eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

For years, Japan has tried to boost its weak economic growth, but to no avail. Now, Japan may get what it wished for. But, it just isn't the way it has hoped.

Japan followed what the central bank saw as a magic formula: stronger inflation and weaker yen. But the recipe didn't work as planned. Inflation has never achieved the government's modest target, despite extremely low-interest rates and heaps of fiscal stimulus. On the contrary, wages for workers have stagnated, and growth has remained weak.

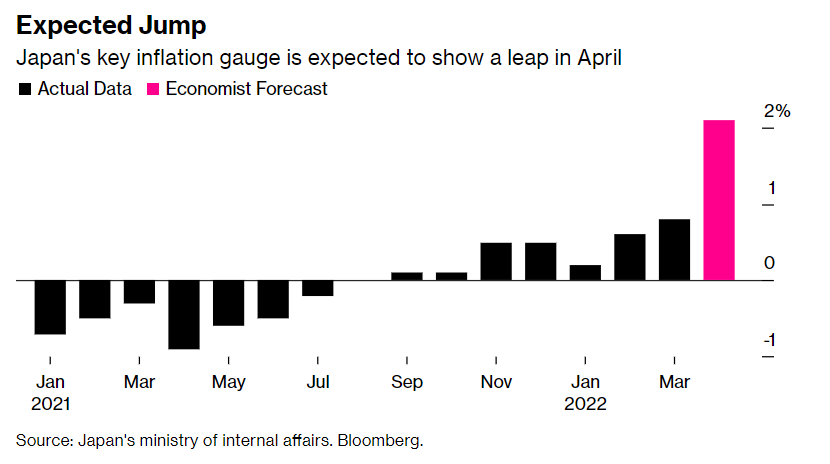

Japan's inflation is expected to rise to 2% in April's reading released later this week, for the first time since 2015, after stronger-than-expected price hikes due to higher prices globally. An outcome that will make it difficult for the BoJ to explain its need for continued stimulus.

Inflation in Japan, which generally remains below the government's 2% target, is likely driven by market turmoil, the war in Ukraine, the pandemic, geopolitical tensions, and global higher prices. It didn't climb due to the rising demand or higher spending. Therefore, inflation may decline once these motives disappear.

Nevertheless, the Bank of Japan reiterated its commitment to monetary easing despite the weaker yen. Yet, it may face more pressure from market players to change its path. The yen hit a 20-year low against the dollar, a massive drop of more than 18% since September 2021. Rising prices have made Japanese consumers, who are used to decades of stability, panic. A weaker yen will reduce demand at home rather than stimulate its strength abroad.

Concerns about the yen's depreciation reflect a gradual shift in the Japanese economy over the past decade. When Japan was an industrial superpower in the earlier period, a weaker yen was the cause for celebration. It made Japanese exports cheaper abroad, raised the value of revenue earned abroad, and attracted foreign investment.

But export is now less important to the Japanese economy, the world's third-largest. Companies also seek to avoid trade restrictions at home, so they tend to produce their products abroad, reducing the impact of exchange rates on their net profits.

1. The faltering Japanese economy during the pandemic and rising prices globally have forced importers to sell more yen for US dollars to pay their bills.

2. BOJ's insistence on maintaining rates near zero and continuing with stimulus, despite the tendency of major central banks to raise rates led by the Fed.

3. The widening spread between Japanese bond yields and US bond yields has caused investors to rush to buy USD for better returns.

The yen fell below 130 against the dollar to its lowest level in 20 years after the BoJ confirmed that it would keep rates at low levels. However, the USDJPY met resistance at 131.00 and pulled back a bit at the end of last week. Given that the Fed's rate hike of at least 50 basis points at the June meeting was fully priced in the markets. Therefore, traders chose to take some profits from the recent rally of the US dollar.

Will the yen be able to withstand against the dollar to return to below 128.00, or will USDJPY regain strength above 131.00? Let's wait for the inflation figures in Japan this week.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later