The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

A growing number of people start playing video games, mainly because of the pandemic. But this is not the only reason. New technologies, game modes, places to play or watch others’ games are emerging continuously. What can be expected from the gaming industry, and how to earn on a revived trend – in our new article.

Revenues in the gaming industry are based on three major sources:

In this article, we will focus mainly on software yet trying to cover all three parts.

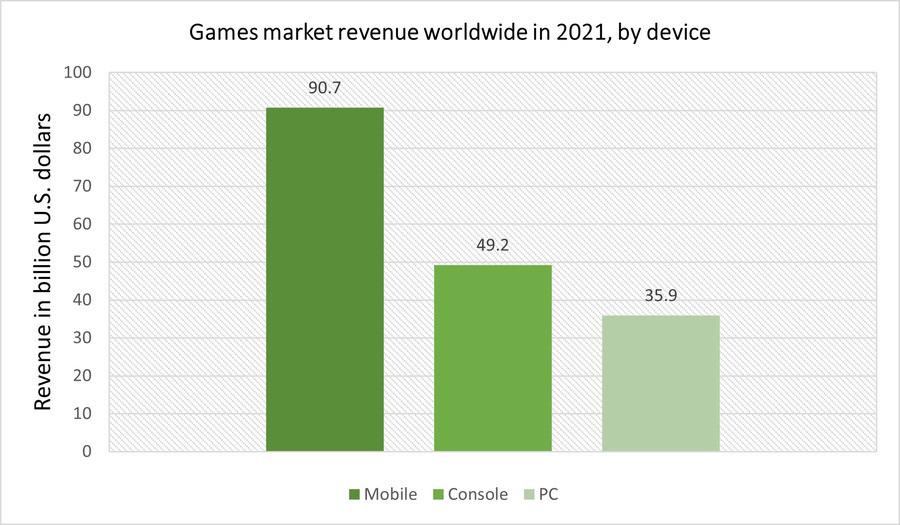

During the global COVID-19 pandemic it has become clear that the world needs games: to communicate with friends and family, to inspire, to provide stress relief and mental stimulation. Today, nearly 227 million Americans play video games. And playing together is a family affair, as 74% of parents play games with their children at least weekly, up from 55% in 2020. DFC Intelligence expects video game sales in the U.S. and Canada to increase 14.6% in 2021, to $19.6 billion. In 2021, mobile remained the biggest gaming segment worldwide with approximately 90.7 billion U.S. dollars in annual revenues. The console segment ranked second with 49.2 billion U.S. dollars and PC gaming ranked last with an estimated 35.9 billion U.S. dollars in 2020.

Long story short: Tencent Games collapses 40% after Chinese media calls online gaming “opium” as regulatory concerns mount. I suppose that this is only the beginning of the new trend for regulating the video games industry, intending to keep children farther from games and their algorithms. This agenda emerged in the US and EU the years before, yet without any significant results.

But not only Tencent is under pressure. China plays a considerable role for lots of video games publishers. Activision Blizzard (ATVI) and Electronic Arts (EA) depend heavily on Asian markets. ATVI has launched its new mobile franchise for China called “Call of Duty mobile” which has earned more than $14 million for the first week. Activision has revealed, that almost 11% of overall revenue is coming from the Asia-Pacific region. However, ATVI’s and EA’s model of games delivery, ironically called “pay to win” doesn’t have a lot to lose from restrictions for children to donate if they are less than 12 years old. Note that most revenue in China is generated by players who are 18 years old and above. And even if the whole industry considers banning gaming for children under 12, it won’t create insurmountable obstacles for Western companies.

