The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

As the coronavirus already made its way into the pantheon of the worst world economic crises causes, it makes sense to compare it to some of the previous global troubles we have been to. But before we go into comparing the economic consequences of the current pandemic, let’s compare the human damage of the COVID-19 to other global diseases the world has faced so far, just to put things into perspective.

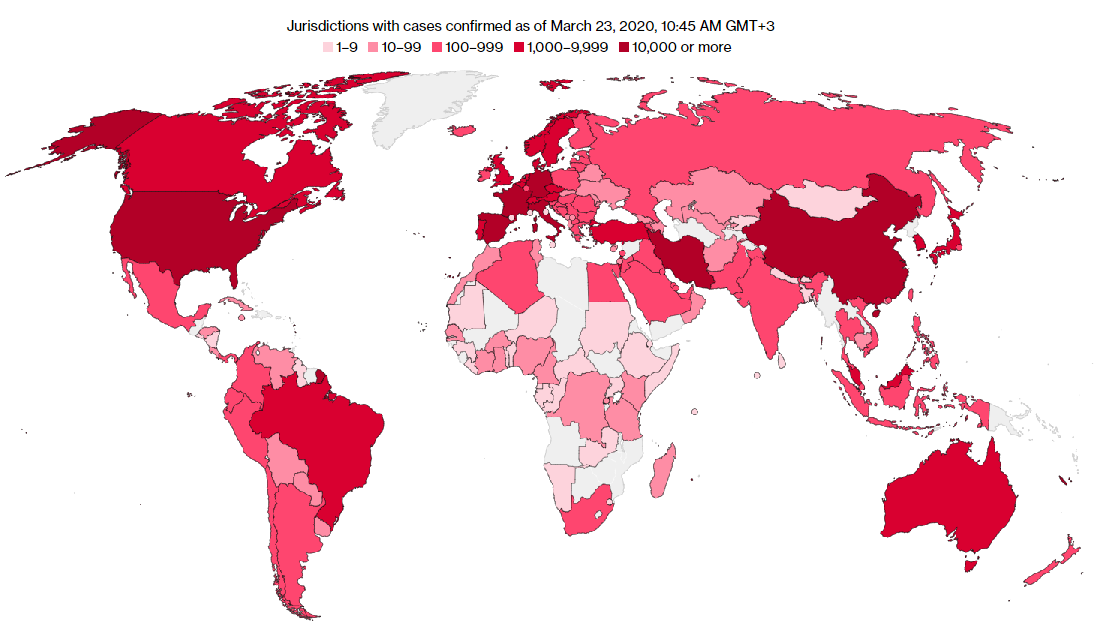

This is the damage of the coronavirus so far: more than 330,000 confirmed cases and 14,474 deaths globally. The map below shows the distribution of the infection, which is now most severe in Europe, the US, and Iran, apart from China itself.

Source: Bloomberg

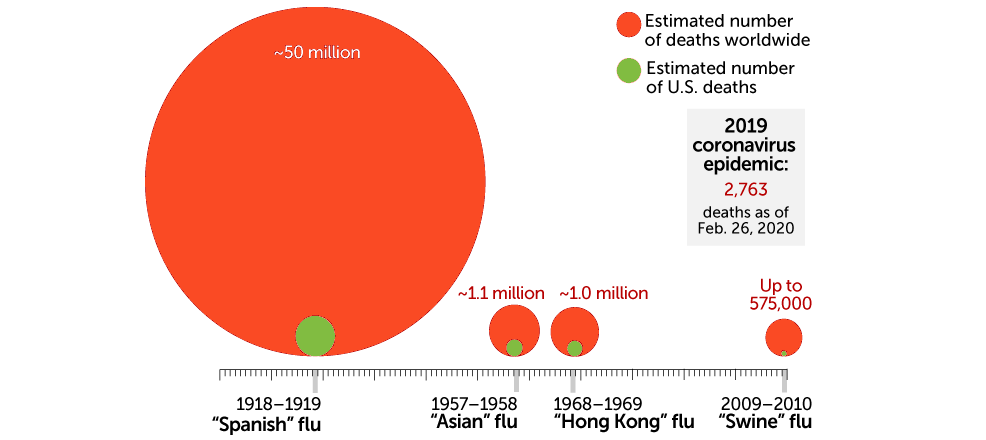

While the worldwide spread of the virus is a frightening sight (which becomes even more frightening with the media propagating it), let’s now compare the human damage of the virus with other historical cases the world has had up to date.

