The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

December 18 was a remarkable day for the New Zealand dollar in 2020. The kiwi strengthened against the USD, reaching the high of April 2018. Of course, a stimulus-driven USD is the most obvious reason for such market behavior. However, there is another one you don’t probably think about, given to current economic situation across the world. It’s a fact: the New Zealand economy is recovering. And the recovery is very fast. Investors like the kiwi, but some experts are worried about this surge. What are their views on the kiwi in 2021?

The early reaction of New Zealand’s government to the coronavirus outbreak paid off to the country’s economy. After New Zealand’s GDP slumped by 11% in the second quarter, the third quarter’s data signed a V-shaped recovery. The Antipodean economy strengthened by 14%, outperforming market expectations of +12.9%. The Reserve Bank of New Zealand has been playing an important role in the stabilization process. At the start of the pandemic, the regulator has cut its interest rate to the record low of 0.25% and unveiled the stimulus, which has been provided through a Funding for Lending program and large-scale asset purchase. As a result, New Zealand’s economy demonstrated a V-shaped recovery in the third quarter.

The Fed’s easing policies and economic stabilization increased the inflow into the NZD by foreign investors. At the same time, the surging kiwi raised worries in New Zealand’s government. The strength of the Antipodean currency pushed housing prices by 19.8% from NZ$605 000 in October 2019 to NZ$725 000 in October this year. In addition, the threats of negative interest rates exist, that is why New Zealand’s finance minister Grant Robertson has already expressed worries in a letter to the RBNZ board. If the government intervenes in the RBNZ policy of targeting housing prices, this will be a good sign for the NZD.

Still, another risk for the economy of the country is a suffering tourism industry, which froze amid closed borders for foreigners. Due to the new coronavirus strain appeared in the UK, the country may remain shut for visitors for a longer period. Therefore, the risks may affect sentiment in the market and hurt risky currencies, such as the NZD.

Despite all negative factors, the forecasts for the kiwi for 2021 are utterly bullish. According to BMO, NZD/USD will go up to 0.75 (three-year high). Westpac expects the pair to reach 0.72 by year-end. Morgan Stanley sees the New Zealand dollar outperforming its rivals in 2021, and forecast a hawkish surprise by the RBNZ in 2021.

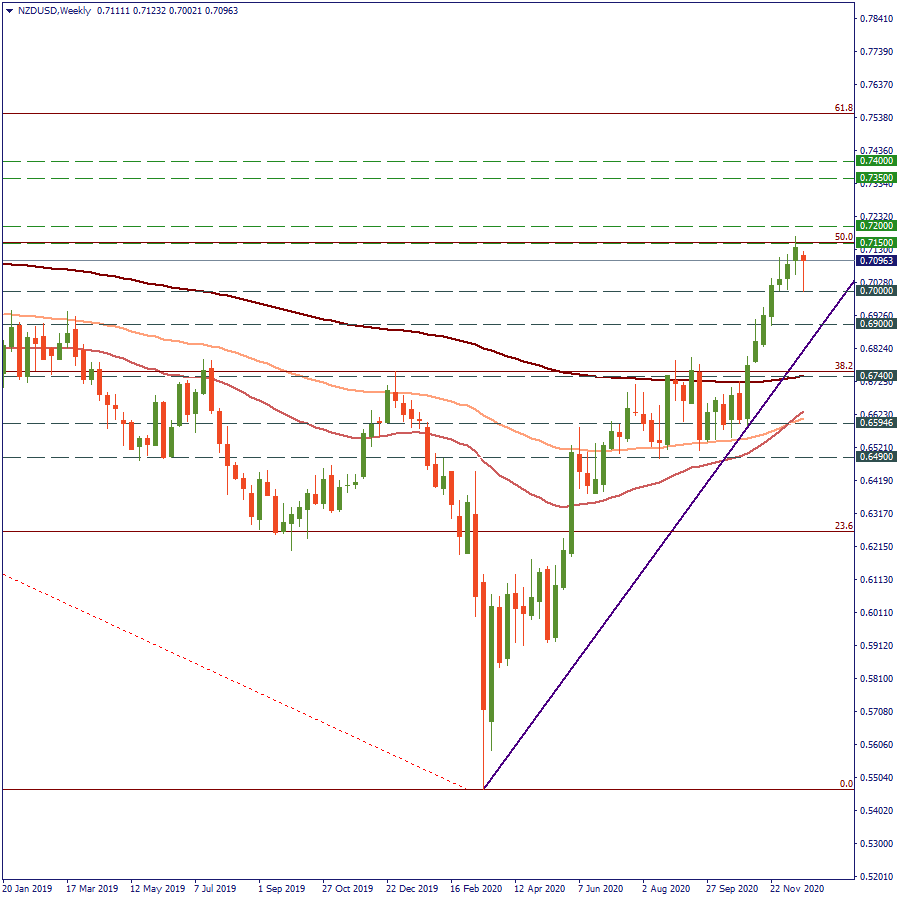

We expect the New Zealand dollar to keep strengthening against a weaker US dollar at least through the beginning of 2021. Its further performance will greatly depend on the situation with Covid-19 cases, vaccines’ distribution, and policy by the Reserve bank of New Zealand. For now, we may see reaching the 0.72 level soon as highly possible. The breakout of 0.7150 (50-Fibo on the monthly chart) will increase the chances of testing the 0.72 level. If buyers overcome the resistance zone formed near the 50-Fibo level, the next resistance will lie at 0.74. The risks of the falls are expected at 0.7 and 0.69 levels.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later