The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The world’s largest oil exporters, OPEC+ nations, will meet on Tuesday. The meeting is expected to start at 15:30 GMT+3.

OPEC+ has a great impact on the oil supply. As the global economy is recovering from the pandemic, OPEC’s actions become even more important. If the organization has a positive view of the global economy and expects demand for oil to rise, it slowly increases production. This was the case in April when the countries announced a plan add more than 2 million barrels a day to global oil supplies from May to July. Since then, Brent oil has been trading with a bullish bias slowly drifting up toward March highs in the $71 area. This time, everyone expects OPEC+ to stick to the previous agreement. That will be a positive outcome for oil because it would mean that all is fine and exporters think that their barrels will find buyers.

On the downside, if OPEC voices concerns about the world’s economic rebound and emphasizes problems in particular regions (for example, India), we may see oil prices go down.

A new topic

Something has changed in comparison with April: Iran. The nation is in negotiations with the West to remove sanctions. If this happens, its oil will return to the market increasing the overall supply and changing the balance. Iran’s potential return is a negative factor for oil. Although the talks about Iran will likely last for months, any comments on this topic tomorrow may rock the price. Until the question remains decided, it’s going to limit the upside for oil.

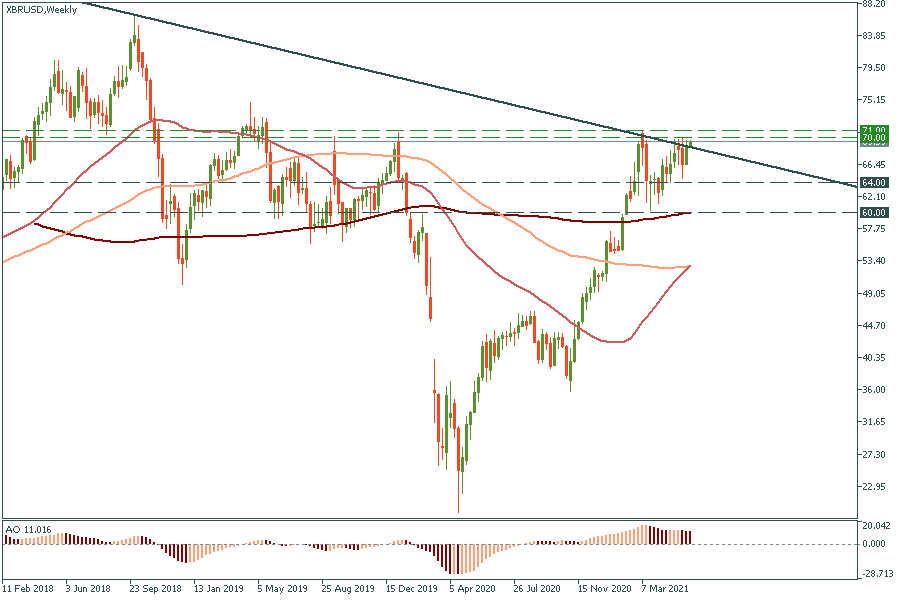

It’s time to have a look at the chart. As you may see on the Weekly timeframe, XBR/USD has reached a very strong resistance area of $70-71 – here comes the resistance line that has been limiting the upside since 2014. Obviously, something really big and positive is needed for a major breakout to the upside. It’s hard to imagine that such a thing will materialize tomorrow. As a result, the best strategy may be to look for peaks as the opportunities to open sell trades targeting support at $66 a barrel.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later