The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

This week three interest rate announcements will be done: on Wednesday by the US Federal Reserve and Bank of Canada, and on Thursday by the Bank of Japan. We will have a look at each of them to have a bit of insight into what is coming in their respective policies.

Oct. 30 – US Federal Reserve interest rate announcement

Financial analysts predict that the US Fed is on the way to announce another rate cut this Wednesday, the third this year. US Fed Chairman Jerome Powell will bring his arguments to the audience to clarify why they choose to lower the interest rate by another 25 basis points and give an outlook on the possible future moves they expect to take. However, for many observers, this tendency of the US monetary policymakers seems more and more questionable. Let us explain why.

Recently the American domestic economy has been indicating positive developments. Partly pacified trade tensions with China, growing US equity indexes, weaker dollar, less risk of no-deal Brexit, better outlook in the sensitive housing sector, lower inflation and unemployment, steady manufacturing order rates and consumer mood – all of these would normally mean that the economy is doing pretty well on its own and does not require further monetary stimulus. Understandably, the Fed would not like to put those recent achievements at risk and lose the hard-earned appreciation by the market. It is had been acknowledged previously as the Fed Vice Chairman Richard Clarida stated that indeed the US economy is "in a good place", being on a nearly 2% growth rate expected for the third quarter. Nonetheless, remaining problems in the context of the international environment and unresolved question of the balance in monetary policy appears to push US Fed policymakers for the further rate reduction. Additionally, they fear to return to previous turbulent times if they do not meet the dovish market expectations. In any case, the Fed will face stronger questioning before making another move in the same direction as they are running out of solid justifications. Given the fact that the expected rate cut is already priced in by the market makers, we only expect temporary pressure down on the US dollar before the rate release; otherwise, the currency shall not be affected much unless the interest rate release happens to be higher than the analysts predict.

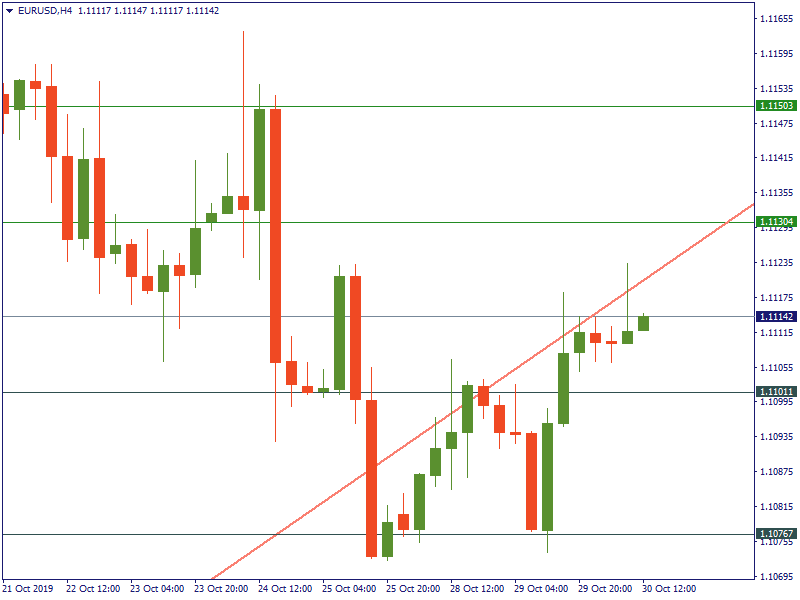

On the H4 of the EUR/USD, 25Oct broke the rising resistance line, now showing the signs of potential to rise further, however, we have to give it a bit more time to indicate a more certain trend. The movement now is more sideways, still with a potential of further falling of dollar, with support at 1.11, 1.1076 and resistance levels at 1.1130 and 1.1150.

Oct. 30 – Bank of Canada interest rate announcement

The Bank of Canada is announcing the interest rate decision the same day with US Fed, but unlike their peer south of the border, they are believed to keep the interest rate at 1.75% as they have been doing the entire year. The reason for them to hold the rate unchanged is mainly the absence of reasoning to act otherwise, the observers comment. Here is some information to consider.

