The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

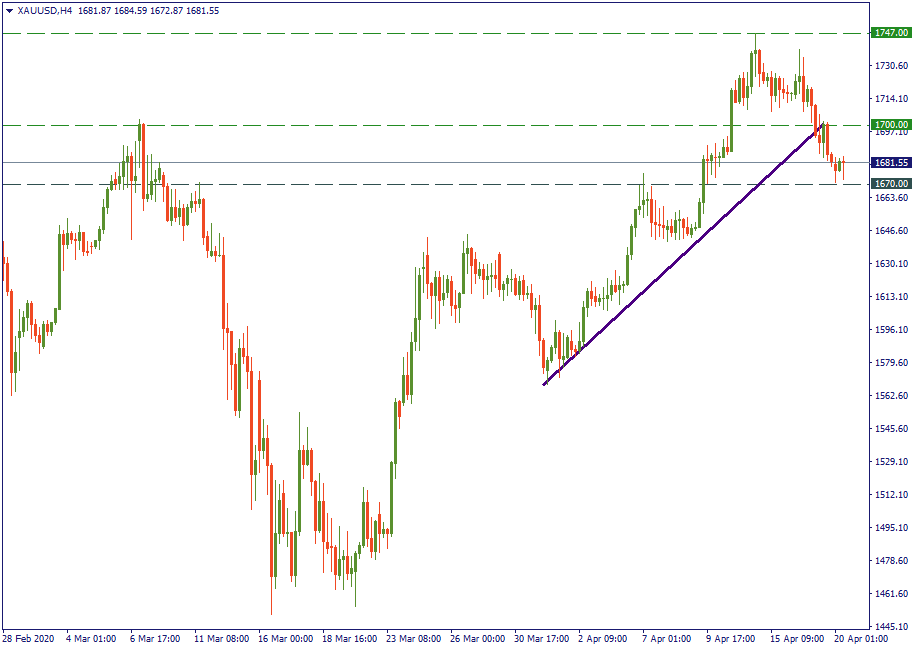

After a “wake-up call” at the end of March, gold has taken a confident upward-looking trajectory. It gradually rose in value from $1,580 to almost $1,750 last week, which made it the apple of the investors’ eyes. Currently, however, it is back down at $1,670, which breaks the previous uptrend and suggests a more lateral, although still volatile, path. What’s going on?

The main reason claimed by most observers when explaining the drop in gold price is the difference between the prices at which the metal was traded for physical delivery contracts in New York and London. As these are the two central markets for the shining metal, they largely “define” how the “universal” price for gold behaves. Therefore, a difference of $70 per ounce between gold futures traded in New York and London is a serious discrepancy. One may say “This difference would quickly go to zero with speculators taking advantage of the situation - what’s the problem for them to buy gold in London and sell in New York at a price $70 higher? That would stabilize gold price and set it back upwards!” Let’s remember we are speaking about futures for physical gold delivery, and that faces a number of problems if we consider linking the two markets in real trade. Even without the coronavirus disruptions, it would be difficult to manage such an arbitrage. Hence, no rapid solution could have been provided – thankfully (for gold traders), the spread between Ney York and London gold prices narrowed to $20 per ounce last Friday.

Observers comment that gold is likely to trade between $1,500 and $1,750 within the next two to five years while the world will be on a recovery course. Spikes up to $1,800 and even $2,000 per ounce are expected. Let’s remember that fundamentals are primary factors with gold, and the main fundamental factor for the nearest future will be uncertainty about how/when/whether the world regions will regain their powers and capacities. For gold, that should be almost like a guarantee for rising higher.

Therefore, the current channel between $1,670 and $1,700 where the gold price is currently contained is likely to be a temporary sideway stop before a possible further increase in value. However, keep in mind that, although $2,000 was voiced out as a possible mark, $1,700 - $1,750 is in the higher range of the predicted performance area. For this reason, expect frequent breakouts from this upper level down to $1,600 - $1,650 in the long run.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later