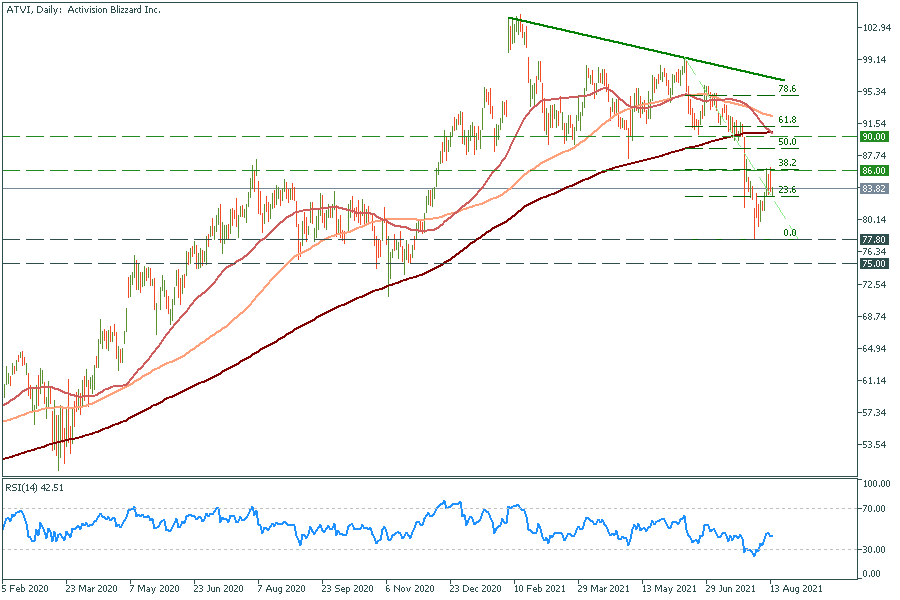

Activision Blizzard's stock price was crushed after a scandal in July. There were complaints about drunken harassment by male colleagues or supervisors, the culture of ignoring complaints, and the widespread discrimination in areas such as equal pay and promotion opportunities. It looks like the company has begun a downtrend.

ATVI daily chart.

Support lines: 86 and 90.

Resistance area: from 77.8 to 75.

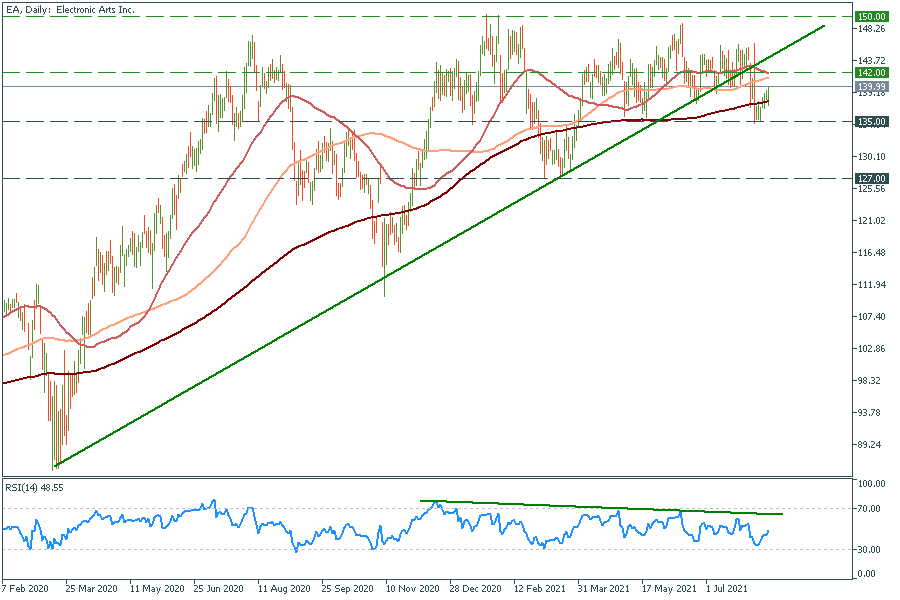

Electronic Arts (EA) stock price failed to get through its ATH (all-time-high) of $150, has broken the year-and-a-half support line, and now looks quite bearish.

EA daily chart.

Support lines: 142 and 150.

Resistance lines: 135 and 127.

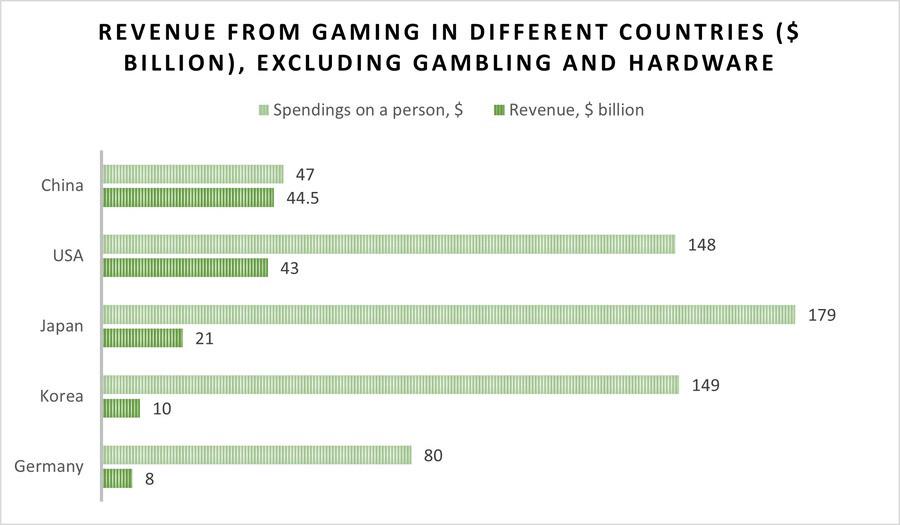

China is still the biggest gaming market in the world, though gamers in other countries tend to spend more.

