eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

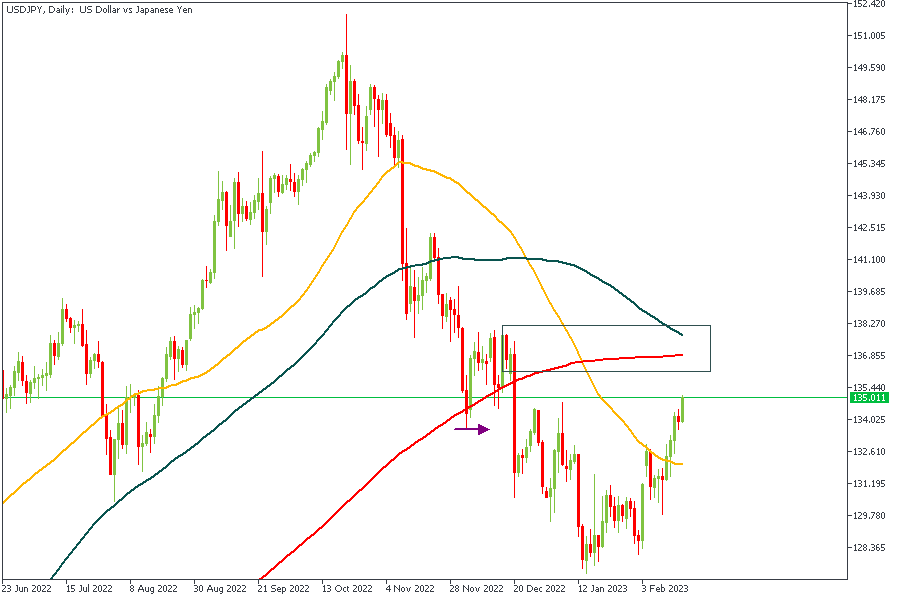

There are rumors from influential sources pointing at Kazuo Ueda as the next governor of the Bank of Japan (BOJ). This decision could lead to the commencement of policies in favor of raising interest rates and monetary policy tightening. Seeing how his appointment is coming after the Yen has lost ground against the Dollar and other top economies, it is only natural to expect a yen recovery. However, let's check the technical factors for confirmation of this prediction to see if the stars align.

The horizontal arrow marks the previous low that was recently broken. At the same time, the rectangle highlights the order block (supply zone) responsible for the breakout. The 100 and 200-day moving averages align with the supply zone, increasing the chance for a bearish reaction from that area. The 88% of the Fibonacci retracement tool can be considered an added confluence in favor of the bearish move.

Analysts’ Expectations:

Direction: Bearish

Target: 131.5

Invalidation: 138.2

The two trendlines slightly inching towards each other have formed a wedge pattern on the daily timeframe of the EURJPY chart. Based on the fact that the most recent break of the structure was bearish, the supply zone responsible has been highlighted. It is also worthy of note that the supply zone falls within 76% of the Fibonacci retracement zone and aligns with a trendline resistance. These factors lead to a convincing bearish sentiment.

Analysts’ Expectations:

Direction: Bearish

Target: 141.5

Invalidation: 146.5

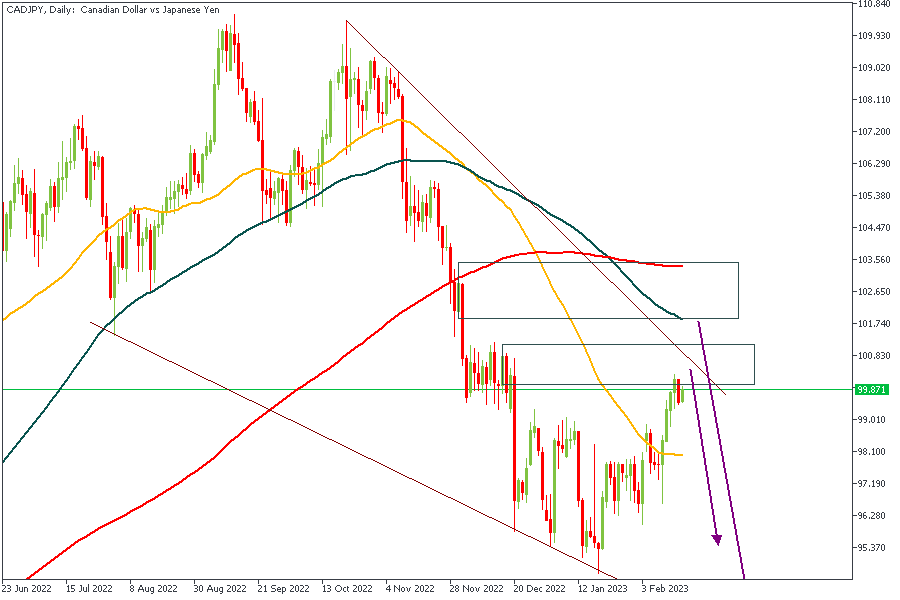

CADJPY is poised for a bearish rejection a short while from now. The clause here is that price has presented us with two possible supply areas. The first supply zone aligns with the trendline resistance, while the other has the 100 and 200-day moving averages as confluences for the supply zone. While either scenario can play out, I'd rather err on the side of caution by choosing the second supply zone since it has a slightly better chance.

Analysts’ Expectations:

Direction: Bearish

Target: 103.56

Invalidation: 97

CHFJPY has the cleanest setup in this article. Here we see the descending channel with confluences from the 100-day moving average, trendline resistance, supply zone, and the 76% Fibonacci retracement level. The sentiment here is bearish.

Analysts’ Expectations:

Direction: Bearish

Target: 139.5

Invalidation: 148

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later