On the domestic side, there is a certain disparity between the economic state of affairs of the Prairies provinces and the rest of the country, which affects the state-wide picture. The research made by the Bank of Canada shows that those provinces report less optimistic investment plans in the future than the other provinces due to regulative reasons and hardly predictable economic environment. Nevertheless, the same research shows an overall 0.43 increase in the autumn business outlook indicator compared to the 0.07 decrease in the summer. This means that Canada does have internal issues to resolve and better integrate energy sector led Prairies, but none of that is a stimulus to push the Bank of Canada to change its stance towards the interest rate. On the international side, Canada, being mostly an exporter, requires a peaceful overall environment, which is the case now at least for some time, as the trade wars are on hold, so no stimulus is required here neither. However, with 60% of exports going to the US, Canadian exporters would be unhappy to see appreciating loonie against the greenback with the Fed cutting their interest rate while the Bank of Canada holds it further. Overall, the picture is that the Bank of Canada is unlikely to change its monetary policy in the coming future unless there are strong indicators of the Canadian economy changing its condition. Hence, no drastic change in the currency movement is expected in the coming news.

On the H4 chart of USD/CAD, we a sideways movement happening within the corridor of support at 1.3056-1.3049 and resistance range at 1.3103-1.3114.

Oct. 31 – Bank of Japan interest rate announcement

Wednesday and Thursday will be the meeting days for the Bank of Japan policymakers, who will conclude their session with an announcement of the interest rate (currently at -0.1%) and the reasoning behind the decision.

Analysts do not have certainty about the outcome of the meeting. The September statements on behalf of the Bank of Japan Policy Board members contained readiness to review the monetary leverage in favor of ease for several reasons. First, the global economy gives indications of a slowdown, which is unfavorable for Japan as it needs unfailing demand for its exports. Second, the consumption tax was lifted to 10% in September from the previous 8%, which poses a risk of domestic economic slowdown, although the Bank officials reassured that they would implement a range of stimulus to prevent that. Third, it is still unclear if the Bank of Japan deems the autumn inflation rate good enough, as they announced previously that they were committed to guiding it to 2%. Lastly, with the US Fed just about to announce their expected rate cut on Wednesday, the Bank of Japan may not want to stand alone and see Japanese yen appreciating against the US dollar.For this reason, traders have to pay close attention to this event and expect a rise in USD/JPY before the announcement on the expected further lowering of the interest rate in Japan.

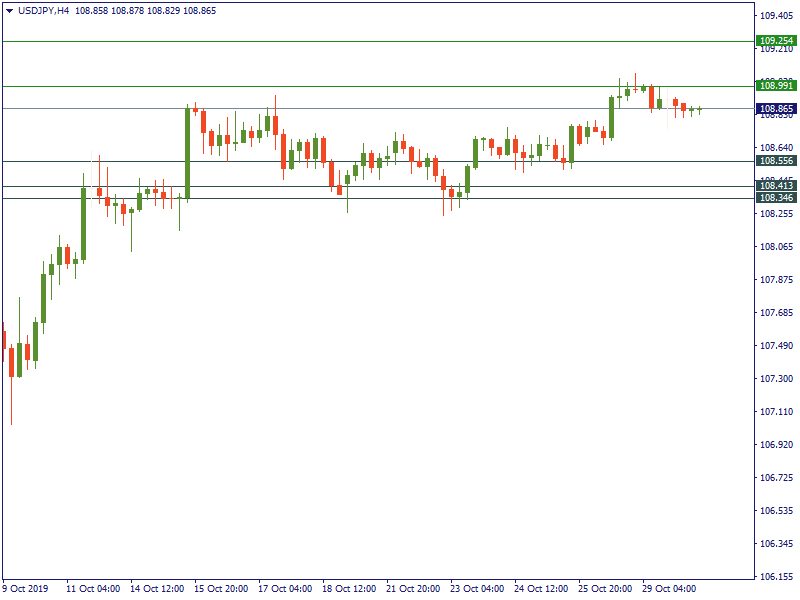

On the H4 chart of USD/JPY, we see that Wednesday started with USD/JPY being traded at the 2-weeks high level of 108.86 with the resistance level of 108.991 capping it. If it is broken, which is quite possible, there will be the 3-months high of 109.254 being the next resistance. The support levels may be located at 108.556 and the range of 108.346 – 108.413.

Conclusion

Watch closely the releases coming on Wednesday and Thursday for even with the market-expected rates the tone of the announcements may shift the markets.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later