The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The e-commerce giant has recently faced a lot of pressure, starting from global uncertainty in China amid lockdowns and geopolitics. The company has been added to the US SEC (Securities and Exchange Commission) delisting queue. Finally, there’s an earnings report coming on August 4. Let’s discuss everything and prepare for the next move.

Tensions between US and China began in 2018 when US President Trump decided to “make America great again” and started a trade war between the two countries. The dispute included tariffs and quotas on imports from China, which also responded with tariffs on US goods. That was the start of the conflict.

Source: Peterson Institute for International Economics

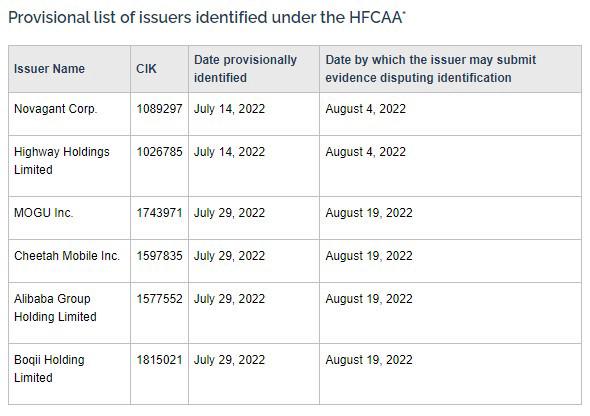

Years later, in February 2022, US president Biden extended tariffs on certain types of goods, including solar panels and cells. While Alibaba doesn’t produce these panels, the overall level of tension kept escalating until on July 29 the US SEC added Alibaba to a list of companies that may be delisted from the US exchange.

A few took in consideration the law issued in 2020 that provides the opportunity to delist the company from an exchange if it has a foreign jurisdiction. Another criterion is that a foreign company hasn’t issued the audit report. Combined, the US SEC has all the needed reasons to ban Alibaba. The company should submit the audit report by August 19, 2022. That’s not rocket science to understand the low likelihood of a peaceful solution to the conflict, especially amid growing Taiwan tensions.

Source: https://www.sec.gov/hfcaa

Alibaba’s US-listed shares extended their declines for the third week and have slumped 29% in July, closing the month below the $90.00 round number. The delisting analysis tells us the plunge in stock will continue. Let’s talk about the upcoming earnings report to grasp all.

Alibaba will release its earnings report on August 4, before the market opens. Analysts expect the EPS to be $1.52 with a revenue of $31.02 billion. In June, the company reported $1.93 per share with a revenue of $32.19. This time, the estimated decrease is low, and the company expects rather good results.

Source: CNN BUSINESS

The 47 analysts offering 12-month price forecasts for Alibaba Group Holding Ltd have a median target of 150.17, with a high estimate of 230.03 and a low estimate of 104.43. The median estimate represents a +66.15% increase from the last price of 90.37. However, I think most analysts aren't taking into consideration the most negative scenario which is a delisting and a bad economic outlook due to the Chinese lockdowns.

As for the chart, the stock is trying to hold above the demand zone (red), but the fourth touch of the area will likely lead to a breakout.

Alibaba daily chart

Resistance: 137.80, 183.00, 210.00

Support: 77.00, 55.00, 40.00

If disagreements between US and China continue, we’ll likely see a delisting of the stock, leading to a massive outflow of the capital from it and other Chinese stocks traded on US exchanges. This situation is rare, and my target for this movement is in the $40-55 support area.

Do you want to get updates Live? Subscribe to the @FBSAnalytics Telegram Channel where I post more daily trade ideas!

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later