China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On Thursday, June 2, the Organization of the Petroleum Exporting Countries Plus (OPEC+) agreed to boost output by 648 000 barrels per day (bpd) in July and August. The decision replaced a previously accepted plan to increase the oil production by 432 000 bpd. Despite the obvious step by the alliance to curb the surging oil prices, the market was not really impressed by it. Both WTI (XTIUSD) and Brent (XBRUSD) closed in the green after the announcement on Thursday. What are the reasons behind this behaviour of the oil market and what should we expect next?

The upside momentum in oil prices remained intact for several reasons. The first one is related to the fact that Russia is still a member of the OPEC+ alliance. Despite multiple calls by major oil importers to exclude Russia from the list of members, the group decided not to do it. As a result, it makes it harder for the alliance to meet its target. The output from Russia has already dropped by 1 million bpd since the start of its war with Ukraine and is likely to continue its downfall. Moreover, the new pack of sanctions by the European Union presented on Friday, June 3, includes an embargo on Russian oil.

Secondly, Angola and Nigeria, members of the OPEC+ union have problems with their output. This way, the current change in the oil supplies is seen as insufficient. As the increases are divided proportionally across the member countries, Angola and Nigeria will be the outsiders in this oil-pumping rally.

Third, China eased its Covid-19 restrictions on the biggest cities at the end of May. The Chinese government promised to support the economy. The restoring demand from China will likely exceed the supplies if nothing changes in the output. As a result, the oil prices have all chances to break higher.

Finally, figures presented by the Energy Information Administration on June 2 showed that US crude inventory declined by 5.1 million barrels last week. It also pushes the oil prices up.

The only thing that can change the trend of oil right now is China’s demand. If new lockdowns are imposed, the oil prices will correct lower. Also, the news from Russia and Ukraine may impact the oil prices as well.

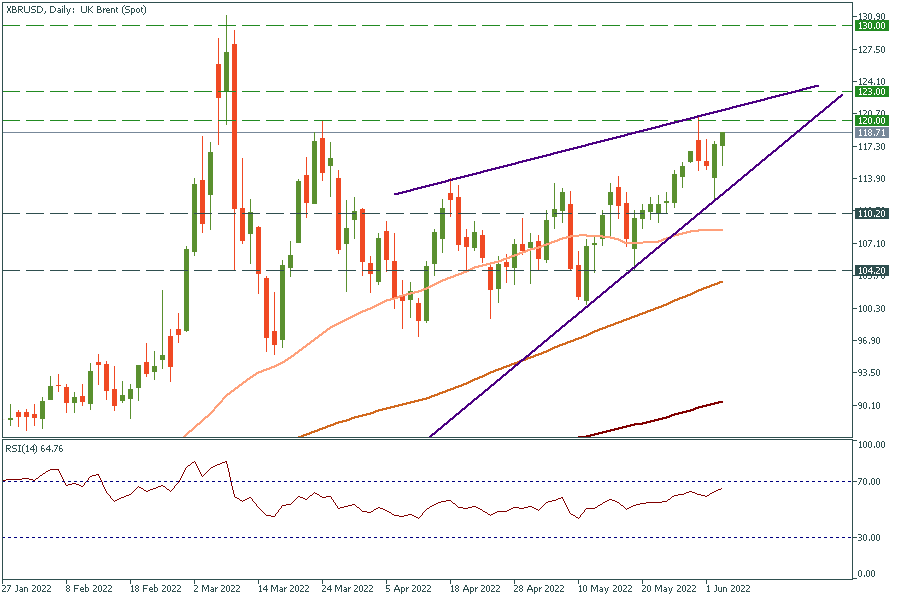

The price of Brent (XBRUSD) has been trading within an ascending wedge. If it breaks above the $120 level, the next target will lie at $123. After crossing this level, buyers have the full potential to retest the high of March 8 at $130. On the downside, the first support lies at $110.20

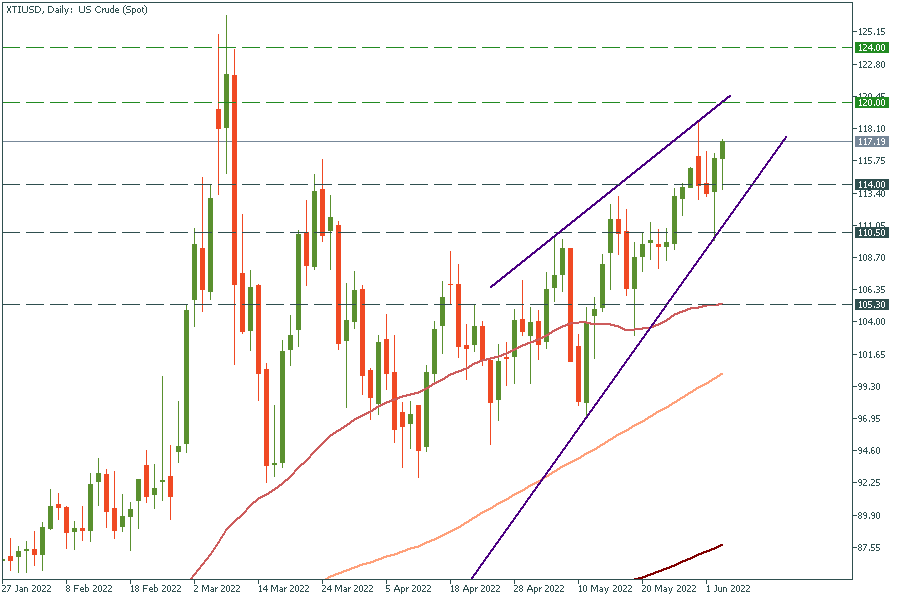

As for XTIUSD, the first target for it on a daily chart lies at $120. The next important level is located at $124. The support for WTI is placed at $120.

If you want to trade oil with FBS, follow these simple steps:

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later