The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Nobody even would be dare to say that such indices like S&P 500, Dow Jones, or Nasdaq will drop in the long term. It’s clear for everybody these well-known indices will rally up no matter what. Even Warren Buffet, one of the most famous investors, has advised his trustees to invest 90% of the money he will leave to his wife in a very low-cost S&P 500 index fund.

This is good advice for newbies and risk-averse investors. However, if you are willing to take a higher amount of risk to increase the potential size of your profit, you should invest the larger part of your capital into stocks. Let’s say 50% into stocks, 50% into indices (in this example we eliminate currency pairs and other assets).

Anyway, almost every investor has stock indices in his/her portfolio as they have one key advantage. An index, especially the popular one like S&P 500 or NASDAQ, is a low-risk investment as it’s an already diversified asset. If one stock loses its value, the other one will rise and offset the losses. Yes, the growth wouldn’t be too fast as some individual stocks may offer, but you will save yourself from unexpected huge losses. It's a so-called trade-off.

What stock indices to trade in May?

Tech outlook of S&P 500

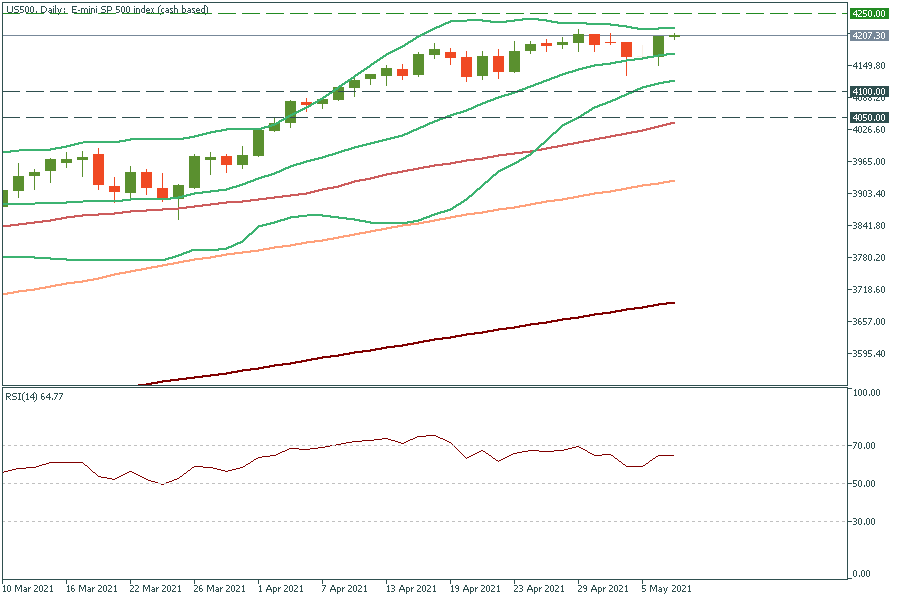

US 500 (S&P 500) has just broken the psychological level of 4200. Thus, the way up to 4300 is clear now. However, the index wouldn’t grow fast to that price target, it’s likely to have struggled to move above the resistance zone of 4200-4250 as there is the upper line of Bollinger Bands, which the S&P 500 has failed to cross many times. Besides, keep an eye on the RSI indicator. Once it’s above 70.00, it will signal the index is overbought and thus it’s likely to reverse down.

It should be interesting to trade S&P 500 during NFP. If the report is better-than-expected, it may confirm bullish trends and help the stock index to rally up further. On the flip side, the poor NFP figures may worsen the market sentiment and trigger the sell-off of the index.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later