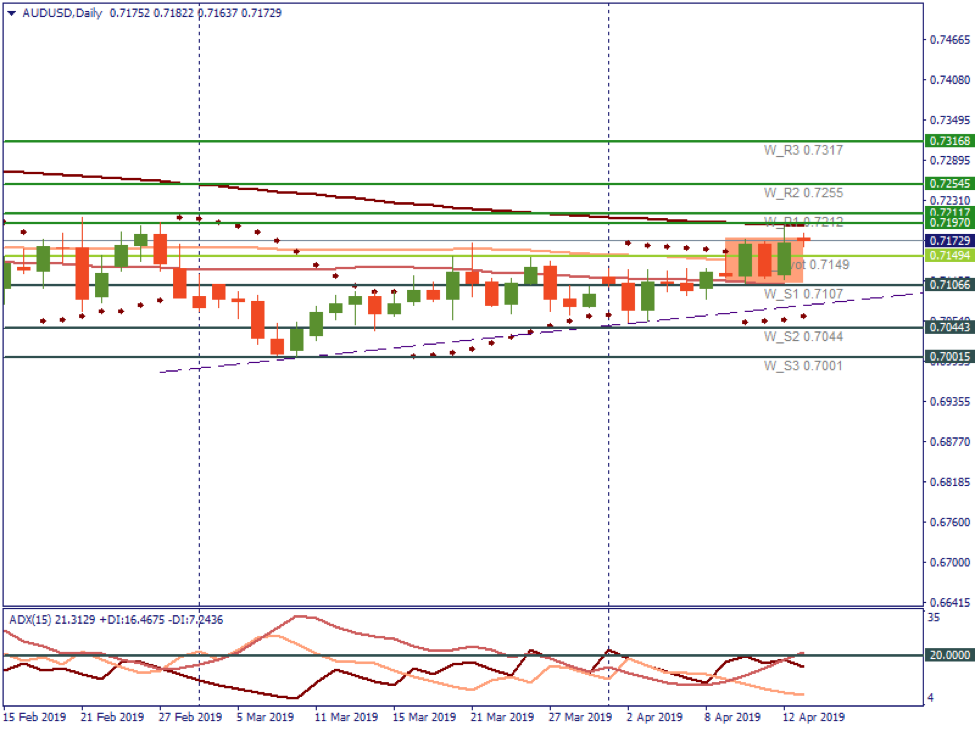

AUD

Although the USD isn’t strong and the market sentiment improved, the Australian dollar couldn’t use the situation in its favor.

Events to watch:

Levels to watch: Monday trading was weak. To prove their strength, bulls need to push the pair above 200-day MA at 0.7197. The next resistance will lie at 0.7212. After the breakthrough, AUD/USD will get a chance to climb to 0.7255 and higher. Technical indicators don’t signal the fall of the pair. However, the rise may be limited if the US dollar recovers. In this case, AUD/USD will return to the consolidation range between 0.7107 and 0.7170. A break below 0.7107 will provoke a decline to 0.7044 (pay attention to the trendline).

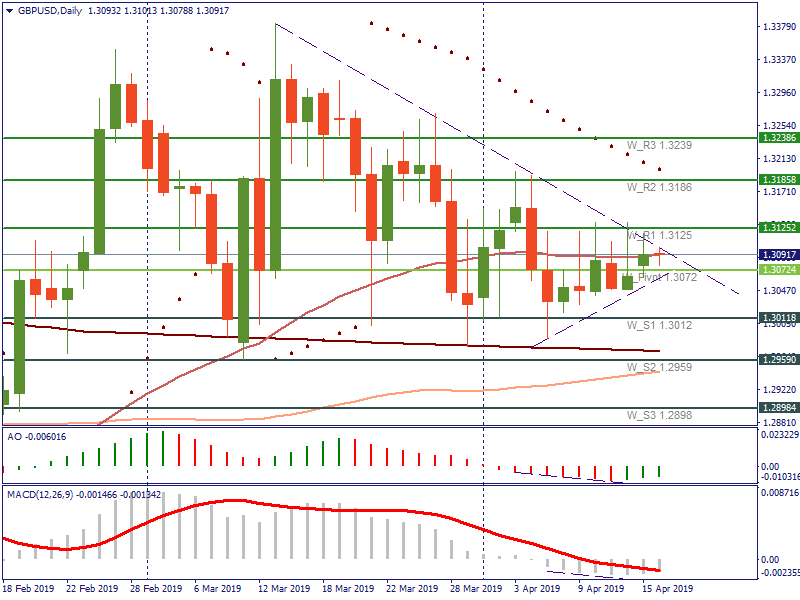

Traders are quite tired of the GBP trading. Did you hear the news that software robots crashed because of the many Brexit headlines? Not surprising. However, up to now, it seems like the situation has softened after UK and EU managed to agree on the prolonged Brexit last week.

Events to watch:

Levels to watch: During Monday, the GBP/USD pair had been rising based on the weak USD. However, last week, the price formed several candlesticks with long upper shadows that was a sign of low bullish strength. Bulls need to push the pair above 1.3125 to cut risks of the downtrend. A breakthrough above 1.3186 will confirm a forming upward movement. However, the pressure is high and the pair may turn around towards 1.3072. Consider the trendline as it will add additional pressure on the pair. Moreover, MACD and Awesome Oscillator formed a bearish divergence. It’s not strong but signs of it exist. Next supports are at 1.3012 and 1.2959. 200- and 100-day MAs are located near 1.2959, as a result, the pair may rebound.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later