The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Senate of the US has voted for an amendment to President Biden’s infrastructure bill. The Senate allows for 30 hours of debate following a vote. This means that the amendment can be debated up until Tuesday morning, after which it would be signed into law.

Senate deliberations continued over the weekend over a $1 trillion infrastructure bill, with a particular focus on how the bill could impact the world of cryptocurrency. The bill includes a tax provision that outlines plans to raise about $28 billion for that $1 trillion package through taxes from crypto transactions. The bill identifies a “broker” as anyone “responsible for and regularly providing any service effectuating transfers of digital assets on behalf of another person,” and anyone thus identified would be subject to tax reporting requirements.

Cryptocurrency investors are unhappy with the new tax provision. Not only it defines miners and cryptocurrency wallet makers as brokers, but it also obliges companies to report information about individuals even if they are not customers. Passing the bill will have a bloody impact on the cryptocurrency market, as well as on all companies somehow connected to it.

Coinbase now supports Apple Pay when buying cryptocurrency, meaning that users can buy with debit cards that are linked to Apple's system. Coinbase is the first crypto exchange to offer instant transactions via Real-Time Payments (RTP), enabling customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

It is important to notice that Coinbase makes the most of its profit in the most volatile markets, due to increased trading volumes and therefore increased amount of fees collected. Nevertheless, Coinbase stock correlation with Bitcoin price is hard to underestimate. Such an effect is caused by the nature of Coinbase as a cryptocurrency exchange and the majority opinion that everything somehow linked to crypto needs to correlate with Bitcoin price movements.

Right now, Coinbase is breaking through resistance lines, after forming a “triple bottom” reversal pattern. RSI is also looking quite bullish. If the news about the infrastructure bill won’t crash the price, the next resistance line will be at $300, a round number, and a Fibonacci expansion 161.8 line. Otherwise, there is a big support area between $250 and $235.

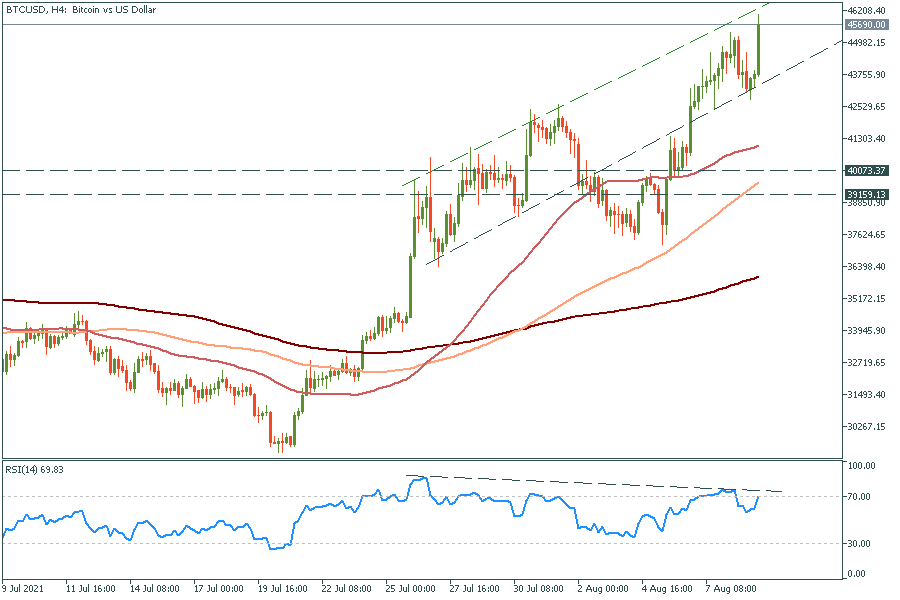

Bitcoin is moving in a channel, that has been already broken once. RSI has formed a bearish divergence, so it’s dangerous to open a long position now. In case of a price falling, the main support area is $40000-$39000.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later