eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Who will save the global economy if the main engine of global economic growth, China, is slowing down? As growth in major global economies slows a result of high inflation, many hoped that China would come to the world's rescue.

Unfortunately, China is also suffering from its problems. To everyone's shock, the Chinese economy grew only by 0.4% YoY in Q2 of 2022, missing forecasts of 1% and slowing sharply from a 4.8% growth in Q1, recording the softest pace of expansion since a contraction in 2020, when the initial coronavirus outbreak emerged in Wuhan.

Yes, China's economy is still growing but at a much slower pace, making everyone concerned about the main driver of global economic growth. Goldman Sachs cut its forecast for China's GDP growth this year to 3% from 3.3%. That marks the third cut by the Wall Street bank since May.

The devil in the details:

1. Industrial production grew by 3.8% in July, following a 3.9% rise in June, and strongly missed the forecast of 4.6%.

2. Retail sales rose by 2.7% year-on-year in July, below market estimates of 5% and after a 3.1% growth last month, pointing to slowing consumer spending.

3. Youth unemployment hit a new record in July, with unemployment among the 16 to 24-year-olds rising to 19.9%.

4. Property sales contracted 29%, deeper than the 18% fall in June.

5. Construction starts declined 45%, unchanged from June.

The second-largest economy in the world is struggling with repeated lockdowns under China's strict zero-COVID policy, a worsening property and real estate crisis, the worst heatwave in 60 years with some provinces shutting factories to save power, and declining in demand and output.

China's economy is on a path for its slowest growth in decades. Its factories are selling less to the world, and its consumers are spending less at home.

China's production affects the global economy directly through the prices of commodities, especially industrial metals. The main Chinese iron ore contract has fallen dramatically since its peak last year, while copper dropped sharply this year, a clear sign of weaker demand.

For decades, buying property was considered a safe investment in China, but now it's related to a lot of trouble. China’s new home prices fell for the 11th straight month in a row for the period ended on July 31, 2022.

The pace of homebuilding has not been this slow since 2009. The result is an extra supply of metals like Iron ore, metallurgical coal, and copper which are essential materials for construction.

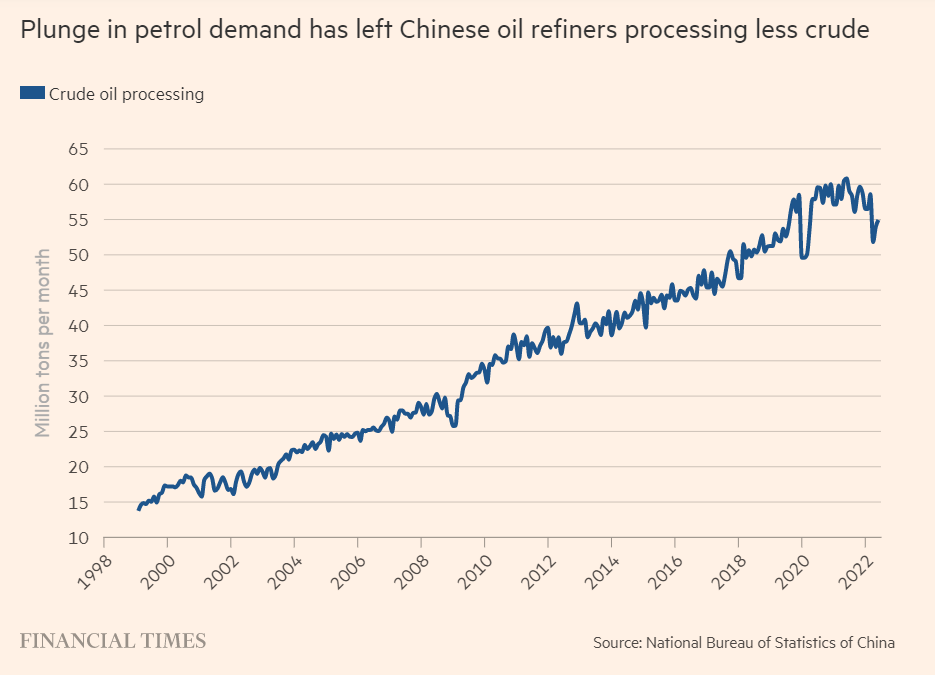

Chinese oil refiners have been processing 10% less crude oil since April due to the decline in petrol demand with weaker consumer spending and industrial output. China’s weaker demand for oil has been a counter move to the tight grip on global energy supplies caused by the war in Ukraine.

After disappointing economic data, the PBOC announced surprise and unexpected interest rate cuts to boost its struggling economy. But the tiny one-tenth of a percentage point last week is unlikely to help economic activity.

Chinese stocks in Hong Kong rallied for the 40 minutes between the PBOC announcement and the release of more data, then gave up all their gains and dropped more.

HK50 remains under pressure and may revisit May lows around 19080. The pair USDCNY has been up by more than 8% since February.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later