The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It seems like better days have passed for the Australian dollar. On October 15, the Reserve Bank of Australia’s Governor Philip Lowe signaled more stimulus measures at the next meeting on November 3. The Australian dollar was triggered by his remarks and immediately dropped below the 0.71 level. In this article, we are looking closer at the highlights of the upcoming meeting and see the forecasts for the AUD.

We recommend you to mark November 3 in your calendars, as the market is going to be very volatile. Firstly, we have the RBA meeting, then the election in the US. You still have two weeks to learn more about these events for successful trading. So, what do we need to expect from the RBA meeting? Here are the main insights by the RBA Governor.

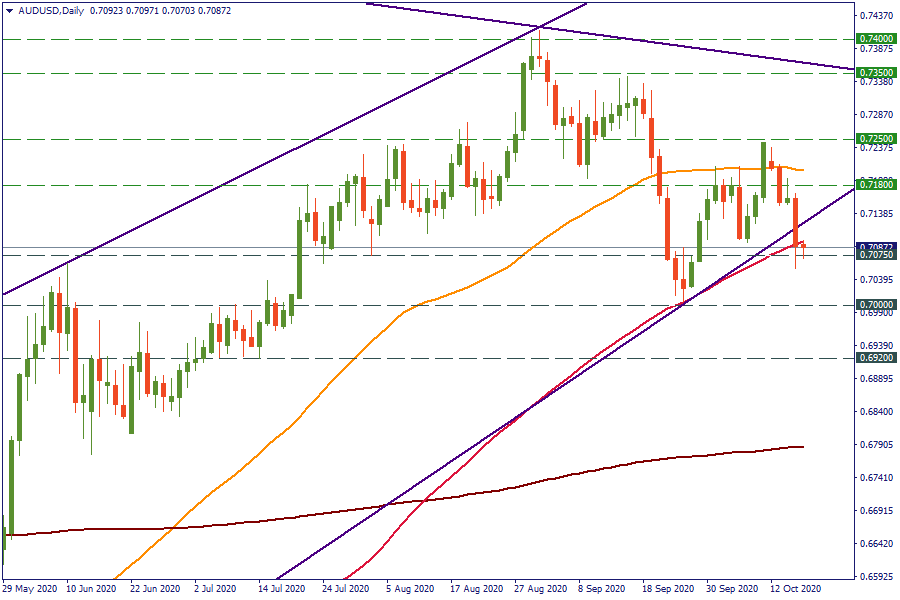

Following these comments, the Australian dollar weakened significantly against other currencies. On the chart below, we can see that AUD/USD broke below the ascending trendline and tested the lows below 0.7075. However, the support at 0.7075 (100-day SMA) appeared to be pretty strong to hold the gears of sellers for now. A drop below this level will pull the pair lower to 0.7. On the upside, a sudden strength of the AUD may provoke the rise to the resistance at 0.7180

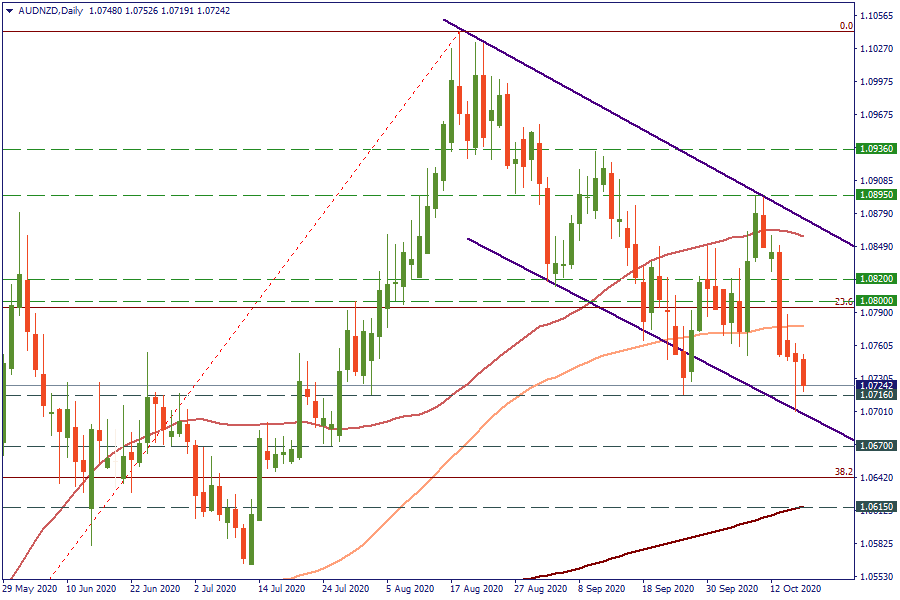

The Australian dollar got weaker even against its antipodean colleague – the New Zealand dollar. On the daily chart, AUD/NZD has been trading within the descending channel. The pair fell below the 100-day SMA this week and tested the 1.0716 level. The next target lies at 1.0670. On the upside, the resistance level is placed at 1.0800.

Despite a quite dovish note, not all major analytical banks are sure about a significant fall of the AUD. For example, analysts from ANZ Bank claim that AUD/USD will remain at 0.7 for the medium term. At the same time, reaching the 0.73 target by the end of 2020 is put at risk, according to them. Analysts from Commerzbank are not so optimistic, as they see AUD/USD falling to 0.6964 and even lower, to the mid-June level at 0.6789. At the same time, analysts from UOB Group don’t expect the pair to cross the 0.7 level.

In our opinion, the dovish tone of the RBA will put the aussie under pressure right until the next meeting on November 3. After the release of the monetary policy statement, the famous “buy the rumor, sell the fact” theory may come into action, and the AUD may correct to the upside, before moving lower.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later