The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

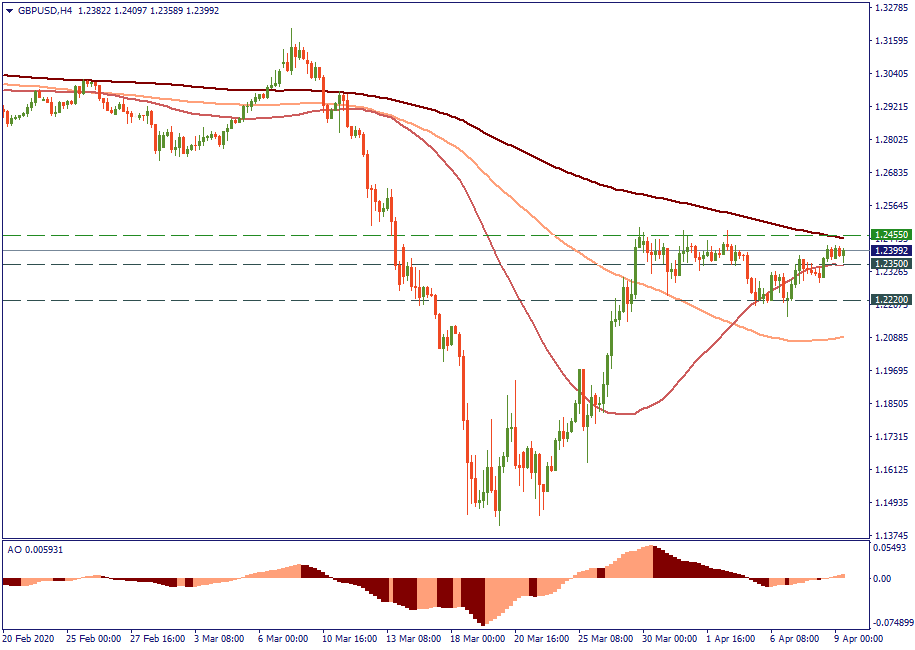

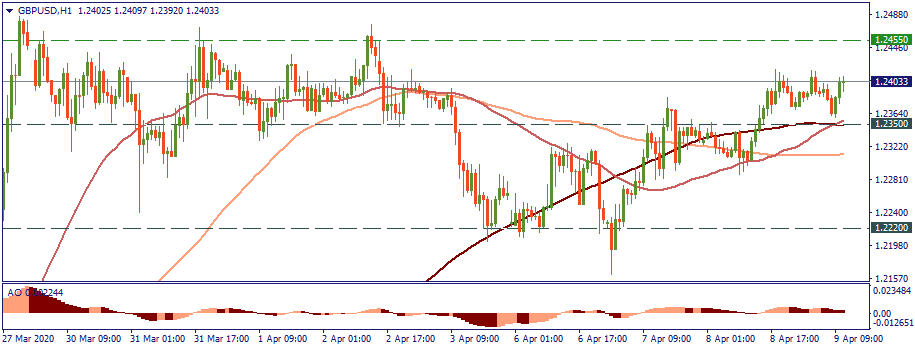

The GBP/USD is in a clear consolidation now. Currently trading at 1.2399, it is contained between the support of 1.2350 and the resistance of 1.2455. these levels correspond to the positions of the 50-MA and 200-MA respectively.

The local view presented by the H1 chart gives even a more pressed and flattened picture: the currency pair rides on the back of 200-hour and 50-hour Moving Averages, supported by the 100-hour MA slightly below. Awesome Oscillator is approaching the zero line, same as in the H4 chart.

That creates a strong impression that the GBP is lying low against the USD as if it was waiting for input to march further. Indeed, there is a lot to wait for.

First, there is Boris Johnson. Whatever you say, but a country leader means a lot to its people and its economy, even if neither wants to openly recognize that. As cynical as it sounds, that’s not only because of the nation’s compassion. The British Prime Minister is a strong figure which incarnates the entire political and economic direction the US is following. Absence of such figure, particularly now, particularly Boris Johnson, for whatever reasons, would mean a political, economic and power vacuum. That would be utterly disorienting to the UK, to say the least.

Second, there is Brexit. Although the main problem for the Britons is fighting the virus, which applies to most of Europe and the US now, time is ticking. Now, December 2020 is eight months away, and June, which was planned to be the last big milestone in the UK-EU separation process, is right there over the pass. The virus is a true test for the flexibility and resilience of the UK economy – and for the commitment of the country leadership to the Brexit guidelines.

Third, the UK economy was reported to shrank significantly before the crisis hit and the counter-measures were taken. Specifically, the GBD fell 0.1% from January, the trade deficit reached 11.5bln pounds, exports dropped by 11%. Observers fear the British economy may face its darkest times in decades.

There are a lot of factors contributing to the wellbeing of the UK economy and the GBP. It would be wrong to say that GBP has nothing to offer against them, but definitely, there are some truly hard times ahead for the pound. In the short term, watch the levels mentioned being crossed. In the long term, once the virus is done, Brexit will define what happens to the GBP – and that is all within the horizon of just a few months. We will keep you updated.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later