The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Intel is going to unveil Q3 earnings results at the midnight from October 21 to 22 after the stock market closes. The market expects Intel to deliver earnings per share of $1.11 and revenue of $18.24B.

Last time, it was expected that Intel would post earnings of $1.06 per share when it produced earnings of $1.28. In general, the stock price should rise after upbeat results, but that situation was different. The report was better than expected but traders priced in the good outcome before (look at the series of green candles before the vertical line). Thus, when the actual numbers were out, the sell-off occurred. This time may happen the same. It’s so good that FBS traders can open both buy and sell trades while trading stocks.

Intel faces strong competition from AMD. Thus, Intel has to show really strong earnings results to signal investors that it can reduce the technology gap with AMD. For now, most forecasts are bearish for Intel. However, Intel’s processor chips are components in the vast majority of laptops and desktops. Intel’s chips are in high demand especially now amid the global semiconductor shortage. Thus, we can see a reverse up in the long term.

The stock price moves sideways between $52.00 and $55.00 inside the horizontal channel. If it manages to break above the 100-day moving average of $55.00, the doors will be open to the 200-day moving average of $57.25. On the other hand, if Intel breaks below $53.00 – the lows of late September/early October, the way to the bottom of the channel at $52.00 will be open.

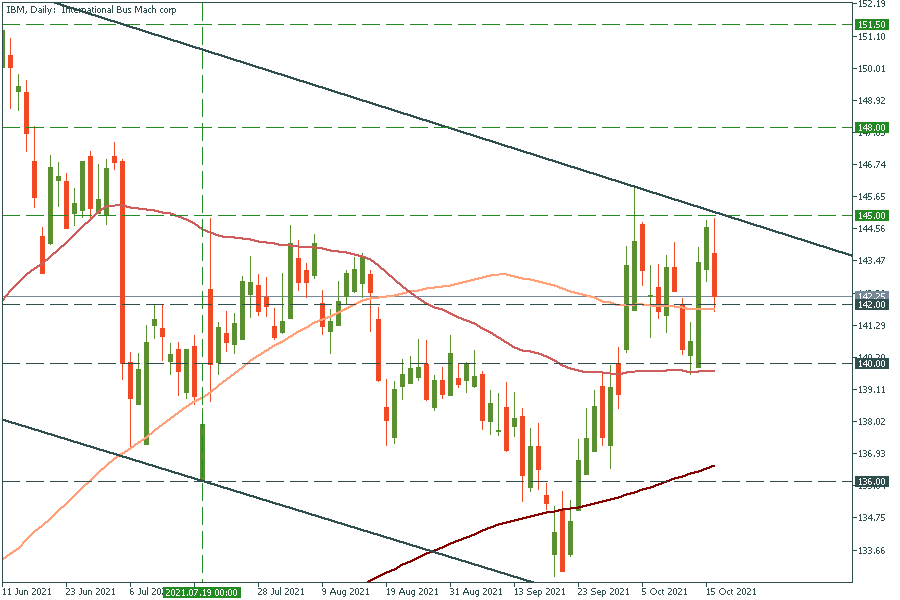

IBM will report its Q3 financial results at the midnight from October 20 to October 21 (GMT+3). Earnings per share are expected to be $2.53 and revenue: $17.78B.

IBM’s third-quarter earnings results are likely to be strong as the company adopted its hybrid cloud computing capabilities and AI-related solutions. Besides, IBM has acquired Red Hat (software company), which should help IBM to increase its cloud segment’s revenue. Now, IBM has more than 3,200 clients. Among them are such giants as Barclays and Walmart!

The previous report comes out on July 19 after the market closed. The report showed better-than-expected earnings but the stock dropped on July 20 (the day after the vertical green line) as the ‘buy the rumor – sell the fact’ scenario occurred. Nevertheless, the stock was rising for the next two weeks.

Now, the stock of IBM is moving inside the descending channel. If it falls below the 100-day moving average of $142.00, the way down to the 50-day moving average of $140.00 will be open. On the flip side, if IBM escapes the channel and breaks the upper line, it may rocket to $148.00 and then to $151.00.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later