Source: https://newzoo.com/

And for the cherry on the top, consider investing in Netflix. During their recent earnings call, Netflix (NETFLIX) clarified some of their plans around their foray into gaming. Free video games will be added to the company's content library that will be accessible at no extra cost to subscribers. Cosmetic items are an inoffensive way for Netflix to generate substantial revenue from their games as they will likely shift from their “no monetization” policy. Netflix remains by far the largest paid video streaming service, with 209 million subscribers, and this is a great launchpad for the company that wants to try something new.

Netflix is in a flat, so I wouldn’t make any trades until the price will be closer to the edges.

Netflix daily chart.

Support area: from 480 to 465.

Resistance lines: 555 and 600 (the round number and ATH).

Xbox has a complicated story, with big ups and downs: PlayStation always a step ahead with lots of exclusive games, an experiment with Microsoft Kinect that went wrong, and “The Red Ring of Death” - X360 seizing up, with the only sign of life from the console coming in the ominous form of the power button flashing red. But it is in the past now. What about the future – Microsoft is preparing a vertiginous software update, and it isn’t new Windows 11, it is Xbox Cloud Gaming. It’s a free add-on to the Xbox Game Pass Ultimate subscription, allowing you to stream a wide selection of Xbox titles to pretty much any device. You can play Xbox games on an Android smartphone, an iPad, your work PC, on a five-year-old Windows laptop - pretty much any device that has a browser and a decent internet connection.

The cloud gaming market already has big players on it, like Google (Stadia), Nvidia (GeForce Now), and Sony (PS Now). But it’s never too late for Microsoft with its tremendous number of Game Pass subscribers. Analytics assumes onward growth of up to 30 million subscribers till the end of the year. Compare it with Microsoft’s main gaming rival: Sony, which has mere 3.2 million users of PS Now in 2021, and we get an understanding of Microsoft’s winning plan.

According to Fortune Business Insights, the global cloud gaming market is projected to grow from $169.2 million in 2021 to $1.9 billion in 2028, at a staggering compound annual growth rate (CAGR) of 40.9%. As Microsoft rolls out its streaming hardware, takes advantage of strategic acquisitions like Bethesda for a stronger game lineup, and utilizes its huge Game Pass user base, it will become clear why console sales were never the end goal for Xbox.

Considering the company's existing position as one of the big three public cloud giants (together with Amazon and Alphabet) and as a trusted growth stock, Microsoft has a strong position and decent prospects “in the clouds”.

As for now, MICROSOFT stock is a little bit overbought, with lots of space between the price and reliable 100-MA. Notice, that for tech stocks it is common to have RSI in an overbought zone for relatively long periods.

Microsoft daily chart.

Support line: 264.

Resistance lines: 300, 310.

What comes next?

The advent of 5G technologies will fully unlock the potential of mobile gaming. Faster speeds and lower latency will unleash a new generation of gaming – and not just on your phone. Thanks to the boost in raw speed that 5G offers – up to a staggering 10Gbps, ten times what even 4G LTE-A can deliver – players can expect faster downloads and streaming, but the bigger impact will likely come from massively improved latency. With response times as low as five milliseconds, this means in-game action will be smoother than ever, with no lag between your input and the game's response. With 5G's greater reliability, this should hold, even with high numbers of concurrent players.

Did you remember that Call of Duty mobile had a great start? But what if I tell you, that you won’t need mobile versions of games anymore? Everything, from immersive 4k+ videos to stunning next-generation games will be available right on your smartphone or tablet, it is only about the 5G. And there is more. Virtual reality headsets, like Oculus Quest or Magic Leap, already have mobile processors in them, and they can run both lightweight mobile games and something big via cable or Wi-Fi connection. They will become truly autonomous with 5G implementation. To fully realize the potential though, developers will have to think bigger than ever.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later