The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Like oil, natural gas is a product of decomposed organic matter, typically from ancient marine microorganisms, deposited over the past 550 million years. Often, gas and oil are neighbors, who are located deep under the ground. Because of that, their prices sometimes correlate. But for the last several weeks gas was skyrocketing at an enormous pace. It has gained more than 17% from August 18. What is the reason for such moves and how can we earn on global gas trading?

Assessment of the Natural Gas market should start with basic points. Usually, there are a set of reasons for the commodity price to change:

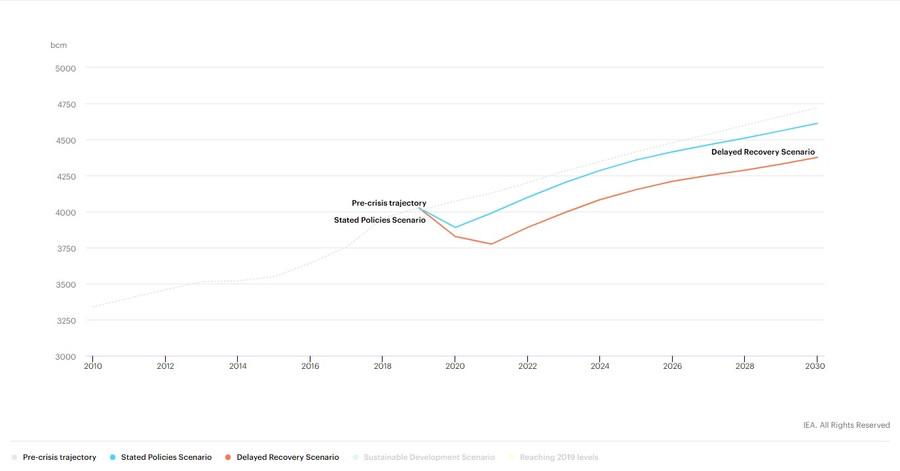

Let’s go through every reason to create a natural gas price forecast. As for now, demand isn’t showing any signs of slowing down. Between 2009 and 2020, global gas consumption surged by 30% as utilities and industries took advantage of booming output. Even in the covid-19 environment, experts are expecting the demand to rise even more in the next 10 years.

Source: https://www.iea.org/data-and-statistics/charts/global-natural-gas-demand-by-scenario-2010-2030

As for ecological reasons, companies and countries are implementing gas in their electrical supplies. The shift to natural gas can be done relatively quickly and cheaply while having a significant impact on lowering emissions. Natural gas is the cleanest burning fossil fuel and emits almost 50% less CO2 than coal. Meanwhile, non-fossil-fuel alternatives such as wind and solar are at a relatively early stage to produce enough energy and offer a cheap deployment.

Already, there are signs around the world that supplies will fall short:

Even if the prices will rise even higher over the next decade, it won’t be enough to drastically reduce demand for the fuel. All we can say for now is that gas is increasingly less dependent on oil prices and this trend is going to continue.

As for the chart, US natural gas is several days away from volatility increase. For now, the price is consolidating in a triangle and the breakout will decide its fate. In case of further growth, it is highly likely for the RSI divergence to form. That would be a sign of a pullback.

XNG/USD H4 chart

Support: 5.60; 4.94; 4.20

Resistance: 6.30; 6.50; 7.00

To trade natural gas, we need a trading strategy. And to have one we need to better understand the asset. Here are some tips for traders that will surely help you.

If to perform trade analysis via technical indicators, the best for gas right now is RSI, because it can show you the divergences between the indicator and the price and spot possible reversal earlier, than others.

No growth is everlasting, and though the gas price has been skyrocketing for the last weeks, most of the time it lacks the volatility. So when this “Gas season” will be over, consider looking at the cryptocurrency, because it’s much more volatile. Also, 24\7 crypto trading means that you don’t need to wait for the market opening, just open your FBS Trading Platform or Meta Trader and enjoy the possibilities of a crypto trading account.

Now you know how to trade natural gas, so what are you waiting for?

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later