The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Oil is the subject of heated debates these days as nobody really knows what to do with the “humiliated” asset. Market traders are scared in the oil markets.

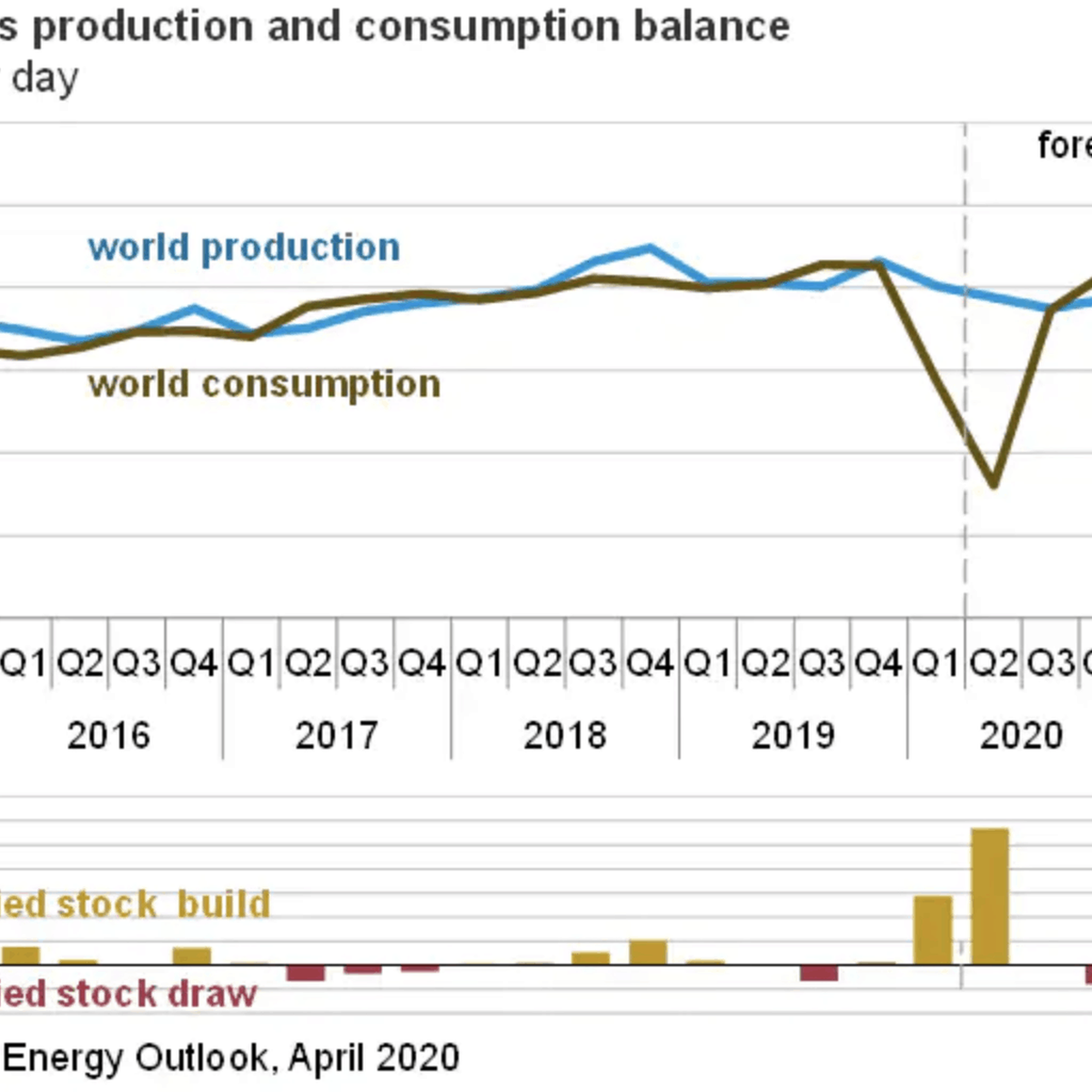

The oil demand declined by 30% because of the coronavirus lockdown. Saudi Arabia and Russia couldn’t agree about the production cut and they started the so-called oil war and supplied as much oil as they want. As a result, the oil glut and reduced demand pushed the oil price deep down.

Only then OPEC+, made a deal to cut 9.7 million a barrel a day, nearly 13% of global production, on May 1 through June. However, it was too little and too late.

The oil price went below zero by two reasons. Firstly, it was cheaper for producers to pay consumers just to take oil off their hands as they run out of all the storages. Secondly, traders, who hadn’t sold the May futures contract on time, didn’t want a physical delivery of the oil.

The situation is absolutely dire for small shale producers, what corresponds to WTI, while Saudi Arabia and Russia can sustain such low prices. However, the US oil will survive this, but it will take few terrible years for them. US oil producers have started already making deliveries to the nation's emergency stockpile or the strategic petroleum reserve (SPR).

Moreover, the United States Oil Fund claimed it would get rid of its June oil contracts this week and reduce contracts for next months. Instead, the ETF will buy into longer-term oil contracts.

Next time before the expiry of the June contract the oil price will go to zero even faster than it did last time, according to the CEO of the largest tanker company, Nordic American Tanker.

Most analysts believe the oil industry will rebound when the coronavirus pandemic is over. Sooner or later we will see it.

On the 4-hour WTI chart we see a strong downtrend. The price reached the 50-day moving average on April 24 at the 17.50 mark and then went down. Maybe it will touch it again at the 15.15 mark and pull back after that. Resistance line is 20.20. Support line is 10.20.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later