We have outlooked several promising Forex pairs and the result can surprise you!

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

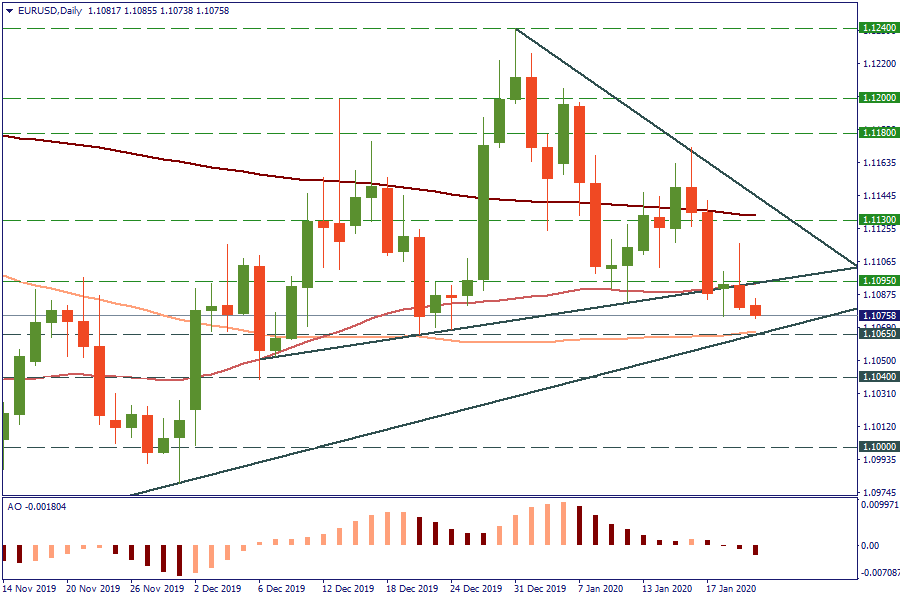

The price action in EUR/USD has been quite unfavorable for the euro. On The W1, the 50-week MA limited the pair’s advance. On the D1, we see formation of lower highs this month. An attempt to get above the 50-day MA (1.1095) on Tuesday has failed. As a result, the pressure on the support at 1.1065 (100-day MA, 2019 support line) will intensify. The meeting of the European Central Bank this week may provide a market moving force.

The decline below 1.1060 will open the way down to 1.1040 and 1.1000. On the other hand, if the trend line support holds, a return above 1.11 may lead to a recovery to 1.1130. There, however, the 2020 resistance line and the 200-day MA should limit further growth.

We have outlooked several promising Forex pairs and the result can surprise you!

4H Chart Daily Chart We sent out a signal yesterday to long EUR/USD between 1…

4H Chart Daily Chart EURUSD declined back yesterday after trying to test its 1…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later