Source: www.sciencenews.org

This is a visual guide, which brings some consolation in its horror. Given the fact that the number of cases in China, where the virus is said to have originated, is already two weeks past the peak of total infections, we are likely to see the same worldwide in about another two weeks if not earlier. In consequence, the total expected human damage is expected to be significantly lower than that of the most recent historical pandemics.

Also, as you have noticed, this presentation is vastly outdated: it shows 2,763 mortal cases across the globe on February 26, almost a month ago. And that is good news: statistics say that the other mentioned diseases were spreading much faster than growing from almost 3,000 to "just" 14,400 deaths in four weeks. Obviously, this “just” only refers to the mathematical perception of the virus spread and merely wants to say that the expansion of the disease doesn’t go with exponential acceleration but increases rather linearly. Otherwise, every single one added to the count is someone’s life and someone else’s tears will lament it, as much as we wish no one to pass through this.

Now, as we foresee the end of this story, another story starts to unveil itself to an observer as the true danger to the world is not in the virus but in its economic consequences.

The virus comes and goes, taking thousands of human lives with it – that’s the reality of its immediate effect. What about the full scope of consequences?

Observers already started counting as the virus countermeasures have started taking their toll on the global economy and the horizon is not yet visible. How bad is it economically? Say, to 2008?

The crisis of 2008 forced the S&P down from 1,600 to 700. That was a 56% reduction. Currently, the indicator is at 2,200 – that’s after it made its all-time high at 3,400. Meaning, it dropped by 35%. Some predict a possible drop to 2,000 as a worst-case scenario, but even so the reduction will not be more than 41%, and such a scenario is considered to represent the extreme red part of the outcomes spectrum. So from the stocks point of view, the coronavirus is not that deadly in its damage as the credit crisis of 2008 was. However, that all is just so far. Even with voiced out opinions that the time of recovery is already somewhere beyond the pass, we will see it only when we get there.

At the same time, there are opinions that point out that the current situation is and will likely get worse than in 2008.

For example, job losses in the US may exceed 1mln according to preliminary analysis – that is significantly higher than in 2008. As this a fundamental factor, it may lead to dire consequences much beyond what is in forecasts now.

“Side” factors such as the oil price war aggravate the situation forcing the global market into depression and turbulence. The slide could have been weaker but overlapping with the virus consequences, the oil price war takes on a new level and becomes a central rather than a side factor.

In addition, the international cooperation is at an inferior level to that of 2008. Isolationism and state individualism is the main international policy line there days – it was not like that (at least, not to this extent) 12 years ago. It is important to consider this as the economic fires could have been quenched more easily and quickly if faced collectively but this most likely will not happen. In the Old World, the UK is in the middle of Brexit and is not willing nor it has any legal mandate to lead Europe out of the financial crisis. Europe itself seems much more fragmented than in 2008.

For this reason, too many fundamental factors make the current situation different from what was more than 10 years ago. That complicates any comparison and scares the observers even more as they do not really know what they are facing.

2008 was “just” a credit crisis – it was a problem created by humans and was controllable as such. No one was dying and states did not have to shut their borders. This time it is very different: the world is facing a natural threat, a microscopic living thing, something that kills people and cannot be managed just by making balance sheets transparent. Thus, phenomenologically, we are living a precedent. Let's hope for the best then, and prepare our trades well.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later