Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On Thursday, September 15, XAUUSD lost its major support, which used to limit the downside since April 2020. The decline happened amid expectations of more aggressive Federal Reserve interest rate hikes due to higher-than-expected US inflation.

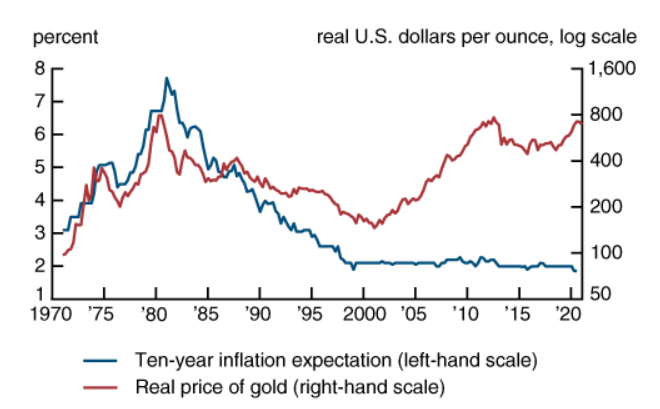

Investors treat gold as a hedge against inflation. A rise in inflation or inflationary expectations increases investors’ interest in purchasing gold and drives up its price. In contrast, disinflation or a drop in inflationary expectations does the opposite.

Gold and inflation expectation. Source: Chicagofed

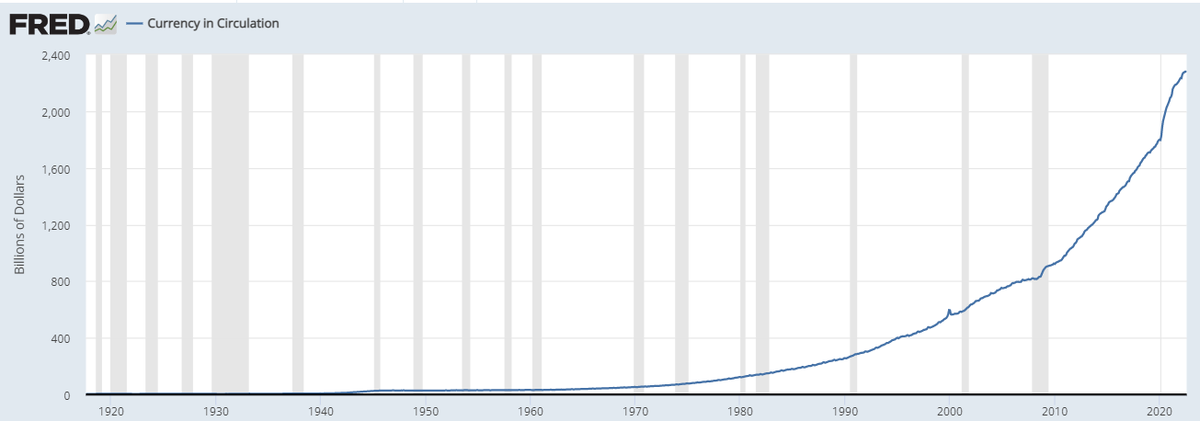

However, we can notice that since the 2000s, the gold price has been rising while the inflation expectations were steadily low. It was caused by the Fed monetary policy, according to which the Federal Reserve has been printing USDs to support the economy. As a result, the amount of USD in circulation increased parabolically, pushing gold prices to new highs.

USD in circulation. Source: FRED

Moreover, gold is sensitive to expected long-term real interest rates. Since metal is a long-duration durable asset, its price has a strong inverse relationship with the long-term real interest rate. A rise in expected real rates should drive down the price of gold.

Therefore, central banks' rate hikes and the Fed's quantitative tightening (QT) monetary policy make gold one of the most unpopular assets among big investors. Holding the metal doesn't provide any dividends or payouts, while big hedge funds have to show a profit to investors. Therefore, smart money prefers short-term government bonds to gold, as yields skyrocketed to 15-year highs.

US 3-month Government Bond Yield. Source: Tradingview

While the consensus is a 75-basis-point hike on September 21, some Fed members call for a 100-basis-point increase. The gold market reflects such a prospect. As a result, an actual rate hike by 75 bps may be a positive surprise for the yellow metal.

After the breakout, primary support levels for XAUUSD are 1530.00, the horizontal level from May 2012, and 1435.00, 161.80 Fibonacci level. The range between 1680 and 1705 acts as the massive resistance for the price since the breakout.

In the short term, the price might increase inside the resistance range to confirm the breakout. However, I expect a massive decline towards the support levels in the middle term.

Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

US dollar gains ahead of the US CPI data on July 13th, pressing gold to new lows!

On May 4, the US Federal Reserve revealed the federal funds rate for the next two months. Even though a 50 basis points hike was widely expected, the future is not so clear. Let’s figure it out bit by bit!

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later