The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

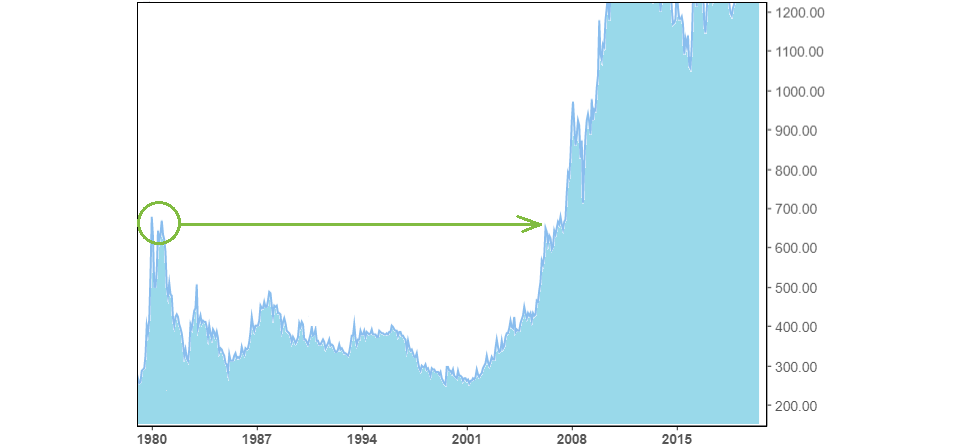

We have seen gold break its historical record of $1 915 at the end of July. Previously, that level was reached in 2011 in the aftermath of the world crisis. As the world went into recovery, gold went into “oblivion” for 5 years. Then, the relationship between the US and China went into a vicious circle, and gold started rising again: from $1, 300 in 2018 to $1 500 in the beginning of 2020. Then, the virus crisis pushed it to $1 900 in July.

As we know, every general always fights a previous war, so let’s look at these dynamics from a tactician’s standpoint. If we do that, we will observe that the phase of active rising took approximately three years 2009-2011 in the previous crisis. Currently, we are peaking at the trajectory that very much resembles that of 2009-2011, and the current one that started in 2018 is already into its third year. Therefore, it is only reasonable to expect not only nearing exhaustion of the rise but a following significant correction downwards.

To make it clear, whether $2 200 or another “epic” level gets reached or not is out of the question: probably it will, but it is of low importance. Somewhere out there, there will be a peak, and it will just conclude what already took years to manifest. Later on, though, there will be another phase – and those who gaze into the far horizon need to be prepared for that. Nothing new happens under the sun, and with all the uniqueness of now-and-here, we learn from the past.

In 1980, the gold price rose to then-all-time highs below $700. It was pretty much as quick as it was done in July – several hundreds of USD value in a few weeks. But then, as quickly as it rose, it fell down to the ranges of $300-400 and was staying there for almost the next 30 years. Eventually, it was only during the previous crisis of 2009-2011 when gold beat its all-time-highs and rose further upwards.

What were the factors that led to such a growth back in 1980? There was a combination of two main factors: the never-so-high inflation and the fear of its further increase in the US gave the economic background, while the Soviet invasion of Afghanistan and the Iran hostage crisis provided the geopolitical tension.

Now, it is understandable that the current economic and geopolitical layout resembles that of 40 years ago to some extent: we have the geopolitical tensions between the US and China, and the economic downturn caused by the virus is providing the economic background.

However, none of the current factors match those of 1980 in intensity and real risks. With the Iranian hostage crisis and the Russians in Afghanistan, we were one step away from a real all-out war, put in the red-hot context of US-USSR polarity. Compared to that, the tensions between the US and China appear nothing but an exchange of mutual regrets, salted by the tariffs exchange.

Economically, the all-time-highs of inflation in the US in 1980 were also something truly unseen and scary. Contrasted by that, the current economic downtown in the States, even taking into account bad virus management and a somewhat stalled recovery, hardly gives a serious fundamental ground to push gold higher in the long run.

Source: www.investing.com

Therefore, there is only one conclusion: as high as it flies, gold may plunge into another decade or even more of slow decline at any time. Of course, history knows now repetition, but people don’t change: once they get bored with the virus and US-China tension, they will just ignore both. Eventually, gold will slowly get “back into position” in lower ranges. Unless things get really bad of course…

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later