The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

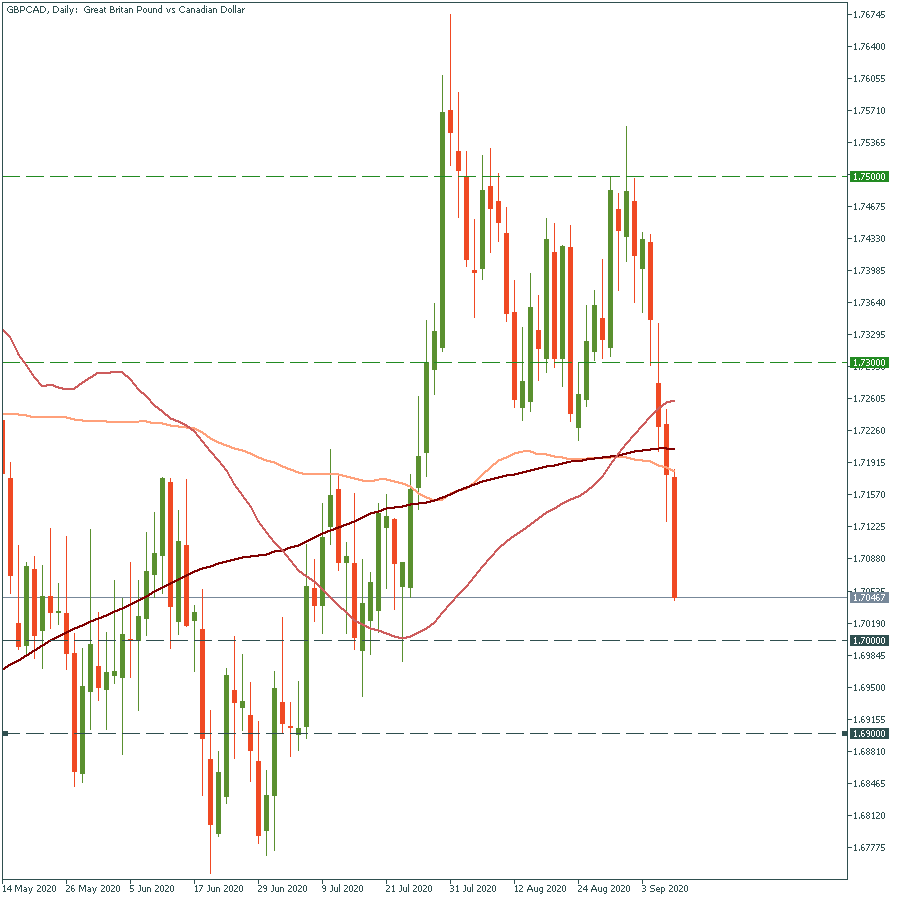

GBP/CAD keeps falling to the downside amid fears over the no-Brexit deal. According to JPMorgan, the pair will continue dipping throughout the whole of September. The bank has recently given a recommendation to its clients to sell GBP/CAD.

"We tactically sell a basket of EUR & GBP versus CAD, to capture near term risks (ECB, COVID-19) and structural concerns (Brexit, fiscal cliff) while CAD screens as a buy in our growth framework and is relatively underweight", claimed JPMorgan.

The bank forecasts GBP/USD will plummet to 1.29 by the end of the month, and USD/CAD will fluctuate near the 1.31 zone. At the same time, according to it, GBP/CAD may tumble to the three-month low of 1.69. However, the pair is expected to recover some of its losses and reach the 1.75 level by the end of the year.

Going a bit further over Brexit talks, the UK Prime Minister Boris Johnson claimed that the UK Government is going to impose new laws that can nullify some significant issues of the Brexit deal. The EU responded that in this case no trade deal would be done. The deadline to reach an agreement is scheduled for October 15, but both sides stay far apart from making a deal. However, analysts believe that in any case, the UK recovery will be under threat.

The Canadian dollar is not in the best position either amid falling oil prices, which slumped to levels unseen since July. Nevertheless, it has been performing better than the British pound. All attention now to the Bank of Canada’s rate statement at 17:00 MT time. Analysts anticipate the central bank will leave rates unchanged at the record lows of 0.25% and asset purchases – at 5 billion Canadian dollars per week. If the BOC’s tone is more dovish, the CAD will fall. However, according to Bank of America, the tone of the statement might be more hawkish, which will push the CAD to the upside and, therefore GBP/CAD to the downside.

GBP/CAD is edging lower. The move below the key psychological mark of 1.1700 will drive the pair to the next support of 1.6900. In the opposite scenario, if GBP/CAD surges above the high of July 28 at 1.7300, the doors towards the resistance of 1.7500 will be open. Follow the report and catch the market movement!

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later