The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The British pound is going through uneasy times, and it is only fair to ask how it will manage this year. Let’s break down the risks that the future holds for this currency to get prepared in advance.

So far, getting out of the trap caused by the virus is obviously the main obstacle for the British economy. Although investors already are aware of the gravity of situation, there is no certainty about the true extent of the problem. Practically, because the effect of the impact takes more than just two months to reveal itself. That’s why there still is a potential for more negative fundamental input, and hence, there is a potential for downside for the GBP from the virus hit.

If not the virus, very possibly the UK and the EU could have been more successful in straightening their economic agreements out. Unfortunately, history knows no such things as “if”, so the time, effort, and resources that could have been dedicated to Brexit were directed to fight the virus. Up until now, there is very little progress done since the beginning of the pandemic. And the latter is just peaking in the UK while the clock is ticking with nearing deadlines. The second phase of the Brexit process is supposed to be concluded in June, which is the last window for the possibility to extend. Although we may be quite sure that Boris Johnson will be adamant to keep all the deadline where they are now, it will be just much harder on the economy and the people to meet them. That, consequently, becomes another downside risk for the GBP.

The Bank of England has been keeping the interest rate steady at 0.1% since March. While these are historical lows, the monetary policy makers expressed no inclination to go into the negative zone – so far. Theoretically, though, that remains an option as the Bank of England is running out of measures to ignite the economy. The quantitative ease program is being carried out already putting the local downside pressure on the GBP. In the meantime, there are members of the committee who would like to see more bond-buying in place. That adds more downward potential for the GBP behind the scene.

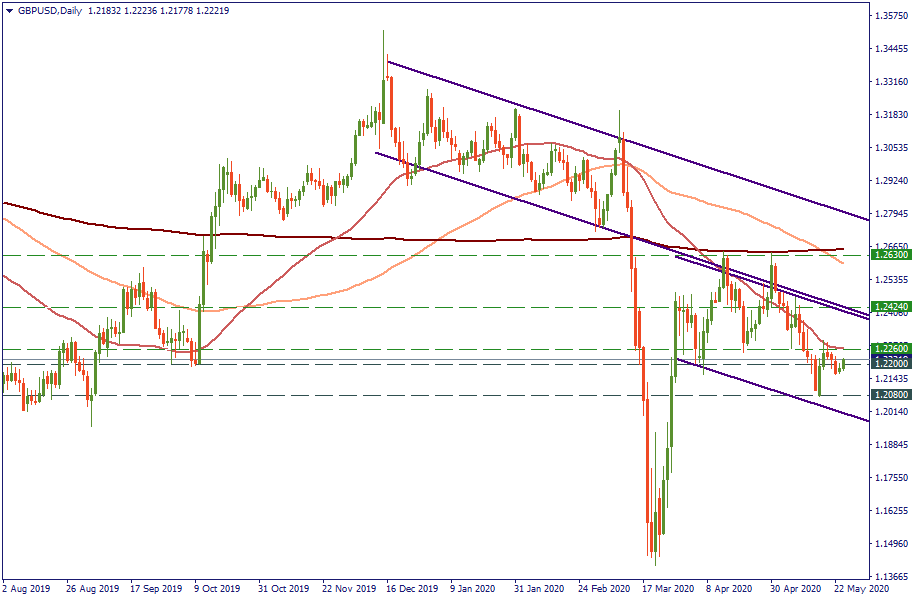

Against the USD, the GBP trades at the lows of summer-2019. The trend it is in is bearish, and there is no indication that it will be reversed – until the resistance of the 50-MA at 1.2260 is broken. The larger picture suggests that even if the GBP does that, the alternative still will be a downtrend, just with a higher baseline level – like the one it was in from November 2019 until February 2020. The dispositions of the Moving Averages confirms the same as they are configured in descending order. Therefore, miles of fighting are there ahead of the GBP this year, and June will very much confirm that.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later